About

Elevar Equity

Elevar Equity fuels the economic resilience and vibrancy of underserved customers and low income communities by investing early growth capital in entrepreneurs building at the intersection of inclusivity, affordability and massive scale. Led by an entrepreneurial emerging markets team passionate about addressing issues of access and inequity, Elevar invests in businesses that demonstrate a direct correlation between high impact and returns. So far in its 15-year journey, the Elevar Method of investing has democratized essential products and services for over 40 million households and catalyzed billions of dollars of capital into 40+ companies across India and Latin America.

01. Elevar Equity is a leading global impact investor with presence across Latin American and Indian markets. In your 15+ year journey, how have you seen the impact investing world evolve? How is the Indian impact investing market different or similar to the rest of the world?

Elevar was founded on a simple yet radical idea: to connect traditional capital markets with entrepreneurs developing customer-oriented distribution models aimed at low income and underserved communities.

Needless to say, over our long journey, we have seen the impact space evolve considerably. There has been increasing interest from mainstream investors, as the conversation around sustainability gathers volume around the world, and with the clear proof points that investing in impact does work.

In our focus on low income and underserved customer segments, traditional notions have always been fraught with assumptions about their wallet share or spending ability. Time and again our portfolio companies have demonstrated the massive potential with regard to creating access to essential products and services through customer-centric distribution models. While individual ticket sizes for products / services may be affordable, the sheer number of households ensures that even a single-digit penetration in these segments can often lead to considerable scale of impact and returns. It has been heartening to see that through Elevar’s entrepreneurial journey, as well as that of others, there has been increasing acknowledgment of this reality in both the Indian and global context.

02. Elevar Equity has a robust and well defined investment thesis – e.M under the ‘Equity for Equity’ philosophy

- What is the Elevar Method about?

The Elevar team spends considerable time with the underserved and low income customer segment, developing a deep understanding of their aspirations, priorities, cash flows, and challenges. This understanding of on-ground need-gaps combined with a penchant for impact at scale has led to Elevar’s unique approach to investing - the Elevar Method (e.MTM). The Elevar Method is pillared on four distinct components: underserved customers, business models that deliver essential products and services affordably, entrepreneurs with the ambition and ability to build businesses that address barriers of access and inequity, and scale.

Core to the Elevar Method is the belief that enhancing the value delivered to customers - Customer Business Value - leads to customer loyalty and advocacy. This accelerates the twin flywheels of business performance & customer impact, leading to massive scale and meaningful impact on millions of lives. - How difficult or challenging is it to find startups who meet this investment thesis? Is there a good pipeline of startups in more recent times relative to a few years ago?

Elevar creates and manages a highly concentrated portfolio of investments. We make a few investments each year to ensure a quality portfolio which aligns with our e.M framework and philosophy. The core premise of our investment policy is customer-centricity. Our mandate is to ensure that portfolio companies have a concrete and demonstrable positive impact on the lives of the end customers, in low income and underserved communities.

Our company’s ecosystems often lack the basic systems and distribution channels, or they are inefficient / unaffordable. We seek to back entrepreneurs who can play a transformational role in their ecosystems in order to establish affordable distribution channels. Hence we look for a rare breed of founders - people with a strong passion and ambition for tackling inequity at scale, a deep understanding of the customer’s aspirations and needs, and significant domain and execution experience.

We also believe that there needs to be a two-way underwriting when we invest. It is not our idea the entrepreneurs are implementing, nor have we just “bought into” the pitch, but instead it is our mutual alignment and shared passion in solving the need-gaps of underserved communities at a scale that moves the needle for us.

Scenarios where all of the above come together beautifully are rare. However, recent years have seen more and more talented individuals and teams with a focused desire to change the status-quo - and that has had a positive effect on the quality of our pipeline as well. - Is there any particular sector where you observe a greater concentration of startups meeting the above stated investment thesis?

Since providing access to finance is the first step to solving for the underserved customer, the natural outcome is that we find many startups that start their journey focused on financial inclusion. This could include MSME lending, personal lending, two-wheeler financing, agri lending etc. As these entities expand their customer engagement and move forward in their journey, they realize in order to use their capital effectively, customers in underserved segments need to overcome many other barriers. Hence, many of our companies are evolving into comprehensive solution providers or what we are increasingly calling ‘impact platforms.’

03. Elevar Equity invests across a variety of sectors in India like Microfinance, MSME Lending, Education & Employability, Agri-Supply Chains, MSME Marketplaces and Specialty Lending. Further, Elevar Equity recently has also invested in a health-tech startup.

- Are there any emerging trends/segments in the Indian market, and do you believe this transition or shift in focus has been triggered by Covid?

Covid has definitely triggered a shift in focus wherein supporting the scalability of essential services/ products has gained tremendous importance. Sectors like education, healthcare, and agriculture have taken the center stage post-pandemic.

Covid has also allowed the development of a more robust rural distribution channel as the need and dependency on essential services and products has seen an exponential rise in the last year. Additionally, the pandemic has been a game-changer for tech-led impact investing - bridging the digital divide has become of paramount importance. - Additionally, do you see yourself investing in segments like climate-tech? Given your mammoth investing experience in the impact investing space, how do you see the climate-tech space grow?

To focus on the climate crisis, we have to be inclusive - else we run the risk of seeking to change ecosystems without hundreds of millions of households. Our understanding of low income and underserved communities continues to uncover demand for essential products and services, and as an understanding of the importance of climate change grows within these communities, our investment approach will adapt and change. We are seeing an increasing number of climate related ideas and continue to seek opportunities that simultaneously serve the intersection of climate needs with boosting household resilience in underserved segments.

04. Elevar Equity is a unique investor who views customers of their portfolio companies as their customers. Does this approach aid in the impact measurement and management process? What impact framework do you use – has it been designed in-house? What are your thoughts on the cost effectiveness of hiring external resources to monitor the impact created by portfolio companies?

The basic premise of the Elevar Method is to back businesses where impact is at the core of the business model, to the extent that there is a direct correlation between high impact and returns.

We believe that impact needs to be part of the company’s DNA from the beginning, measurable by thoughtful business metrics and allowing entrepreneurs to focus on what is vital to scale their business.

The Elevar Impact Measurement and Management (IMM) Process is built on this philosophy. We strive to create alignment with our entrepreneurs through this process to help them differentiate their business models. Working together on IMM is not just an exercise but a critical tool that allows management to track key business metrics that are central to their core business, and that speak to impact.

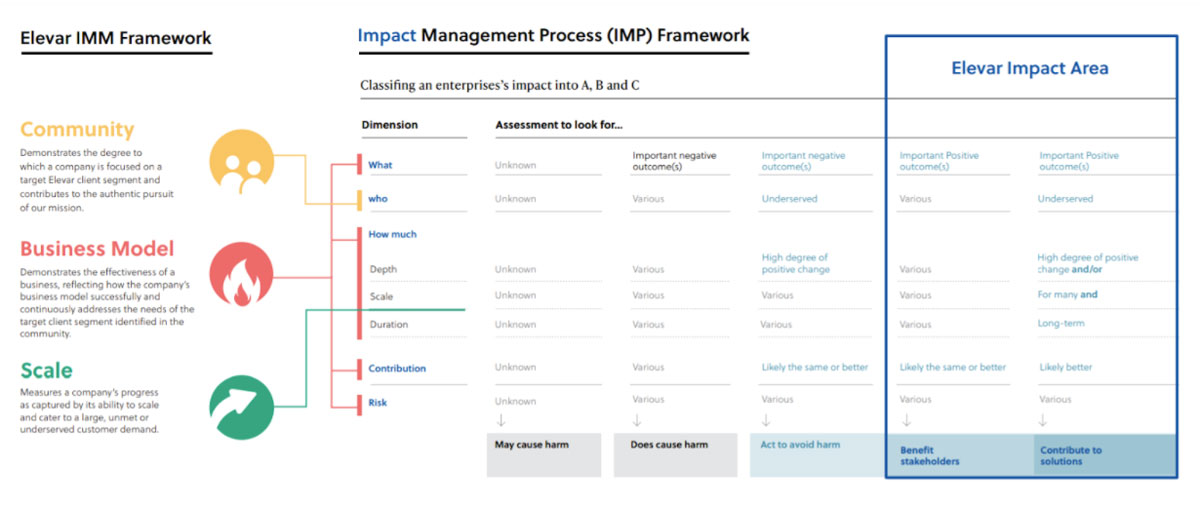

When considering the impact created from an investment, we look at 3 pillars:

Community: Demonstrates the degree to which a company is focused on a target Elevar client segment and contributes to the authentic pursuit of our mission.

Business Model: Demonstrates the effectiveness of a business, reflecting how the company’s business model successfully and continuously addresses the needs of the target client segment identified in the community.

Scale: Measures a company’s progress as captured by its ability to scale and cater to a large, unmet or underserved customer demand.

Of late, we have also been trying to bring in elements from the Elevar Method - specifically, Customer Business Value (CBV) - into our impact measurement metrics. By doing this we are taking further steps towards tightening the linkage between impact and business performance.

We do not have a separate impact measurement team at Elevar - this effort is fully integrated into the Elevar Method. Our investment team drives the definition of metrics, impact reporting and firm-wide discussions around impact.

05. Elevar Equity tracks the impact created by its portfolio companies and also publishes impact reports. What is your opinion on aligning impact measurement and management practices with international best practice or standard like GIIN’s IRIS+ or the UN SDGs?

Through a comprehensive exercise, we have mapped our portfolio’s contributions to the Sustainable Development Goals (SDGs), the set of 17 goals adopted by the Member States of the United Nations as part of the “2030 Agenda for Sustainable Development.” Together, Elevar’s active portfolio directly contributes to 10 of the 17 SDGs.

Elevar’s IMM process is also aligned with the Impact Management Process (IMP) framework, as shown below:

06. With investments across 40+ companies globally and several exits. Exit timing is crucial for an impact investor. At what stage of the investment life cycle do you consider making responsible exits? Also, could you throw some light on the financial performance of impact investments made by Elevar Equity.

We have a robust and disciplined approach to portfolio management with exit planning as part of this process. As we work with our companies to build value, we assess each opportunity to return capital to our investors while looking to maximize both return and impact. It is an evolved process and the exit environment continues to improve with each year. To date, as you said, we have successfully exited many companies. In addition, our work has directly impacted over 40Mn households.