Vinayak Kamath, Co-founder and Partner, Hearth Ventures, shares insights on the Fund’s focused approach on financing for circular economy solutions, by developing a unique investment thesis centered around the trifecta of ‘Creative, Cultural and Circular Economy’ .

Q1: The waste management & circular economy segment has been drawing increasing investor interest since the last 2 years.

What was your assessment of this space that prompted you to set up a fund focussed on startups engaged in circular economy? Could you please share with our readers a little on Hearth Ventures’ investment thesis?

We originally started with wanting to build a fund for the creative and cultural sectors – namely Indian Handmade brands and business / technology solutions that enabled them. Early into our journey we realized three things, one is that these handmade brands used sustainable raw materials and sustainable processes in their manufacture, second that customers who valued handmade products were also environmentally conscious and most likely to consume slow fashion, extend the usable life of the products they consumed and cared about how these products were disposed after their useful life and finally we started realising that a key element of the global carbon footprint caused due to retail consumption, what you and I eat, wear, use on a daily basis is in double digits. Most sustainable / climate funds are solving for Energy & Energy Transition, Mobility and Waste Management. We chose to focus on circularity in retail consumption as a critical under-addressed theme.

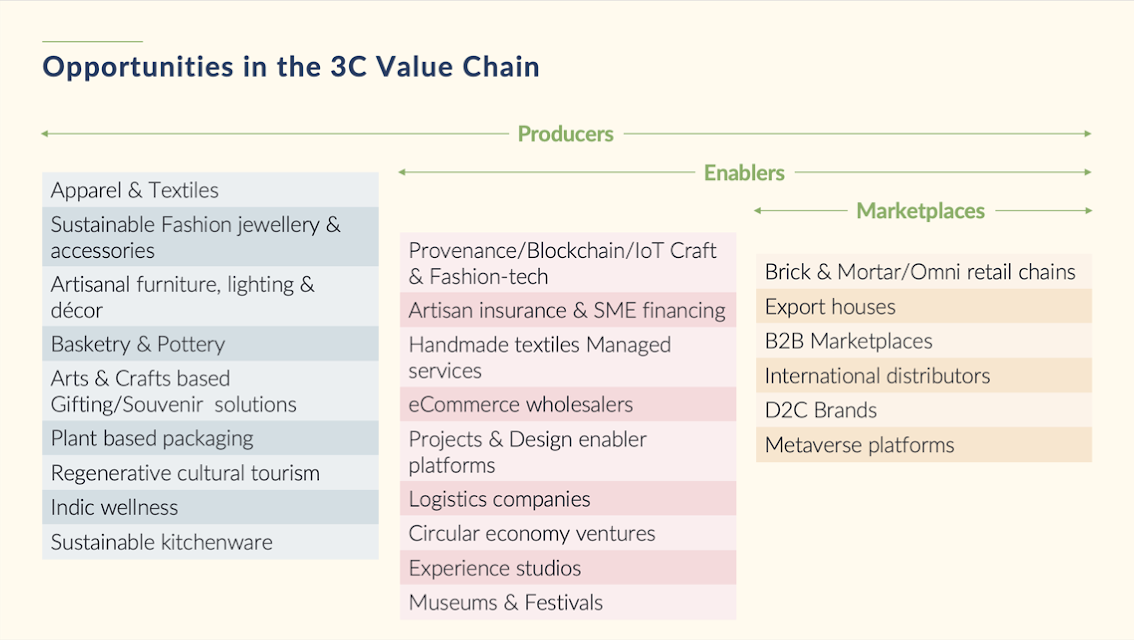

Hearth Ventures Investment thesis is focused on the intersections of Creative, Cultural and Circular Economy where India is underrepresented as part of the global trade. We seek to invest and help build for-profit enterprises which naturally have an impact on climate, livelihoods and communities.

Q2: How is investing in circular economy startups different from other sectors? How do you assess it in terms of return expectations, gestation periods, challenges in establishing scale and other critical factors for an investment thesis? What should prospective investors be keeping in mind

There are similarities and differences from other sectors. The biggest similarity if you compare this with the evolutionary history of every sector that has been funded and mainstreamed, is that this is still an unknown as far as what scale will come to represent, and while it might not be obvious to those outside our sectors of focus, some of the brightest entrepreneurs are now veering towards these sectors fueled by a sense of purpose.

We understand and accept that gestation periods are an unknown and hence we have used some thumb rules to model the return expectation and scale. First, there might not be Unicorns as understood by the tech investing ecosystem. A scale in a handmade brand using natural fibres, for example, starts when it achieves a revenue run rate of $20 Mn per annum, growing at 25%, generating cash and carefully deploying capital. Note that in our investments two of the key imperatives at entry are a product market fit and positive unit economics. So our message to entrepreneurs is to work with frugal innovation, blend equity with grants and debt and other forms of patient capital.

Prospective investors should realize that in the early stages of any sector, the first fund such as us, attracts the best entrepreneurs and the best deals. The reason is that by our presence, focus and participation in the sector we come to be known and trusted. The second is acceptance that gestation might be longer but take courage again in the fact that the investment team is focused on the sector and constantly learning and adapting.

Q3: What are some of the business models that you are coming across that align Hearth’s 3-C approach (Creative, Cultural Crafts & Circular economy) along with a strong climate impact?

Do you see a pipeline of investable opportunities emerging?

We have mapped the possible business models as a theoretical exercise (see figure below) early in our journey and we are delighted to actually see startups in nearly all of those buckets.

In each of the categories within the creative and cultural economy, we are observing some agile "test and learn" experiments going on to develop the circularity aspects - resale enablers in handcrafted clothing, jewelry or personal accessories. Beyond early adopters, some active market making among Gen Z and Gen alpha for returning back to more responsible consumption habits.

Q4: Apart from capital support, what are some of the other areas where early-stage enterprises in this segment require support? What are some of the interventions that investors interested in this segment should extend to their portfolio companies to enable their growth and scalability?

Some illustrative areas of support are in governance, refining of business and operating model, capital allocation, long term planning, hiring, technology selection in some cases, marketing

Not at the enterprise level, but at the industry level, advocacy is a key imperative. Over the next several years we need to create that ecosystem of financiers and various classes of capital to make our focus sectors vibrant.

Q5: Given that Hearth’s target segment has a direct impact on livelihoods, sustainability and climate action, how do you carry out the impact assessment of your portfolio?

What could be some of the monitoring metrics that prospective investors could look at, to develop an impact assessment approach to their investment portfolio?

Currently we use anecdotes, success stories often inspire more than numbers. Having said that, our entrepreneurs measure livelihood impact. We are in the process of integrating carbon offset measures and that will take some time to do.

Q6: Given your experience and learning from this sector, what are the key risks for potential investors in this space - and how should one mitigate them?

We have tabulated our risks and mitigants and we use this as a guideline at the evaluation and execution stage

Vinayak Kamath, Co-founder and Partner, Hearth Ventures

Vinayak is an alumnus of Jamnalal Bajaj Institute of Management Studies(JBIMS), Mumbai, and BITS Pilani and a Certified Corporate Director from the IoD. His earlier stints include global leadership positions with Indian and MNC companies such as Arvind Mills and GE, as Group CEO at a diversified privately held family business and in Private Equity Funds like Fairwinds and Halcyon.

Vinayak is an Angel Investor and pro-bono mentor for start-ups with two Angel networks. He is also a Board Member and Treasurer at a significant non-profit CSA (www.csa.org.in) and an honorary Investment Committee Member at a climate tech venture fund Satgana, incorporated in Luxembourg.

Background of Hearth Ventures

Hearth Ventures is India’s first Venture Fund addressing the Creative, Cultural and Circular Economy startups. Hearth Invests at the Series Seed to Series A with active mentoring to their portfolios.

Typical portfolio companies are for-profit startups with positive economics with a significant impact on livelihoods, the environment and communities.