Dvara E-Registry

Agrifintech startup which enables farmer’s access to finance and productivity across the agri-value chain

About Dvara E-Registry

Dvara E-Registry is an AgriFinTech start-up that works with the vision to be the financial inclusion and productivity enabling platform for all stakeholders in the agricultural value chain. Dvara E-Registry was founded in 2019 by Sanjay Mansabdar, who believes that data and technology can play a critical role in creating sustainable and scalable solutions in the agricultural sector.

Most farmers and FPOs in India face difficulty in gaining access to credit and insurance, information about modern and productive farming methods, challenges in acquiring agri-inputs and selling their produce at fair prices.

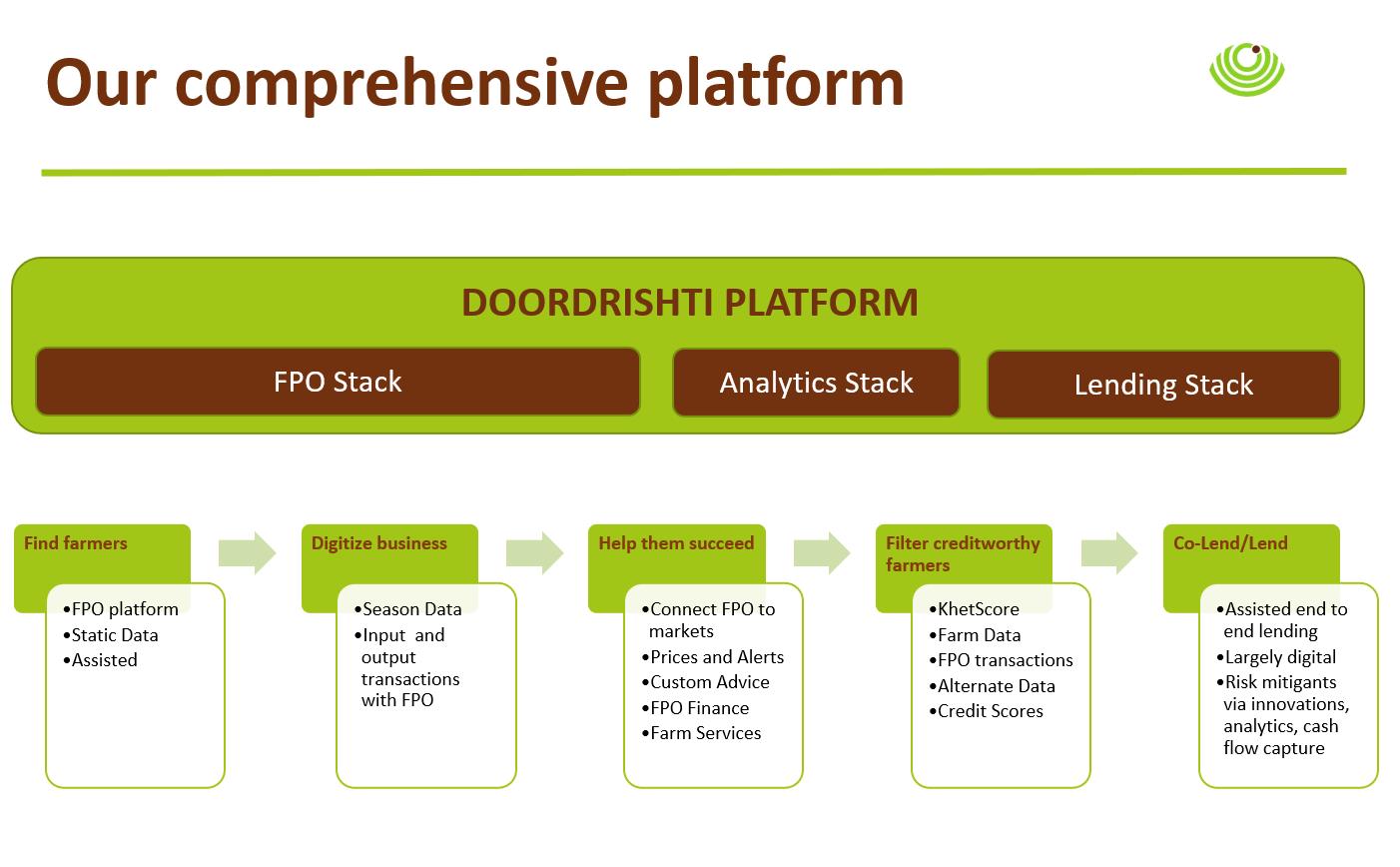

Doordrishti:

As a response to challenges faced by farmer aggregates and farmers, Dvara E-Registry has created a comprehensive digital platform called Doordrishti that uses technology, analytics, and information to connect farmers with various service providers enabling farmers to source inputs from seeds and fertilisers companies and access credit and insurance from financial institutions and seek crop advisory.

FPO Stack:

Doordrishti digitises the FPOs business, that helps in estimating the health and growth stage of their crops (i.e. their business) and other relevant data that establishes better business linkages in a timely manner. Doordrishti acts as an information backbone providing crop production and status estimates, farmer engagement and access, warehouse and credit linkages, price dissemination, a mechanism to enable aggregation of input demand and farmer outputs. Doordrishti also provides accounting services to FPOs that helps them keep track of their business.

Doordrishti helps the farmers succeed by engaging them through a mobile application where they receive customised advisory, information on their FPO’s procurement activities, block level weather updates and alerts, credit and warehouse linkages and price dissemination. To ensure no farmer is left behind, farmers who do not have access to smartphones receive information via SMSs.

Analytics Stack:

Analytics is the backbone of all of Dvara’s services to FPOs, farmers and other agri value chain stakeholders. Through farm level digitisation and sourcing land specific data through multiple sources, Dvara E-Registry is able to procure multi dimensional, historical data for each plot that is crucial to assess yield estimation, harvest date and multiple other parameters of farm analytics. These analytics help farmers and FPOs make smart sowing decisions that help them mitigate risk. Analytics are also the foundation for multiple farmer and FPO services such as advisory and timely market linkages.

In the absence of digital records and credit scores, Dvara’s analytics helps smallholder farmers with no formal credit history by providing verifiable information on land holding details, crop-specific analytics, sowing area details; helping prove their repayment capacity and financial stability to lenders.

Lending Stack:

Using alternative data generated from Doordrishti platform and combining it with geo-spatial and weather analytics that are farm and farmer specific, Dvara E-Registry has the capacity to identify credit worthy farmers and provide them with loans and insurance, in conjunction with partner financial institutions and help grow their business. To participating financial institutions, DER offers end-to-end farm loan management beginning from farmer acquisition and onboarding to credit underwriting, loan disbursement, monitoring & risk management and collection. Farm assessment is facilitated through the KhetScore and KhetScore Now analytics that provide historical and real time data for accurate assessment. Farmer assessment is done through using data from FPOs, Credit Bureau and cash flow analysis.

These details are crucial for financial institutions in credit underwriting, arriving at insurance premiums, and optimizing claim settlements. The end-to-end process ensures that financial institutions can engage with customers without physical presence and multiply their reach considerably. Dvara’s Field Representative called Krishak Saathi is present throughout the process beginning from loan origination to collections, providing any support needed at every stage.

Doordrishti Reach and Partnerships:

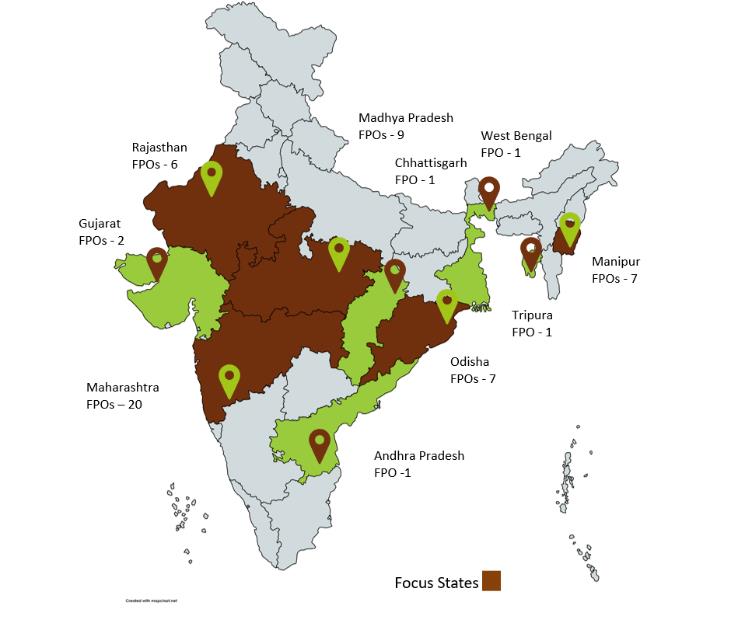

As of September 2021, Dvara E-Registry has a portfolio of over 55 FPOs across 10 states of India. These FPOs and farmers receive Doordrishti’s customised services, profitable agribusiness linkages, advisory and access to credit through Dvara E-Registry’s partner lenders.

Dvara E-Registry has partnered with Dvara Trust, Avanti Finance, Samunnati and other Financial Institutions to provide agricultural loans using alternate credit underwriting for smallholder farmers, who otherwise would have no access to formal agricultural loans. Dvara also has forged partnerships with multiple agri businesses like Plantix, BigHaat, Yara among others to provide the most profitable input and output services to farmers and FPOs.

In July 2021, Dvara E-Registry raised a pre-Series A round of funding from Omnivore, an India-based venture capital firm, and Dvara Holdings.