500

Amount Invested

(USD Mn)

|

72

No. of Deals

|

Climate-tech

Leading Sector

|

|

|

*All figures in Million USD |

|

|

|

Interesting Reads for the Month

|

|

|

|

Dvara Holdings

Dvara Holdings is a mission-driven organisation working to ensure that every individual and enterprise has complete access to financial services. Since 2008, it has pioneered innovative initiatives that have enabled over USD 26 billion in finance and positively impacted 125+ million lives across India. At the heart of its approach is the Dvara Venture Studio, which incubates and supports early-stage entrepreneurs building scalable solutions to bridge systemic gaps in financial inclusion—spanning rural wealth management, agriculture, dairy, health, and the gig economy. Complementing this is Dvara Research, an independent policy research institution that generates evidence-based insights to inform and influence inclusive financial systems. Together, these efforts reflect Dvara’s commitment to building a robust ecosystem at the intersection of finance, technology, and impact—anchored in three cohorts and nine ventures over the past 17 years.

|

|

Indigram Labs Foundation

Indigram Labs Foundation (ILF), established in 2015 with support from NSTEDB, DST, and the Government of India, is one of India’s most reputed agri-tech incubators. A subsidiary of the ISAP India Foundation, ILF leverages ISAP’s extensive network of 600,000 farmers and 300+ FPOs across 20 states to nurture innovation in agriculture and rural entrepreneurship. With over 200 startups supported through its incubation facilities, ILF works across AgriTech, BioTech, GreenTech, ClimateTech, and the circular economy. Through collaborations with academia, government, investors, and corporates, ILF enables technology-driven solutions to transform India’s rural and agricultural landscape.

|

|

Lightrock

Lightrock is a global investment platform committed to building a sustainable future. Operating across private and public markets, Lightrock advises over $5.5 billion in assets and Lightrock funds invest in Europe, North America, Latin America, Asia, and Africa. Lightrock is a certified B Corp with a dedicated team of over 130 professionals working across a network of seven offices. Lightrock’s private market investing is focused on backing purpose-driven companies tackling the world’s biggest challenges. Lightrock-advised funds have invested growth equity in more than 90 companies that pursue scalable and tech-driven business models around the key impact themes of people, planet, and productivity.

|

|

Tamil Nadu Infrastructure Fund Management Corporation (TNIFMC)

TNIFMC is a professional investment management company that manages multiple SEBI-registered AIFs. TNIFMC manages three thematic funds; the Tamil Nadu Green Climate Fund (TNGCF) is a flagship initiative investing in Energy Transition, Mobility, Circular Economy, and Agri/Food/Forests to accelerate the low-carbon economy. The Tamil Nadu Shelter Fund (TNSF) focuses on affordable housing solutions, including worker rental housing, senior living, and hostels for students and working women. The Tamil Nadu Emerging Sector Seed Fund (TNESSF) supports growth-stage enterprises across diverse sectors with investments up to INR 20 crores. Together, these funds channel private capital into impactful, sustainable enterprises driving long-term economic growth.

|

|

|

The Month That Was

The Month That Was

|

🌆 IIC in Berlin for the GIIN Impact Forum

On the sidelines of the prestigious GIIN Impact Forum, the Impact Investors Council (IIC) hosted the 12th Edition of The India Room in Berlin on October 9th, 2025. The event brought together a distinguished group of Global Limited Partners, DFIs, Family Office, and pioneering Indian impact fund managers for high-quality, closed-door discussions.

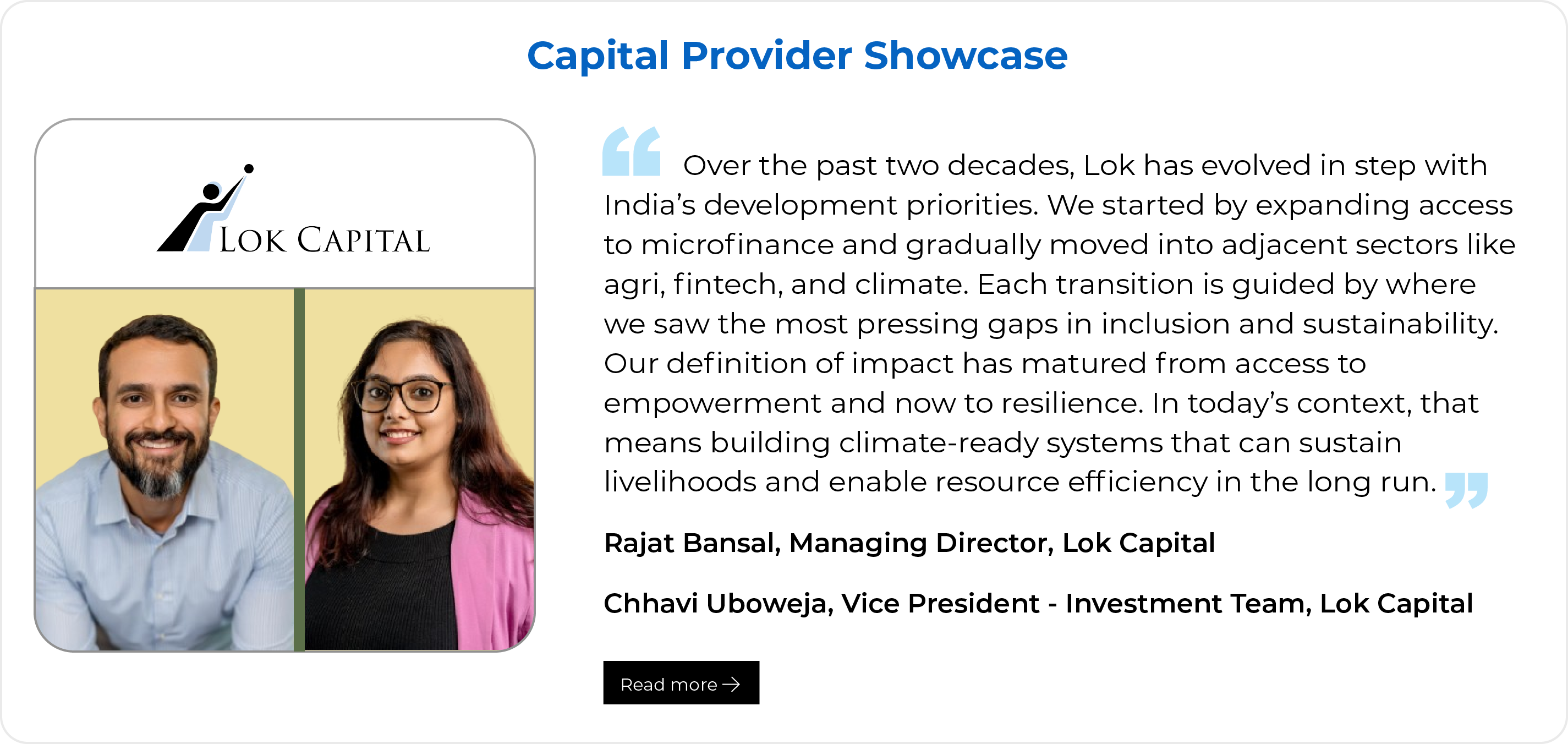

This exclusive gathering focused on strengthening the Indo-European impact investment corridor. The agenda was designed to move from theory to action, centering on a powerful fireside chat, "Mobilizing Global Capital to India's Populous Impact Market". The session featured insights from esteemed panelists Jim Sorenson, Eric Savage, Caleb Ballou, and Rajat Bansal, who underscored the historic opportunity to channel capital toward scalable solutions in India.

The candid conversations and robust networking laid a stronger foundation for cross-border collaboration, set to catalyze significant investment and drive profound social and environmental progress across India.

The proceedings report can be accessed here

🍀India Green Investment Forum (IGIF) 2025🍀

✨

Held on 30th & 31st October in New Delhi, the India Green Investment Forum (IGIF) 2025 brought together a dynamic community of investors, policymakers, innovators, and sustainability leaders committed to driving India’s green transition.

Across two days, the forum hosted 10 insightful plenary sessions exploring the full spectrum of climate investment, from blended and debt finance to climate-smart agriculture, adaptation, energy transition, and emerging mitigation opportunities.

Each conversation reflected a shared vision: accelerating India’s shift toward a low-carbon, climate-resilient future through innovation, collaboration, and purposeful capital.

💫 Among the many highlights this year, one stood out: over 1,350 meetings were booked on Brella! The energy was electric as climate leaders, entrepreneurs, and investors came together to connect, share ideas, and drive India’s green transition forward.

A heartfelt thanks to our knowledge partner, Climate Policy Initiative (CPI), as well as our sponsors, speakers, and all delegates who made IGIF 2025 a resounding success.

🎥 Catch all session recordings on our YouTube Channel: Impact Investors Council

Green Investment Opportunities: Report Launch

At this year’s India Green Investment Forum (IGIF), we proudly unveiled the highly anticipated 2025 edition of the Green Investment Opportunities in India report, developed by the Impact Investors Council (IIC) in collaboration with the Climate Policy Initiative (CPI).

Building on the landmark 2023 edition, this refreshed roadmap dives deeper — spotlighting not just clean energy and industrial decarbonisation, but also resilience-driven opportunities in water, climate-smart agriculture, and sustainable cooling.

Packed with data-driven insights, expert perspectives, and real-world examples, the report charts where investment can most effectively accelerate India’s green transition and advance its net-zero ambitions.

✨

Explore the report here and see how India’s next wave of green investments is taking shape!

Climate Bulletin:

We’ve launched the 11th edition of the Climate Bulletin at IGIF! 🎉

This edition brings fresh insights, inspiring stories, and key updates from the climate-tech ecosystem. Dive in to explore what’s shaping the future of inclusive and sustainable growth — read it now!

|

|

Watchout For

Watchout For

|

🧑🌾 In-person Discussion | “The Role of Different Types of Capital in the Impact Continuum for the Agriculture Sector in India” 🧑🌾

The Impact Investors Council (IIC), with support from The Rockefeller Foundation, will launch a whitepaper and host an invite-only discussion on “The Role of Different Types of Capital in the Impact Continuum for the Agriculture Sector in India” on Wednesday, 26th November 2025, in New Delhi.

The session will unpack how philanthropic, developmental, debt, equity, and blended capital can collectively drive India’s agricultural transformation, enhancing productivity, sustainability, and climate resilience. It will also explore partnership models, risk-mitigation mechanisms, and innovative instruments such as blended and results-based finance that can de-risk and scale investments across the agricultural value chain.

📅 Date: Wednesday, 26th November 2025

🕙 Time: 10:00 am to 1:00 pm

📍 Location: New Delhi, India

🎟

Invite Only: Express your interest here

🏦 NSE-IIC Closed Door Session: Social Stock Exchange

IIC is convening a member-exclusive session with the National Stock Exchange (NSE) on November 28 to deepen the sector's understanding of the Social Stock Exchange (SSE). Held at the NSE headquarters in Mumbai, this session will focus on operational nuances, from compliance to financial structuring.

Through this expert-led open house, IIC is working to clarify regulatory pathways for our members, ensuring the impact investing community remains at the forefront of India’s evolving social finance landscape.

🌆 IIC Socials - Bangalore | December 2025 | IIC Member Exclusive

IIC Socials comes to Bangalore this December, bringing together members of the impact investing community for an evening of connection and collaboration. Designed as an informal yet high-impact gathering, it offers a space for meaningful conversations, valuable networking, and shared insights. This member-exclusive event aims to foster stronger relationships and new synergies within India’s vibrant impact investing ecosystem.

Market Pulse:

Mark your calendars for the November release of the Market Pulse Bulletin! This edition dives into two critical themes — WASH (Water, Sanitation & Hygiene) and Financial Inclusion — featuring powerful insights, expert opinions, market trends, and exclusive industry interviews. You won’t want to miss!

|

|

|

|

|