|

Capital Provider Showcase

Dialogue with Mayur Sirdesai, Co-founder, Somerset Indus Capital Partners

|

|

.png)

1 Somerset Indus Capital has had a strong thematic focus on healthcare in India. Can you walk us through your investment thesis—how do you identify sub-sectors or business models within healthcare that align with both financial viability and tangible health impact across India’s diverse population?

|

Our thesis fundamentally centers on identifying where strong financial returns and critical healthcare gaps overlap — particularly in underserved markets across India.

Our portfolio has evolved significantly over time. While we initially focused on traditional delivery models like hospitals and pharmaceuticals, we’ve expanded into Diagnostics, Medtech, and Supply chain solutions. This evolution reflects both market opportunities and our deepening understanding of where scalable impact is achievable.

What remains consistent is our focus on three key criteria:

- Businesses serving large, underserved segments

- Models with sustainable unit economics that improve at scale

- Solutions that deliver measurable outcomes — whether that’s reducing cost barriers, improving diagnostic access, or expanding quality care beyond metro cities

Impact is integrated throughout our investment process. We evaluate companies on dimensions like affordability, innovation, geographic reach, and alignment with broader health system needs and employment generation. We use established frameworks to track this systematically across our portfolio.

The companies that excite us most aren’t just positioned for growth — they have the potential to fundamentally reshape healthcare delivery in India. This dual lens — seeing both commercial opportunity and systemic improvement — is really what defines our approach in this sector.

|

2

You actively pursue impact-driven investments. How do you structure and measure impact in sectors like pharma or diagnostics, where the pathways to long-term health outcomes are indirect? What frameworks or indicators do you find most useful or nuanced?

|

In sectors like pharma and diagnostics, impact happens through systemic channels rather than direct patient care. What makes this interesting is the natural alignment between commercial opportunity and social impact.

We focus on four dimensions that really matter: Are companies improving affordability and access to essential medicines or diagnostics? Are they strengthening healthcare infrastructure in strategic locations? Are they creating quality employment, particularly outside major cities? And are they driving innovation that enhances India’s healthcare resilience?

Take diagnostics – businesses that reduce detection times for prevalent conditions while making testing more affordable in Tier 2 and 3 markets aren’t just doing social good; they’re opening entirely new customer segments and revenue streams.

Our approach integrates these considerations throughout the investment process. We’re looking beyond simplistic metrics to understand how companies build resilience into India’s healthcare system – whether through localized manufacturing, workforce development, or technological innovation.

At Somerset, we’ve developed practical techniques to operationalize this approach. We map clear theories of change during initial diligence, incorporate key impact indicators into our regular portfolio reviews, and where appropriate, develop customized metrics that reflect each company’s unique contribution to healthcare access and affordability. This allows us to measure what matters while maintaining our focus on building businesses that deliver both financial returns and meaningful health outcomes.

The most promising companies we see recognize that addressing gaps in affordability and access isn’t separate from business strategy – it’s fundamentally the key to creating value in a market where traditional approaches have left millions underserved.

|

3

Digital health has been a rapidly evolving area, especially post-COVID. What’s your perspective on viable digital health models for Tier 2 and Tier 3 India? How do you balance the tech promise with the operational realities of infrastructure, user adoption, and integration into formal healthcare?

|

We focus on hybrid care models that bridge technology with frontline delivery in the Missing Middle Segment, where unique challenges require more than just technology.

What works? We’re seeing three models gaining traction:

First, hub-and-spoke telemedicine/teleradiology connecting urban specialists with rural providers, especially when paired with local staffing. Apex HOPE’s e-ICU initiative exemplifies this approach, connecting 18 centers across Tier II and III cities to specialized command centers. This model has achieved a 32% reduction in ICU mortality while also reducing unnecessary patient transfers, shortening hospital stays and ventilator days, and lowering hospital-acquired infection rates.

Somerset Portfolio Company Apex Hospitals under Fund 2

Second, AI-assisted diagnostics addressing the shortage of trained professionals in smaller markets.

Third, chronic disease management systems combining digital tools with human navigators — much more effective than app-only solutions for conditions like diabetes that need routine monitoring.

Success in these markets isn’t about sophisticated technology — it’s about practical implementation. Models must be offline-first, include regional language content, integrate community health workers, and align seamlessly with government schemes.

Our investment approach is simple: we seek economic sustainability with clear paths to profitability, regulatory alignment, and measurable impact on healthcare access and affordability.

The future belongs to integrated platforms that address real problems through a mix of technology, local partnerships, and policy alignment.

|

4

Your recent investment in Emil Pharmaceuticals suggests a growing interest in manufacturing-led or contract services models. How do you view the role of India’s pharmaceutical and API manufacturing sector in serving both domestic and global demand—and what do you look for in potential investees in this space?

|

India’s pharmaceutical and API manufacturing sector presents compelling investment opportunities by serving as both a vital domestic healthcare enabler and a key global supplier of cost-effective generics. As the world’s third-largest API producer, India accounts for roughly 8% of global API output and manufactures over 500 different APIs, underpinning its strategic role in global pharmaceutical supply chains.

Our investment approach prioritizes companies demonstrating:

- Regulatory differentiation through top-tier certifications (US FDA, EMA, WHO GMP), ensuring access to regulated markets.

- Portfolio diversification across high-margin APIs and CDMO (Contract Development and Manufacturing Organization) services, balancing volume with specialty products.

- Sustainability practices, including advanced waste management, adoption of green chemistry, establishment of Zero Liquid Discharge (ZLD) facilities, and the use of agri-briquettes instead of coal for boiler operations, reflecting growing environmental and regulatory expectations.

- Supply chain control via backward integration to mitigate raw material volatility and enhance reliability.

- Innovation pipelines that leverage advanced technologies for complex generics and biosimilars, driving long-term differentiation.

Emil Pharmaceuticals exemplifies this hybrid model by integrating API manufacturing with finished dosage formulations, creating operational synergies while hedging against raw material price fluctuations. This positions the company to capitalize on rising demand for complex generics in both domestic and international markets.

The domestic API market is projected to reach $22 billion by 2025, propelled by India’s significant cost advantages, skilled workforce, and supportive government initiatives such as the Production Linked Incentive (PLI) scheme and the development of bulk drug parks. These factors collectively enhance India’s competitiveness as a global pharma manufacturing hub.

Importantly, companies like Emil Pharmaceuticals and Globela Pharmaceuticals actively engage with a broad portfolio of countries, including low- and middle-income countries (LMICs) such as Chile, Sri Lanka, South Africa, Jordan, Honduras, Philippines, Nigeria, and Ecuador, alongside regulated markets like the UAE and the Netherlands. Participation in government tenders and supply to these LMICs underlines their commitment to improving affordable access to essential medicines globally.

Globela Pharmaceuticals, in particular, has a strong focus on serving the African continent, addressing healthcare needs in a region with growing demand for quality generics and APIs. Their manufacturing and supply capabilities support critical healthcare programs and government initiatives across Africa, reinforcing India’s role as a reliable partner for LMICs.

|

5

Somerset has also explored healthcare financing and insurance as an area of interest. What models in this space are showing early promise? Are there innovations in micro-insurance, credit underwriting for health loans, or tech-led health wallets that you believe deserve more attention and capital?

|

In our investment thesis evaluation, we’ve identified several promising healthcare financing models that deserve attention. The landscape has been fundamentally transformed by government initiatives like Ayushman Bharat – PM-JAY and NITI Aayog’s policy frameworks, shifting from out-of-pocket expenditure toward greater social health security.

Somerset is open to investment in this space and has healthcare financing as part of its investment focus areas. From our pipeline screening, four models show particular promise:

First, public-private partnerships aligned with Ayushman Bharat are effectively combining government coverage with private sector efficiencies, especially in underserved areas. We’re seeing impressive results where these collaborations enhance both reach and affordability.

Second, micro-insurance products tailored for low-income populations are gaining traction through mobile and digital platforms that simplify the entire insurance lifecycle. The most successful implementations we’ve evaluated are using behavioral design principles to overcome traditional adoption barriers.

Third, tech-enabled health wallets with AI-powered credit underwriting are revolutionizing healthcare financing by using alternative data for real-time loan approvals. These innovations are particularly impactful in enabling timely care for previously underbanked populations.

Finally, receivables and supply chain financing solutions are addressing critical operational challenges for providers, especially those experiencing delayed reimbursements from government schemes like Ayushman Bharat. We’ve identified several businesses with compelling unit economics in this space.

Looking ahead, we’re particularly excited about businesses building comprehensive ecosystems that integrate interoperable digital health infrastructure with financing solutions. Our investment focus prioritizes businesses that demonstrate clear alignment with Ayushman Bharat while building sustainable, scalable models that can meaningfully reduce financial barriers to healthcare access.

The convergence of Ayushman Bharat, supportive policy, and fintech innovation creates an exceptional investment environment. We believe the most promising opportunities lie at the intersection of technology integration, PPP frameworks, and alignment with Ayushman Bharat, where businesses can achieve both significant impact and sustainable returns.

|

6

While investing in health delivery and preventive care, how do you evaluate enterprises working on affordability without compromising on quality? What role does patient education or community trust play in scaling such models—and how can investors support that?

|

In evaluating healthcare delivery enterprises focused on affordability and quality, we apply three core principles that have proven effective across our portfolio.

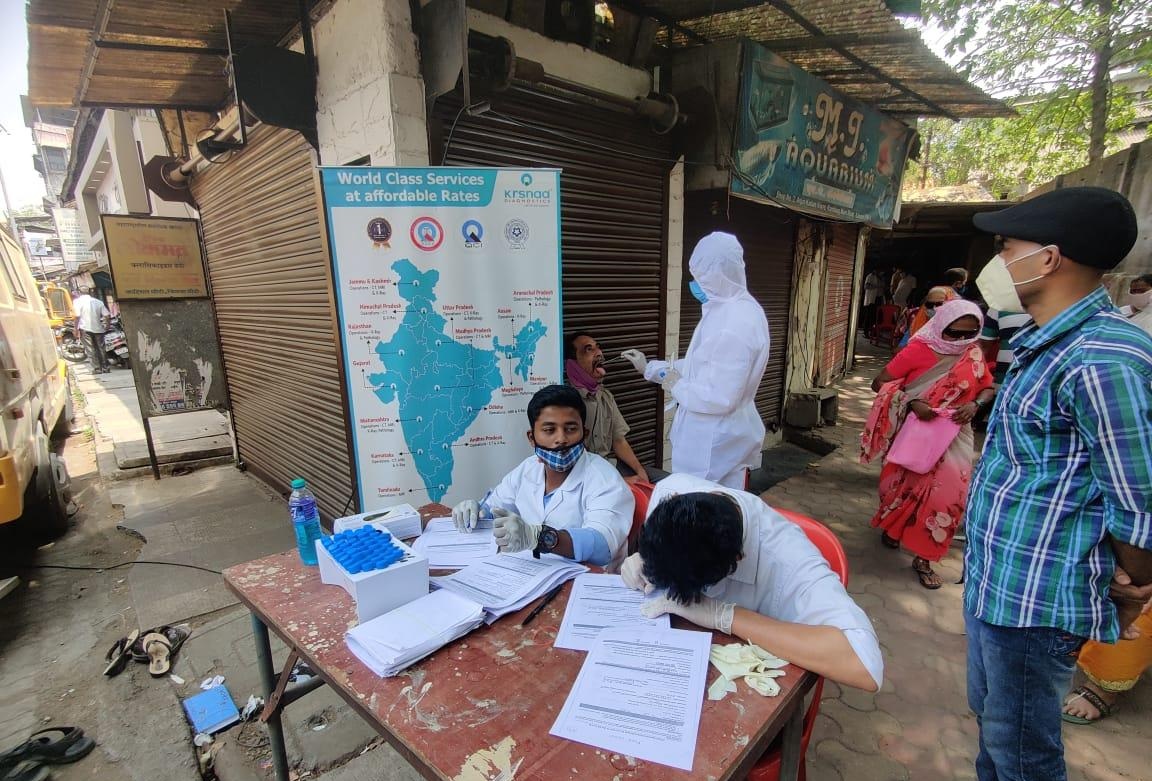

- First, we look for affordability that genuinely drives utilization. This is particularly critical for the ‘missing middle’ population that falls between government scheme coverage and private care affordability. We’ve found that meaningful price reductions – like those achieved by Krsnaa Diagnostics with 40–80% lower pathology rates – create the necessary conditions for increased healthcare engagement.

- Second, quality must be structurally embedded in operations, not treated as an add-on. We prioritize businesses that integrate clinical protocols, outcome monitoring, and adherence to national standards like IPHS and NQAS. This systematic approach ensures consistent care delivery regardless of location or provider. Further, quality certifications such as NABH for hospitals and NABL for labs are not just compliance checkboxes—they serve as tangible indicators of service excellence. A strong regulatory framework across healthcare ensures that organizations striving for these certifications embed robust quality practices into daily operations. In fact, we’ve observed that payors—including government and insurance entities—often provide better pricing and partnership terms to companies that meet these standards, reinforcing quality as both a compliance and commercial imperative.

- Third, and perhaps most overlooked, is community relevance and trust. In our experience investing across healthcare financing models, including those aligned with Ayushman Bharat, we’ve seen that technical solutions alone aren’t sufficient. The most successful enterprises in our portfolio combine technological innovation with frontline human touchpoints.

Patient education and community trust are absolutely fundamental to scaling. Somerset has observed that even perfectly designed affordability models fail without proper navigation support. Take our investment in Ujala Cygnus Hospitals – their success in Tier 2 and 3 cities stems not just from pricing, but from significant community outreach that builds awareness and trust.

Somerset Portfolio Company Ujala Cygnus under Fund 1

As investors, we support these dimensions in several ways. We prioritize businesses building frontline capacity through community health worker integration. We fund data infrastructure specifically designed for low-resource settings. And increasingly, we’re emphasizing impact frameworks that measure patient outcomes rather than just service volume.

The integration with insurance mechanisms, both government and private, creates particularly interesting opportunities. Our healthcare financing investments that establish predictable revenue streams while reducing out-of-pocket expenses have shown strong performance, as highlighted in our 2023 Impact Report.

|

7

What are the biggest ecosystem-level or policy bottlenecks you encounter while working in healthcare investing in India—be it licensing, cross-border compliance, public-private integration, or talent? Where do you see the most scope for government partnerships or blended finance to unlock scale?

|

When investing in healthcare across India, we often encounter what can be characterized not as bottlenecks but as quality checkpoints that ultimately lead to better outcomes.

The regulatory framework around healthcare licensing and accreditation—while sometimes perceived as cumbersome—has actually helped elevate standards across our portfolio companies. When properly navigated, these standards like NABH or NABL accreditation have become valuable differentiators for businesses like Krsnaa Diagnostics and Cyrix Healthcare, whose quality certifications reinforce patient trust alongside their affordability.

Somerset Portfolio Company Krsnna Diagnostics under fund 1

In pharmaceutical CDMOs, cross-border compliance adds another layer of rigor. Navigating international quality audits and meeting standards such as WHO GMP and EU GMP is essential, not only for regulatory approvals but also for building credibility in global markets. These requirements, while intensive, push Indian players to deliver world-class quality consistently, opening up vast export opportunities.

Public-private integration, particularly with Ayushman Bharat, represents an area where initial complexity leads to significant expansion opportunities. While establishing these partnerships requires rigorous documentation and process alignment, the enterprises in our portfolio that successfully integrate with PM-JAY gain scalability advantages that purely private models cannot match. Increasingly, there’s also scope to innovate around financing—such as top-up insurance coverage that extends protection beyond Ayushman Bharat limits, enhancing affordability for lower-income segments.

We also recognize that healthcare delivery faces persistent human resource challenges, especially in deeper geographies where clinical talent is scarce. Rather than seeing these constraints as limitations, we’ve found that investing in capacity building creates sustainable advantages. Additionally, technology is becoming a vital enabler—Point of Care (PoC) testing and mobile diagnostics, for instance, are helping bring quality care to Tier 2 and 3 cities and rural areas, even in the absence of specialist doctors.

The most promising opportunity lies in scaling PPP frameworks that align incentives between government insurance schemes and private providers. NITI Aayog’s policy support for blended financing approaches has created pathways for innovative capital structures that reduce risk while maintaining commercial viability. Strengthening these frameworks not only boosts infrastructure investment but also fosters more integrated care delivery across public and private stakeholders.

These quality-focused approaches may extend timelines initially but ultimately enable more sustainable expansion. The healthcare businesses in our portfolio that embrace these structured quality systems—whether through regulatory compliance, tech-enabled delivery, or public-private integration—consistently demonstrate better patient outcomes and more resilient growth trajectories.

|

8

Looking ahead, what sub-sectors or emerging models in healthcare are you most excited about in India? Are there overlooked areas or non-obvious innovations—say, around AI in diagnostics, climate-health intersections, or home-based care—that you believe could define the next decade of healthcare impact?

|

Our investment thesis centers on addressing what we call India’s ‘missing middle’ in healthcare—those populations caught between subsidized public systems and premium private care. This segment represents not just a market gap but a significant investment opportunity where financial returns and meaningful impact can converge.

We’re primarily focused on growth-stage companies that have proven their operational model and are ready to scale. What we look for are businesses that combine strong unit economics with measurable health outcomes—companies that aren’t just growing but are growing by expanding access to underserved communities.

This might be hospital chains extending into Tier 2 and 3 cities with right-sized delivery models, digital platforms that meaningfully integrate with on-the-ground healthcare workers for healthcare delivery, or diagnostic solutions businesses that dramatically reduce cost barriers without compromising quality.

The most exciting opportunities we’re seeing now fall into several categories:

- Tech-enabled care delivery models that extend specialist reach beyond urban centers,

- Preventive health models that address conditions before they become acute and expensive to treat,

- Climate-resilient health infrastructure addressing emerging environmental challenges,

- Decentralized care models that bring services closer to patients’ homes.

The preventive health angle is particularly compelling from both impact and returns perspectives—interventions that shift care upstream not only improve outcomes but also create more sustainable economics for both providers and patients. We’re seeing innovative models emerge around chronic disease management, maternal and child health monitoring, and community-based wellness initiatives.

What sets our approach apart is this dual focus on financial discipline and healthcare accessibility. We believe the next generation of healthcare leaders in India will be those who recognize that serving the underserved middle isn’t just socially valuable—it’s commercially compelling when approached with the right business model and capital structure.

Ultimately, we’re backing companies that view India’s healthcare gaps not as obstacles but as the greatest untapped opportunity in a $610 billion market that’s only beginning its transformation journey.

|

|

|

.jpg)

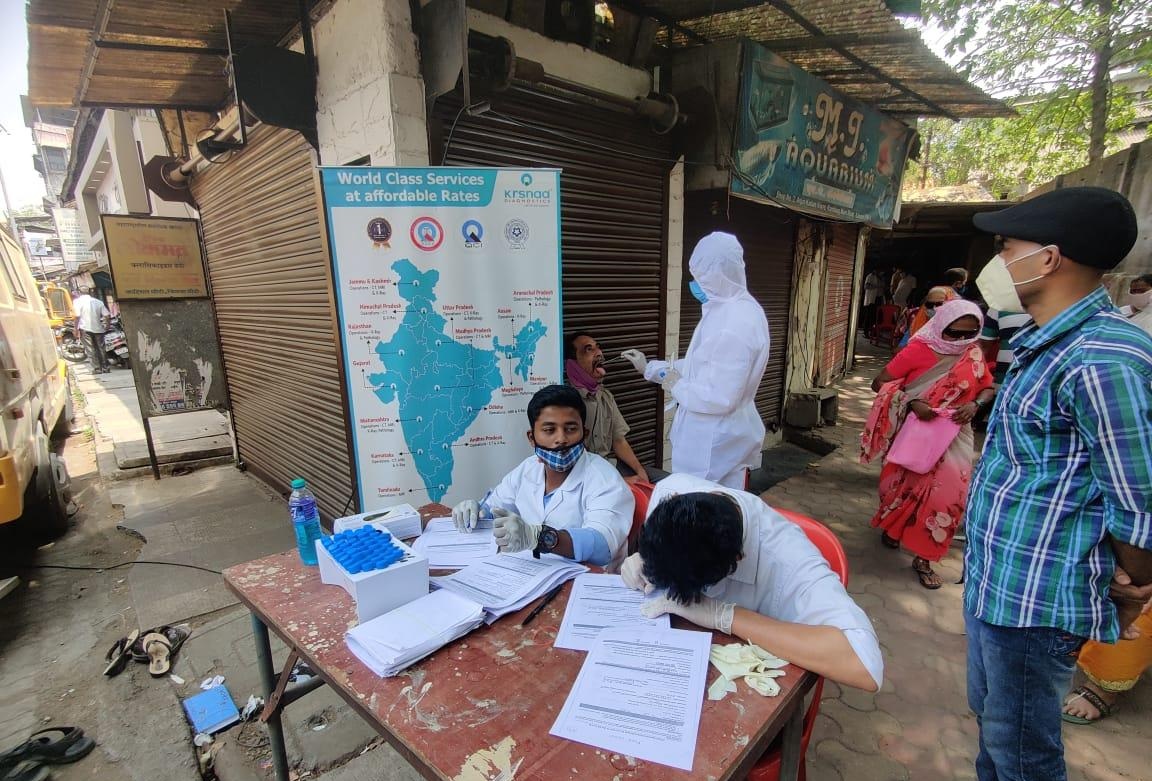

Mayur Sirdesai, Co-founder, Somerset Indus Capital Partners

Mayur brings over 30 years of specialized healthcare experience spanning private equity, strategy, operations and entrepreneurship. As co-founder of Somerset Indus Capital Partners, he drives fundraising, investment opportunities, and strategic value creation for portfolio companies. His multifaceted career includes founding medical device and stem cell ventures, establishing IMS Health's India practice, leading business development at German Remedies, and directing operations at his family's manufacturing group. This diverse background gives him exceptional insight across the healthcare ecosystem.

Mayur remains actively involved in healthcare innovation as a mentor at SINE (IIT Bombay's incubator), advisor to BIRAC's biotech grant committee, and leader within IIT Bombay's Healthcare Special Interest Group. He holds degrees in Chemical Engineering from IIT Bombay and Penn State, plus an MBA in Finance from the University of Texas at Austin.

About Somerset Indus

Somerset Indus Capital Partners is a healthcare focused private equity firm making private equity and equity-linked investments primarily in growth-oriented healthcare companies in India. It aims to invest in healthcare delivery product and service platforms run by experienced healthcare entrepreneurs which are focused on providing quality and affordable healthcare across India, especially in the lower tier markets. Somerset Indus through its investment thesis of profitable and sustainable impact-oriented investing has been supporting capacity build up and aims to deliver accessibility and affordability to healthcare in India. Its key focus lies in creating a positive impact on the environment and society.

To know more, visit: https://somersetinduscap.com/

|

|

About Impact Investors Council:

Impact Investors Council, India (IIC) is a member-based national industry body formed with an

objective to build and strengthen the impact investing eco-system in India. To know more about our work visit https://iiic.in or reach out to secretariat@iiic.in

|

Disclaimer: Data and Information in this newsletter is made available in good faith with the exclusive intention of helping market and ecosystem players, policymakers and the public build a greater

understanding of the Indian impact investing market. The data is collated from sources believed to be reliable and accurate at the time of publication. Readers are urged to exercise independent judgment and diligence in the

usage of this information for any investment decisions

Some of the information provided in this newsletter is supplied by third parties. It is important that all users understand that third party information is not an endorsement of any nature and has been put together with the

sole purpose of benefiting stakeholders.

|

| Unsubscribe |

|

|

|

.png)

.jpg)