|

Impact Enterprise Showcase

Dialogue with Arun Nayyar,

Managing Director & Chief Executive Officer, NeoGrowth

|

|

1 a) Could you share with our readers an overview of NeoGrowth's business model and how it supports the mission of extending credit to small businesses?

|

India has over 70 million MSMEs, creating over 111 million jobs and contributing around 30% to India’s GDP. Supported by momentum in retail consumption and digital payments, MSMEs sit at the center of India’s economic development. Despite these encouraging numbers, timely access to finance remains a key constraint for the growth of micro and small businesses. Only about 12-14% of overall formal credit goes to them, leading to a significant credit gap.

Currently, formal credit supply addresses only INR 24 trillion worth of MSME financing needs, leaving an addressable credit gap of approximately INR 44 trillion. Hence there is a credit demand amongst the underserved and unserved MSME segment.

Access to credit can help in the formalization of the MSMEs sector and drive inclusive growth.

To enable credit access for MSMEs without a credit history, flow-based lenders like NeoGrowth play a crucial role. NeoGrowth is a new-age lender, with a focus on Micro, Small, and Medium Enterprises (MSMEs) and a diverse product suite catering to various segments.

NeoGrowth assesses MSMEs basis digital cash flows and new age data-based models which show a true picture of their repayment capabilities. The products are designed to ensure that the varied needs of distinct segments are addressed through features such as daily repayment facility, simplified application process, quick disbursals, collateral-free and end-to-end digital process. Through our differentiated approach to serving the MSME segments (Retail and Supply Chain), we have disbursed ~USD 1.5 billion since inception across 55,000+ customers.

|

1 b) What sets NeoGrowth’s business model apart from traditional financial institutions?

|

NeoGrowth’s emphasises customer-centricity and transparency in lending processes. Daily repayment schedules are tailored to align with customer cash flows, alleviating the overall repayment burden. Utilizing digital payment trails, we ensure verifiable business volumes, enhancing trust and accuracy in financial assessments. Creditworthiness is evaluated through Credit Bureau and digital transaction flow, ensuring fair and reliable assessments. Our seamless digital processes enable swift loan approvals, with 90% of loans approved within 2 days. Superior customer experience also enables us to generate higher lifetime value driven by technology, data, and customer relationships.

India’s innovative digital public infrastructure has been a catalyst for the growth of the financial services industry. The India Stack, Aadhaar authentication, GST, and Account Aggregator simplify access to financial services and form the core of NeoGrowth ecosystem.

Moreover, a robust digital stack empowers us to enhance credit profiling accuracy, lower borrowing costs, minimize credit risk, ensure higher operational flexibility, and provide a flexible repayment schedule. This gamut of digital financial infrastructure facilitates seamless access to credit, reduces paperwork, and improves turnaround time, allowing MSMEs to obtain funds quickly and conveniently with our flow-based lending solutions.

Our focus remains steadfast on fostering financial inclusion. By combining Digital Public Infrastructure with AI/ML and analytics, we continue to enhance our customer selection and risk management processes. We aim not only to empower countless small businesses nationwide but also to simplify lending across the value chain for MSMEs.

|

2 In recent years, there has been a noticeable emphasis by investors on businesses achieving scalability alongside profitability.

Could you help our readers understand NeoGrowth's strategy for maintaining profitability while simultaneously expanding its reach and impact?

|

NeoGrowth has completed ten consecutive quarters of profitability post COVID, driven by innovative products, deep customer understanding, and robust digital lending capabilities.

NeoGrowth profitability and scalability are governed by factors like:-

- Mature product suit: Our diverse product portfolio aims at driving financial inclusion by offering innovative collateral-free and secured loan products to meet the ever-changing customer needs.

- Deeper customer understanding: At the core of NeoGrowth lies customer centricity, we have 4 pillars that make us customer-centric:

i)Consumer intelligence ii) On-ground connect iii) Customer Service iv) Education Hub

We constantly strive to understand MSMEs holistically including their mindsets, needs, aspirations, and challenges.

- Technology: We have in-built robust digital capabilities aiding efficiency and productivity, this is proven by our best-in-class Opex to NIM ratio of 33.4% at end of Q3 FY’24. We make use of artificial intelligence, machine learning, and advanced analytics to make objective decisions enabled by data.

- Risk Management: We have sound liquidity and risk management through pragmatic portfolio management, robust collections framework, and proactive mitigation measures supported by data science.

- Capital Management: We are committed to broadening our network of lenders, banks, and financial institutions, enhancing our position through competitive pricing and flexibility. In FY’23, NeoGrowth raised INR 300 Cr. in Series D equity round led by FMO along with existing participants.

|

3 Could you also take us through your journey with debt funding as well? What were some of the interventions or steps you took that enabled you to become debt-ready?

|

At NeoGrowth, our diverse lender base and proven ability to raise debt sets us apart. With over 40 lenders and various instruments such as NCD, ECB, Team Loans, Banks, Large NBFCs, PTC, and CC, our lender mix is robust.

NeoGrowth has demonstrated its ability to raise debt from both domestic and international lenders with ~60% of its debt portfolio funded by domestic lenders.

FY’24 marked a significant milestone in our debt funding journey. We became the first Indian company to list a Foreign Currency Borrowing (FCB) on the Gift City Exchange, opening doors to future collaborations with overseas investors. In addition, we achieved a record-breaking fundraising of 1875 crores across 55 deals in a single year. Furthermore, we exceeded previous years' figures for securitization and Direct Assignment trades, reaching a combined total of 900 crores. We also expanded our network by adding five new banks, bringing the total to seven.

We remain dedicated to expanding our network of lenders, banks, and financial institutions, strengthening our position with competitive pricing and flexibility. Notably, the rating agency ICRA upgraded our credit rating to BBB+ in February 2024.

|

4 Given that Neogrowth has been the first to list at the IFSC exchange at Gift City, what are some of the other fundraising avenues that you see now opening up for impact-focused enterprises such as yours? How could they be more prepared to participate in innovative structures?

|

NeoGrowth's FCB listing at the IFSC Gift City Exchange has unlocked several fundraising avenues for impact-focused enterprises like ours. Listing FCBs on the Gift City Exchange route has enabled investors and borrowers to avail the benefit of a concessional WHT rate which has a favourable impact on the cost of such deals. This attracts new overseas lenders and encourages existing ones to increase their exposure, allowing NeoGrowth to onboard more impact-driven lenders at a more concessional rate.

Demonstrated profitability, scale, and capital base will be a catalyst for improving the credit rating in the coming years. This will open new avenues for funding.

|

5 We've noticed NeoGrowth's continuous support towards women-owned businesses. Could you elaborate on how you ensure gender inclusivity as a lender?

|

Women entrepreneurs are increasingly making a mark across diverse sectors in India with their contributions. Women-owned MSMEs have created 18.73%* of the total jobs. They contribute more than one-tenth (10.22%)* of the total turnover of the registered MSMEs.

Keeping with the growing importance of gender equality and inclusion, we at NeoGrowth, have aligned our core business activities with the crucial United Nations Sustainable Development Goal of gender equality to create significant impact. Our women MSME borrowers comprise businesses run by women, whether as sole proprietors, partners, directors, or co-applicants.

We extended loans to over 3600+ women entrepreneurs in FY 2023-24, amounting to approximately INR 650 Crores, marking a substantial uptick from the previous years, reflecting our efforts to promote gender equality in lending.

*(Basis MSMEs registered on the Udyam Registration Portal (URP) of the Ministry of MSME)

|

6 Could you share some impactful stories that showcase how you’ve fostered women entrepreneurship?

|

|

|

Story Of Seema a Proud Business Owner

Meet Seema (Restaurant Owner), a mother of three, is an exceptional leader in her household and business. Despite completing her education till 10th grade only, she has gained valuable practical knowledge and expertise in running her only business. Seema started her business love for cooking and feeding others and the appreciation she received from her community motivated her to start her own business, Indian Masala House. Even though many did not support her idea initially, she continued to serve her customers. She availed a loan from NeoGrowth for her working capital requirements. With her hard work and savings, Seema will be inaugurating her own hotel soon. She is breaking barriers and has emerged as a proud businesswoman. She acknowledges NeoGrowth’s crucial role in her journey.

|

|

|

Story of Ujwala A Pet Lover

Ujjwala, a former housewife and mother of two children, joined her husband in their entrepreneurial journey of all things related to pets. Their love for animals and their business background made it a natural fit for them. Over the course of 7-8 years, they have opened three stores and now sell all kinds of pet foods, accessories, and grooming services. With the help of a loan from NeoGrowth, they were able to set up a new store and nearly doubled their employee base, including hiring women staff. They also participate in various social drives for animal welfare, such as feeding programs, adoption drives, and providing vet care facilities. Their true passion for animals has contributed to the organic growth and advertising of their business. They realize overall looking at their growth story that receiving credit support for non-traditional businesses such as theirs could only have come from a flexible capital provider like NeoGrowth.

|

7 How do you measure the end impact of your financial inclusion initiatives? Could you describe your methodology for assessing and quantifying the impact at the beneficiary level?

|

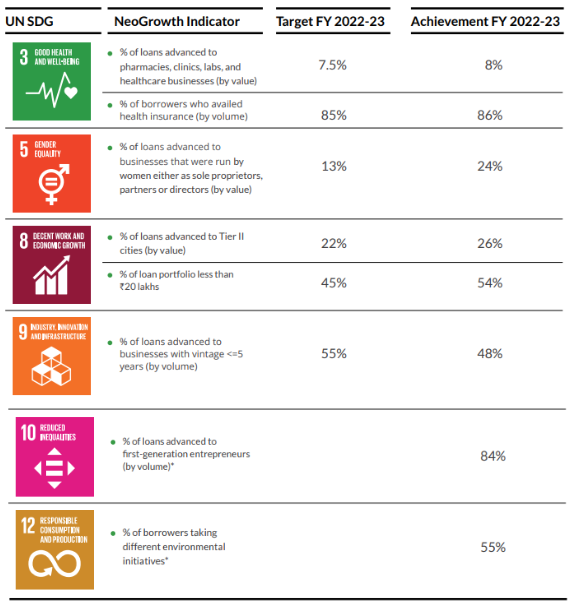

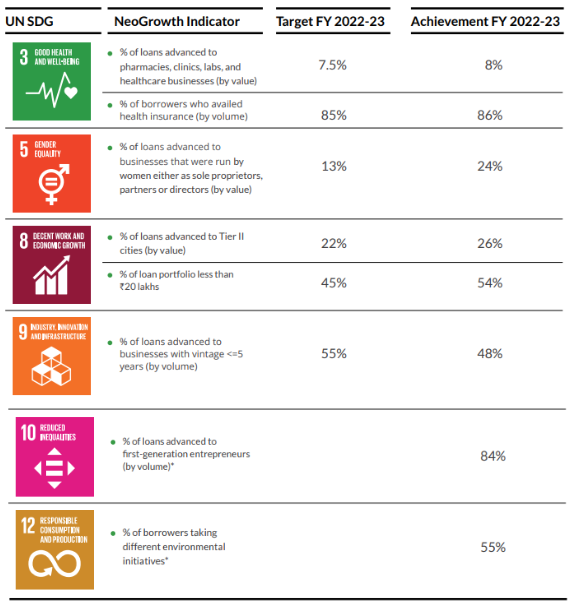

Our approach to lending is centred on creating a positive impact by setting a distinctive standard for financial inclusion in India. Importantly, NeoGrowth’s business activities are tracked and aligned to 6 out of 17 United Nations SDGs and we are constantly working towards holistically contributing towards them. We have delivered on key UN SDGs including Good Health and Well-being; Gender Equality; Industry, Innovation and Infrastructure; Decent Work and Economic Growth in terms of value and volume.

Our loan books are monitored to capture the percentage of loans advanced to companies run by women, the percentage of loans advanced to first-generation entrepreneurs, the percentage of loans advanced to Tier II cities, etc.

*Data basis FY 2023 customer survey

Our annual impact-linked research helps us to understand the difference made by our loans on MSMEs and the wider community.

The research follows a detailed methodology for evaluating and quantifying the impact at the beneficiary level. The agency randomly selects the sample of MSMEs from NeoGrowth’s active borrowers spread across the country based on various parameters, such as industry, loan size, business vintage, gender of customers, and business constitution for conducting an in-depth survey.

A tailor-made questionnaire is designed on established parameters, keeping the various MSMEs’ persona in mind. The Impact Assessment Agency conducts in-person interviews with the customers of NeoGrowth to understand their mindset, behavior and motivations, and the snowball effect created by us on the community beyond our customers.The information received through the survey helps us to effectively assess and quantify the impact created by all its financial inclusion initiatives and core lending activities.

As a digital lender, NeoGrowth has limited direct impact on the environment, we remain dedicated to building a positive environment-friendly focus. Our customers receive educational mailers addressing environmental challenges, fostering awareness and promoting sustainable practices. Additionally, we also share informative content on cybersecurity, empowering customers to safeguard their digital assets and navigate cyber threats effectively.

These initiatives aim to enhance customer knowledge, encourage responsible behavior, and strengthen our commitment to environmental sustainability and cybersecurity resilience.

More details on these initiatives are captured in our Impact Report link: https://www.neogrowth.in/social-impact/

.jpg)

|

8 For enterprises building impactful solutions in the financial inclusion space, what risks must they be cognizant of—and how can they mitigate them?

|

NeoGrowth has seen multiple economic cycles and disruptions like GST, Demonetization and COVID since its inception 10 years ago. Learnings from these events have enabled NeoGrowth to develop a sustainable business model through deeper customer understanding and a robust risk management framework.

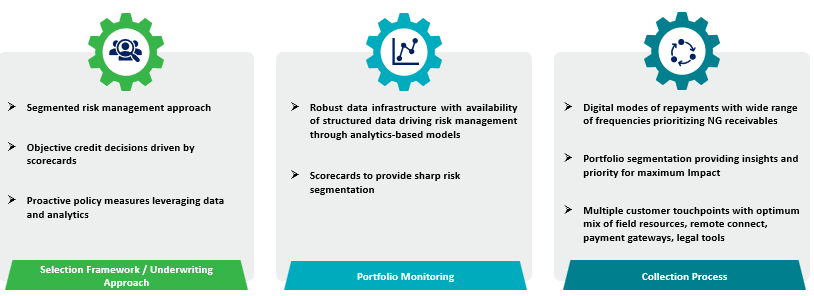

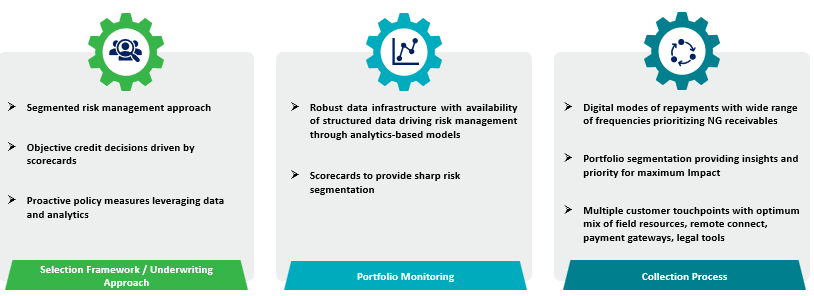

NeoGrowth’s customer selection and risk management approach is differentiated by objective decision making driven by data and analytics and maintaining the right balance of customer connect. Our segmented and modular risk framework enables optimal risk reward balance and provides the ability to manage disruptions.

NeoGrowth has deployed a robust corporate governance with dedicated committees such as Credit & Risk Management Committee, Audit Committee, IT Strategy Committee, etc. Our well defined compliance framework ensures adherence to all required regulations. Stark focus on risk and compliance is necessary for a growing business such as NeoGrowth.

Being a new-age digital lender, we constantly evaluate various business risks in our operating ecosystem and develop the most suited risk management strategies that aligns with our core objective of attaining risk-calibrated growth and long-term sustainability.

|

9 As we look to the future, could you shed some light on NeoGrowth's funding requirements, whether in the form of equity, venture debt, or other capital sources? How do you anticipate utilizing such capital to drive your growth strategy and expand lending among small businesses?

|

At NeoGrowth, we focus on serving the large, growing, and profitable MSME segment, aiming to bridge the MSME credit gap while continuing to scale. Our proven model, characterized by sustained growth and profitability, positions us for further expansion. With an adequate capital base, we plan to achieve a growth rate of approximately 30-40% over the next five years, solidifying our commitment to meeting the evolving needs of the MSME sector.

|

|

|

Arun Nayyar, Managing Director & Chief Executive Officer, NeoGrowth

Arun is a seasoned finance professional with more than 20 years of diversified experience in commercial and consumer lending. A Chartered Accountant, Arun has a successful track record of building businesses from scratch, scaling up established businesses and managing stressed portfolios.

A passionate financial services industry professional, Arun has a great understanding of key business drivers, risk and product management, route to market and digital lending. He spearheaded businesses across Micro Enterprise Lending, SME Lending and Consumer Finance.

Arun was earlier with Edelweiss where he was heading the SME Lending business of the group. Prior to Edelweiss, Arun held several key positions across Business Development and Risk Management with Citibank India. Arun also worked with credit rating firm CRISIL early in his career.

|

About NeoGrowth

NeoGrowth is a new-age lender, with a focus on Micro, Small, and Medium Enterprises (MSMEs). It is a Systemically Important, Non-Deposit taking Non- Banking Financial Company (NBFC-NDSI), offering a wide range of products tailored to the dynamic needs of small businesses. Its data science and technology-led approach enable it to offer quick and hassle-free loans to MSMEs across 75+ segments across 25+ locations in India.

It offers a unique daily repayment option to its customers with multi-channel repayment modes. It has served and engaged with 1,50,000+ businesses and supported them with their growth ambitions. It not only helps small businesses grow but also drives financial inclusion making a positive social impact. Founded by industry veterans, its Board of Directors comprises experts, who guide the leadership team toward its strategic goals.

NeoGrowth was founded by Dhruv Khaitan and Piyush Khaitan a decade ago and is backed by renowned investors, namely Omidyar Network, Lightrock, Khosla Impact, Accion Frontier Inclusion Fund, Quona Capital, 360 One Asset, FMO, and Leapfrog Investments.

|

|

About Impact Investors Council:

Impact Investors Council, India (IIC) is a member-based national industry body formed with an

objective to build and strengthen the impact investing eco-system in India. To know more about our work visit https://iiic.in or reach out to secretariat@iiic.in

|

Disclaimer: Data and Information in this newsletter is made available in good faith with the exclusive intention of helping market and ecosystem players, policymakers and the public build a greater

understanding of the Indian impact investing market. The data is collated from sources believed to be reliable and accurate at the time of publication. Readers are urged to exercise independent judgment and diligence in the

usage of this information for any investment decisions

Some of the information provided in this newsletter is supplied by third parties. It is important that all users understand that third party information is not an endorsement of any nature and has been put together with the

sole purpose of benefiting stakeholders.

|

| Unsubscribe |

|

|

|

.jpg)

.jpg)