The funding for Climate-tech saw a significant increase in the second half of FY2025, rising from $364 million in the July- September quarter to $1,435 million in the October- December quarter. This surge was primarily fueled by a $1 billion investment in Erisha E Mobility in March 2025. When excluding this substantial investment, the Climate-tech sector still experienced a 20% growth over the six months.

Early-stage (Seed and Series A cumulative) deals saw a notable decline, with their share of total capital raised decreasing from 34% in July to September to just 12% in October to March. In contrast, the proportion of later-stage deals (Series B onwards) surged significantly, primarily driven by a $1 billion Series D investment in EV manufacturer Erisha E-Mobility by undisclosed investors.

Sustainable Mobility retains its position as the preeminent subsector in Climate-tech, having raised $172 million across 32 deals (excluding the Erisha Mobility deal). EV manufacturers continued emerging as frontrunners, receiving the top three biggest ticket sizes in the segment- namely PMI Electro Mobility, BGauss, and Ultraviolette.

Emerging innovations increasingly capture investor interest, complementing the traditionally dominant EV Electric Original Equipment Manufacturers (OEMs) in the mobility landscape. For example, Sarla Aviation, an aerospace startup, is developing an electric aircraft for urban air mobility applications such as ‘flying taxis,’ securing $10 million in January 2025 in a funding round led by Accel. Similarly, Vecmocon Technologies is a deep-tech startup specializing in designing advanced components and software solutions for EVs Another very interesting entrant in this subsector is Zingbus an intercity mobility startup that aims to make intercity bus travel more reliable, affordable, and tech-enabled by aggregating fleets from small and medium-sized bus operators and optimizing fleet operations through data driven pricing and scheduling models

Battery, as well as charging infrastructure startups, continue to build their distinct universe of innovation landscape within the broader electric mobility ecosystem, attracting increasing investor interest. VoltUp, a battery-swapping startup enabling rapid battery exchange for electric two and three-wheeler users for depleted batteries, raised $8 million in a Seed round, and Urja Mobility focuses on battery leasing solutions, facilitating EV adoption through financial solutions. Bolt Earth offers smart EV charging stations, while Exponent Energy is advancing fast-charging technology through the development of charger and battery solutions, enabling rapid charging for EVs.

Closely following the momentum in Sustainable Mobility, the Energy segment received $227 million across 17 deals. This is a massive increase from $6 million across 3 deals between July to September 2024.

Within this space, conventional energy startups focused on renewable energy generation and transition secured the largest funding rounds, such as Ampin Energy Transition, Bhilwara Energy and Solar Square, which are scaling renewable energy infrastructure and supporting the energy shift.

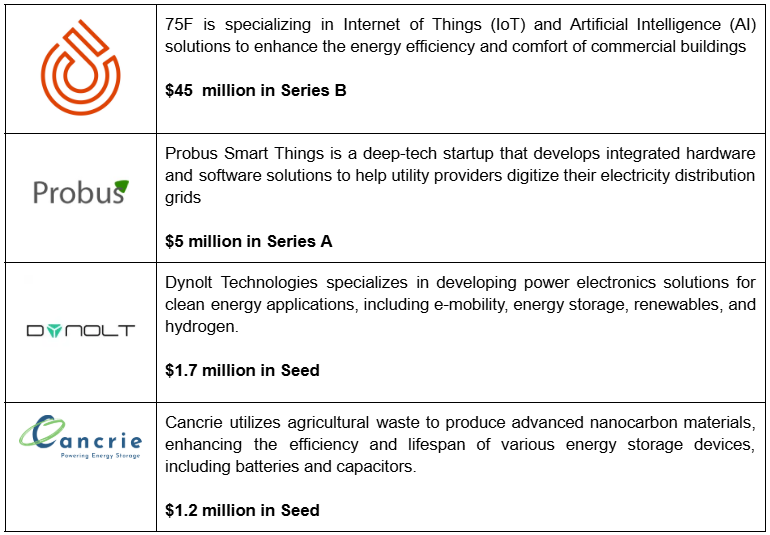

The energy sector remains one of the most dynamic, diverse and highly specialised segments in terms of innovations. Its multidimensional nature, spanning generation, storage, distribution, and grid integration, can make it challenging to decode. We observed a number of pioneering innovations gaining traction and signalling investor confidence recently, and some are highlighted below -

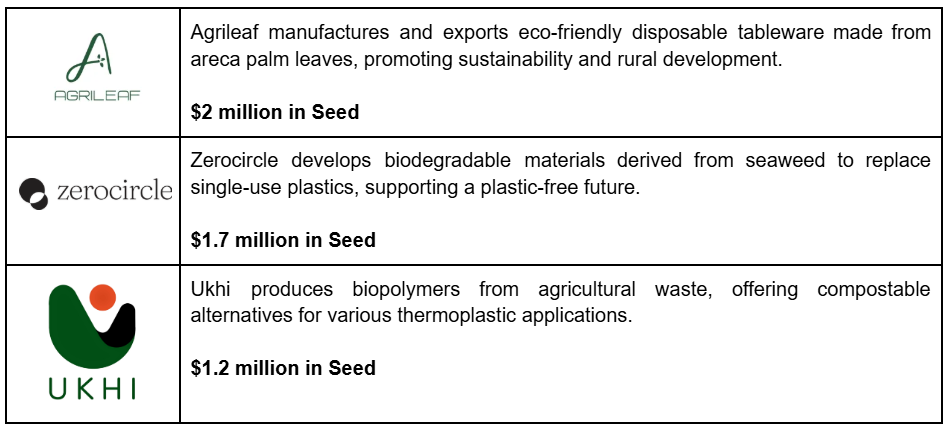

An emerging segment garnering growing interest from entrepreneurs, investors and policymakers is Waste Management & Circular Economy, with its ‘eco-friendly’ solutions. Seed-stage funding takes precedence in this segment, given the prevalence of nascent-stage startups. Bumboo, a sustainable packaging solutions provider for food service businesses, raised consecutive seed-stage funding in November and December of 2024, reflecting the sector's momentum,

Stage Wise Snapshot

Sector Wise Analysis

Disclaimer: Disclaimer: The logos of enterprises used in this newsletter are for illustrative purposes only and do not imply their endorsement or affiliation to IIC. All trademarks and logos belong to their respective owners, and their inclusion in this newsletter is not intended to infringe upon any intellectual property rights.