Over the years, India’s EV ecosystem has grown steadily, supported by active investments from VCs, PEs, and corporates; strong policy action; and rising consumer adoption - both from individuals and businesses.

According to IIC’s internal database and reports, sustainable mobility has been one segment that has received the highest amount of investments from investors, attracting ~$2.1 billion between 2022–2024, accounting for nearly 70% of all climate tech investments during this period. 1

While the sector was initially dominated by large-ticket investments in Electric Vehicle (EV) Original Equipment Manufacturers (OEMs), it’s now interesting to see it draw capital across diverse models – charging infrastructure, EV ride-hailing and logistics, and battery energy storage systems, among others. 2

India’s EV Adoption Story

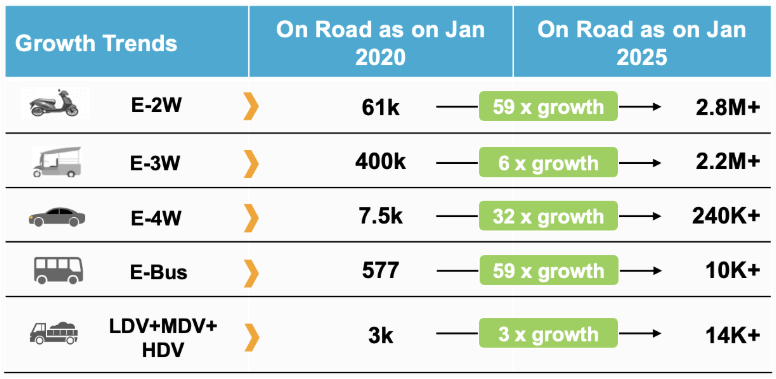

The past five years have witnessed a remarkable rise in the adoption of electric vehicles in India. As per data from the Vahan Dashboard, JMK Research, and other public sources, the growth has been especially pronounced in the 3-wheeler segment, with over 50% of all 3-wheelers sold in 2024 being electric. The 2-wheeler and car segments are also catching up, with EVs accounting for around 5-6% of 2-wheeler sales and nearly 2% of car sales during the same period.

These numbers have consistently grown over the years, as seen in the accompanying table.

Source: Vahan Dashboard, JMK Research, https://asianbusinessreview.com/news/indian-consumers-embrace-evs-in-pursuit-sustainability

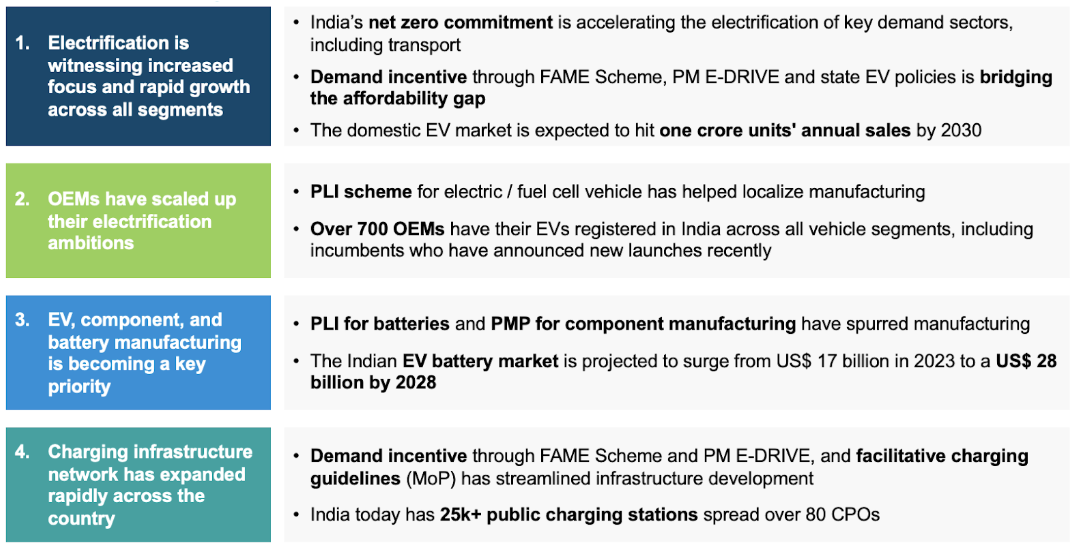

EV sector growth driven by supportive government policies

A range of national and state-level policy initiatives have played a key role in accelerating EV adoption across India.

Source: Economic Survey 2023, Vahan Dashboard, IBEF and JMK Research – the policies listed are only indicative & are summarised for easier reference.

Key Trends in the Sector

These emerging trends and the evolving landscape have sparked active interest across the EV ecosystem, from automakers to energy players - setting the stage for increased EV adoption and growth of ancillary services in the coming years.

Driving the Growth Forward: EM-PACT

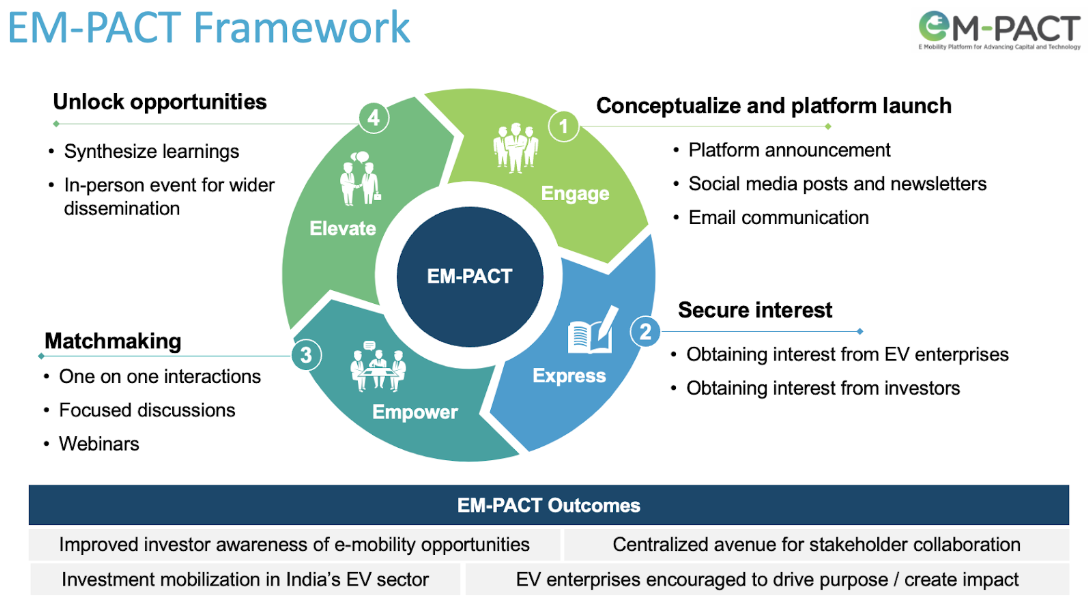

EM-PACT (E-Mobility Platform for Advancing Capital and Technology)

To sustain and accelerate this momentum of E-mobility in India, the Impact Investors Council (IIC) and KPMG in India have launched EM-PACT – an Impact Investment Facilitation Platform designed to connect investors with high-potential opportunities in the e-mobility space.

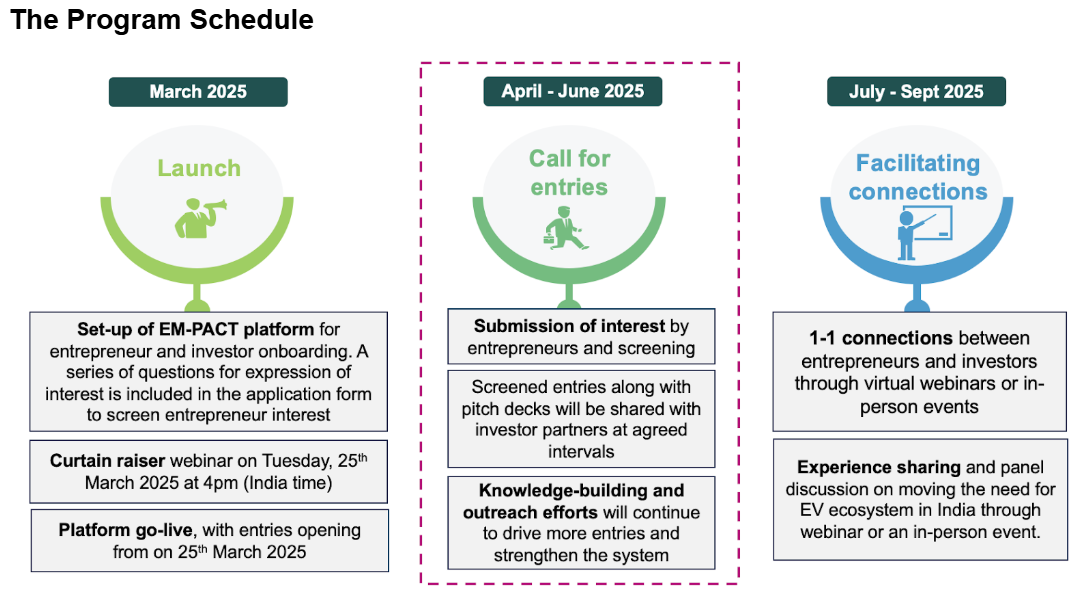

The platform was launched virtually on Tuesday, 25th March, drawing 100+ delegates from 7 countries, representing 90+ organizations. It featured conversations among leading investors, EV entrepreneurs, and experts discussing the e-mobility investment landscape, financing gaps, and emerging trends in India.

Be a Part of the Collaborative

Be a Part of the Collaborative

If you're an entrepreneur or enterprise working in the sustainable mobility space, EM-PACT is for you. Join us as we bring the ecosystem together – connecting capital with innovation and building a robust knowledge base around e-mobility in India.

Details of the registration can be accessed here.

Authors

Team EM-PACT

KPMG India & IIC

1 IIC Research Database

2 Based on Past IIC Reports & Publications