SIDBI’s focus has been promoting and financing the development of micro‐, small‐ and medium‐sized enterprises (MSMEs). It has also been helping MSMEs ‘go green’ with programs and initiatives that enable access to affordable finance and also increase their resilience to climate change.

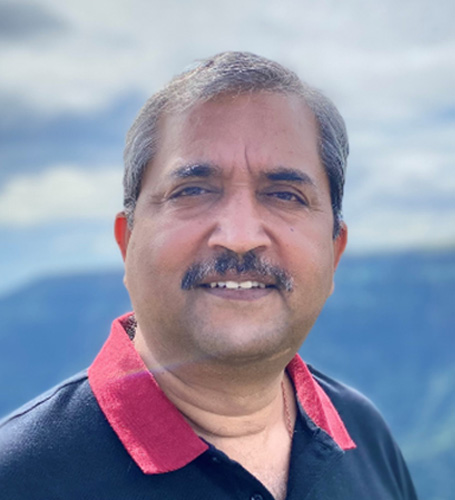

The following dialogue with Dr. Ravindra Kumar Singh, Chief General Manager, SIDBI, talks about the various initiatives that SIDBI has been taking to promote greening of the MSME sector and also shares SIDBI’s approach towards supporting climate tech innovations and scaling up climate finance.

Q1: The climate-tech space has been seeing most private sector investments focused on renewable energy and electric mobility segments. In your opinion, what are the sub-segments within climate technology that you see scaling up and inviting private as well as public capital, in the next 3-5 years?

In view of the nation's commitment to NetZero, and the government’s policy push there has been a surge in investments towards renewable energy and electric mobility.

We are in alignment with these streams and see them gaining more momentum in the coming years. Renewable energy and alternative fuel, particularly Solar energy and EVs should gain pace as the technology prices, supporting policies, and increasing finance to both sectors are making them a suitable and wise option. After a successful scale-up through government procurements, the government has raised its targets.

India now stands committed to reducing the Emissions Intensity of its GDP by 45 percent by 2030, from the 2005 level, and achieving about 50 percent cumulative electric power installed capacity from non-fossil fuel-based energy resources by 2030. The Government of India also set up ambitious targets to combat the adverse impacts of climate change and has set an ambitious target to reach its non-fossil energy capacity to 500 GW by 2030. Therefore, we do see Solar expanding beyond government and Industries to residentials eventually.

The third highest emissions after energy and industrial are from transport, which creates a larger focus on the adoption of EVs. The fuel costs and technological advances are making them more amenable options too. We are addressing the bottlenecks of EV infrastructure and availability of finance through EVOLVE (A SIDBI- World Bank program having concessional finance and risk sharing facility). We are optimistic about growth in this sector.

Q2: SIDBI has entered into collaborations with international development agencies to support green finance initiatives. What is the kind of initiatives/projects that you see receiving support under these collaborations? What will be the nature of support that SIDBI and its international partners will extend to beneficiaries?

SIDBI has executed several projects successfully under various collaborations. It provides more impact when expertise is pooled to provide solutions and address the demand of the sector. SIDBI, not only collaborates with International Development agencies but various government bodies, industry organizations, and other financial institutions in India.

The benefit of collaborating with other financial institutions is to get a perspective that applies to most developing countries, creating schemes with a broader outlook and getting exposure to more cutting-edge knowledge and similar cases.

SIDBI is collaborating/ under collaboration with multilateral and bilateral agencies like the World Bank, ADB, AFD, KfW, GIZ, etc for concessional finance and Risk Sharing facilities for various sectors viz Energy Efficiency, Decarbonization, EVs, Bio Gas, Waste Management etc.

Q3: The Green Finance Scheme launched by SIDBI is helping MSMEs ‘go green’ and reduce their carbon emissions. This will give a huge boost to facilitating enterprises to align their business activities with the COP26 goals.

Could you please shed some light on the strategy and thought behind the nature of enterprises that the Scheme is looking to support?

Is there a particular sectoral focus (For example Sustainable mobility, Waste management solutions)?

The objective of the Green Finance Scheme is to provide financial assistance and support for green projects in the MSME sector (Ex. Energy Efficiency, Renewable Energy, Waste Management, EVs, CBG, Wastewater Treatment, Innovative technologies, etc with a potential for climate change mitigation or ensures Sustainable Development Goals (SDGs)) as aligned with the nation's commitment to reduce Green House Gas (GHG) emissions. We are catering through Green Finance to MSMEs, RESCOs, ESCOs, EPC companies, and vendors on either Supply or Demand side of the Green Value Chain. MSMEs Executing projects or providing services related to the activities eligible under the scheme to various government bodies on BOT, BOOT, BOOM, PPP, etc may get support under our Green Finance Schemes.

The idea behind the initiative is Greening the MSME ecosystem which will help them gain global competitiveness, and brand recognition in the market, create a better work environment, and enhance profitability through a reduction in energy & environment-related cost.

Q4: The Srijan Scheme launched by SIDBI is looking to provide concessions loans to innovative technology projects. What nature of innovation under climate-tech do you see being financed under this scheme?

Can we expect technologies that are in the research and development stage and yet to be accepted in the market, also receive financial support? What would be the suggested approach toward financing technologies that are still to receive market validation?

Emerging technological sectors often face a lack of early-stage funding for the commercialization of innovations by micro, small, and medium enterprises due to the high risks of an investment in unproven technologies. Thus through the SRIJAN scheme, the bulk of the available early-stage funding is invested in relatively low-risk opportunities based on proven technologies, that limit innovations to reach the market. The SRIJAN scheme supports technologies in all fields.

Some examples of supported innovations are in medical technologies, waste management, energy, dairy, logistics, defence, battery systems, etc. These have been selected after screening around 400 cases.

Though Climate is not the sole focus under SRIJAN, it is thrilling when there are such projects that focus on energy efficiency like Promethean Energy which utilizes industrial heat for energy use, or a case of resource utilization by Hassle-free technologies that prints labels on both sides of the paper.

The aim is to support the commercialization of Innovative Projects, Promote Make in India and connect to the Market.

Q5: Are there any specific challenges or risk areas that you would like to highlight for scaling up green finance in India?

Green Finance has just started gaining space on the discussion table. The global movement is pushing a transition that is much needed for the environment. The sectors that need focus are new, don’t have legacy knowledge, and lack demonstrable examples. Therefore, building a trajectory is a challenge.

Similarly, capacity building of both MSMEs and financial institutions in the Green Sector, and gaining acceptance for a new product or service is a challenge.

But, we believe these are teething problems, there is a broad sense of inclination toward change and eventually, it will iron out. We are making efforts through many of our programs and capacity-building platforms such as GIFS (Green Indian Financial System), SPEX (Sustainability perception index), Project GRiT (Green Inclusivity for Clusters), and many such initiatives.

Dr. Ravindra Kumar Singh, Chief General Manager, SIDBI has an experience of over 30 years spanning different aspects of development finance and MSME development including sustainable development, environment and social risk framework, microfinance, international partnerships, and policy advocacy.

Background of SIDBI:

Small Industries Development Bank of India (SIDBI) acts as the Principal Financial Institution for Promotion,Financing and Development of the Micro, Small and Medium Enterprise (MSME) sector.

SIDBI's programmes and schemes focus on the sustainable growth of the MSME sector with an objective to increase the resilience of the MSME sector to combat climate change and facilitate greening of MSMEs.