Digital health and Indian venture capital post-COVID-19

The last time India faced a massive disruption was in November 2016. Demonetization upended the financial services sector and created countless digital financial businesses. It’s not that the sector sprang overnight. It already existed and just needed the right set of conditions to decisively unlock itself. Three and a half years down the line, COVID-19 is showcasing how healthcare can be delivered in a digital world. 2020 could well be the year for digital health tech- though it has been around for a while, the pandemic could be its “demonetization” moment.

(Insert Graph - Data Points in Excel Spreadsheet, Source: Inc42)

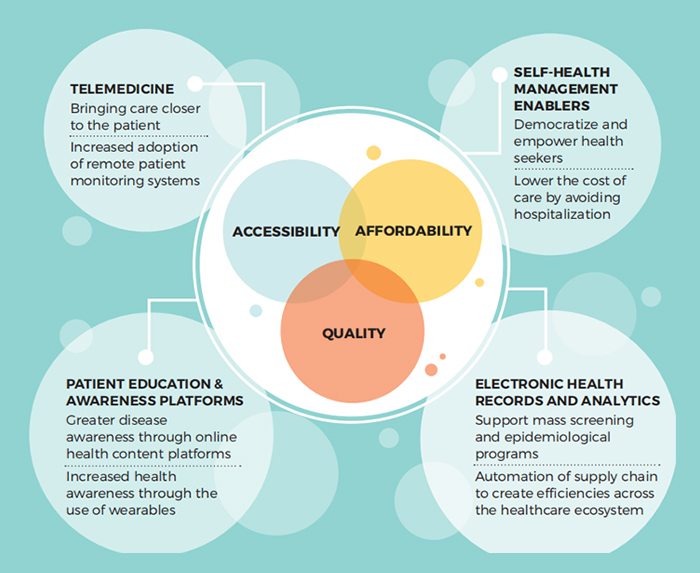

Spurred by the ramp-up in funding, India is poised to become a global center for health tech innovation. Its huge domestic private healthcare market, big talent pool, and expertise in tapping global healthcare markets make for a perfect recipe. These new age start-ups are focused on solving problems across healthcare delivery, diagnostics, pharma by using data and tech. However, the focus still rests on augmenting the capabilities and capacity of doctors and healthcare providers in delivering care and not replacing them. We dive into detail on four such models that we see as the frontrunners for Indian health tech.

1. Telemedicine:

Though the promise of telemedicine has been around for a decade, its time appears to be finally here. Teleconsulting solves two key issues that plague Indian healthcare – uneven distribution of doctors (concentrated in cities) and financial barriers to care. Banking on the telecom revolution of the past three years, teleconsulting was seeing a steady uptake in semi-urban and rural India. It offered patients the ability to consult with doctors in urban areas at low costs. Further, teleconsulting has also allowed doctors to widen their reach and increase productivity. During this pandemic, teleconsulting models like Neurosynpatic* have seen increased demand. Neurosynaptic has ramped up their capability by customizing their process and systems to COVID-19 with triaging algorithms and complementary telediagnostics.

Apart from bridging geographic barriers for rural India, telemedicine also helps urban patients get connected to their doctors for follow-ups and second opinions. Mental health is also emerging as a great use case for telemedicine. Here, telemedicine offers a refuge from the unfortunate stigma of a visit to the psychiatrist.

The Government’s release of a formal set guidelines for telemedicine during COVID-19 has given this sector a significant push. Clarifications on e-prescriptions and interstate validity of consultations will help in further propagating these models. The repeated use of teleconsulting during the lockdown will create lasting changes in the attitude of patients and doctors towards it and finally make it mainstream.

2. Digitization and Analytics

Data unification and homogenization via Electronic Health Records (EHR) has improved the communication between various healthcare providers and patients. This may eventually help patients have decentralized,seamless, and secure access to their health records. Big Data analytics has also enabled the application of clinical insights derived from the analysis of healthcare data.

THB**, a Gurgaon-based start-up, has created a unique database of about 500,000 clinical microbial culture samples with antibiotic sensitivity patterns from across India. This can help hospitals in evolving a rational antimicrobial stewardship program, thereby ensuring better clinical outcomes for patients. THB also uses such anonymized datasets to create real world evidence of a given drug. THB analyses the datasets using criteria such as the drug prescribed and its treatment duration, efficacy and side effects, and patient outcomes. It also augments this by providing a comparison with competitor drugs. These insights are then packaged and can be used by pharma firms to engage doctors scientifically.

THB’s real-time analytics also has huge potential in epidemiological monitoring and early identification of emerging hotspots for vector-borne diseases like dengue and malaria. By exactly pinpointing emerging foci, analytics can enable proactive interventions before these turn into outbreaks. However, such public health issues will require governments to provide financial incentives for private providers to report cases and deploy analytics.

3. Patient education and awareness platforms

Digital platforms help consumers find curated health-related information, enabling democratized healthcare. These are especially important in health systems that offer low patient empowerment, have overburdened healthcare providers, and extremely short consultation times. The platforms allow patients to seek healthcare at their own pace and support informed decision-making. Numerous English and vernacular content providers have sprung up over the recent past to cater to a highly diverse Indian market. Most people with access to smartphones are now able to get curated and verified health-related content on the go. These platforms have also reduced the risk of patients consuming misinformation in social and news media.

While the market for health education is vast, providers are yet to identify substantial monetization opportunities. Many content platforms like Lybrate have been able to monetize their platform by partnering with pharma companies to sell health-related products and services.

4. Self-Health management enablers:

Digital therapeutics (DT) and smart wearables that complement clinical care have been slowly but steadily gaining acceptance in India. DT apps like Wellthy therapeutics provide real-time health guidance on diet and exercise to dynamically manage blood glucose/ pressure levels, enabling better clinical outcomes. Similarly, smartwatches and fitness apps have the ability to measure and record health data – including body vitals, sleeping patterns and physical activity. This data can indicate disease progression or disease likelihood thereby transform healthcare from merely ‘reactive’ to ‘preventive’.

In the wake of the current pandemic, people have become more health-conscious. For instance, the last months have seen a surge in the sales of digital thermometers and glucometers. However, this transformation is still nascent and could be accelerated by an increase in the adoption of tele-consulting (model 1).

Early adoption of DT may come from chronic patients, who seek follow-up care by traveling long distances from peri-urban areas to cities. Currently, DT apps require human involvement to guide patients in making relevant lifestyle and medication modifications. But these models should accelerate the accumulation of large health datasets to create predictive algorithms. That would eliminate the need of human involvement altogether.

In summary, Indian health tech is set for a strong uptick aided by tailwinds from COVID-19. However, governments also need to play a role in unlocking the potential of these technologies. Although COVID-19 is an unwelcome event of massive proportions, it also presents a singular opportunity for health systems. Now may be the time to disrupt existing paradigms and innovate on how healthcare is funded and financed, provided and consumed. Developing countries need not take the trodden path as they look to increase healthcare access. They need not necessarily build costly physical infrastructure the last mile. They could instead look to leapfrog this stage and create digital-enabled patient pathways and care systems. That would make healthcare more personalized, accessible, and affordable and create significant value for consumers and investors alike.