About

Chiranth Patil

Co-founder & Director

Chiranth’s background includes FinTech, enterprise SaaS, strategy consulting, and investment management spaces. He co-founded Riskcovry InsurTech Platform along with a team of ex-execs from the insurance and tech industries, where he leads strategy and growth. Prior to Riskcovry, Chiranth also co-founded BetaPlus Capital, a family and friends investment office that has invested in an angel capacity in more than 25 startups. Before entering the world of startups, Chiranth’s corporate career included product management at Fidelity Investments and strategy and operations consulting with Deloitte Consulting in Boston. He received his bachelor of engineering degree in computer science from VTU, Belgaum, and an MBA from the University of Massachusetts, Boston.

The Opportunity

India's insurance penetration is currently at a paltry 4.2% as of 2019 compared to a global average of 7.1%. Riskcovry's solution has multiple use cases to improve insurance penetration as well as to widen the insurance reach.

The Riskcovry Solution

We feel that the best way to increase penetration in India is to bridge the trust gap with the customer. Our technology enables any business where trust is already established to embed our solution into their digital or offline channel. We do so with our seamless user journeys with simple language product explanations coupled with robust APIs. Even in the absence of APIs, we have built a solid underwriting engine using insurance company rules to ensure that the customer's risk is accurately priced. As far as claims go, we have created a simple WhatsApp bot that ensures claims are intimated at the comfort of the customer's home as opposed to the current manual paperwork-led process that can take days or sometimes weeks to process.

About Riskcovry

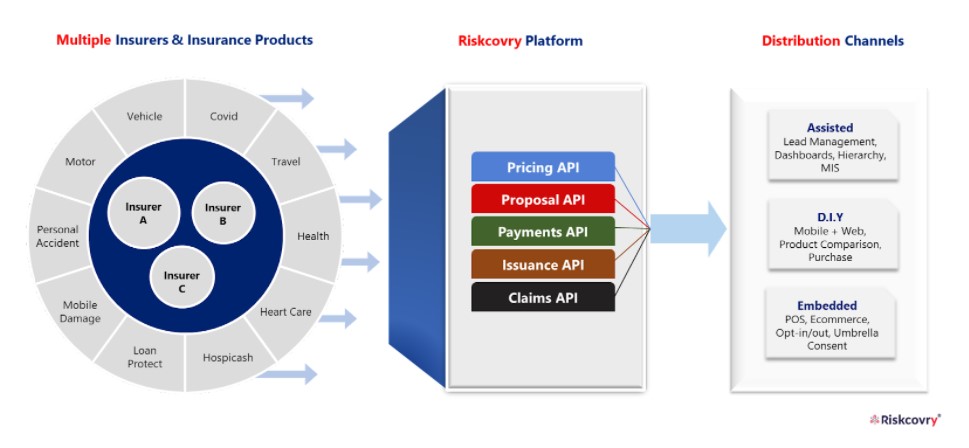

Riskcovry enables organizations to distribute insurance by providing a powerful unified API that enables organizations to distribute insurance over multiple channels. The vision is to 'enable insurance anywhere' by providing our enterprise customers with the necessary technology infrastructure to distribute insurance, seamlessly and holistically.

Riskcovry’s flexible and customizable insurance-in-a-box, API-based platform powers various types of businesses from startups to large enterprises and enables insurance distribution via a plug-and-play model. The Riskcovry SaaS platform, which is typically used by large enterprises, can enable any organization to customize its insurance workflows by directly integrating into existing workflows such Core Banking Systems, HRMS, Lead Management Systems, or CRM, enabling a seamless flow of data and an extremely smooth customer experience.

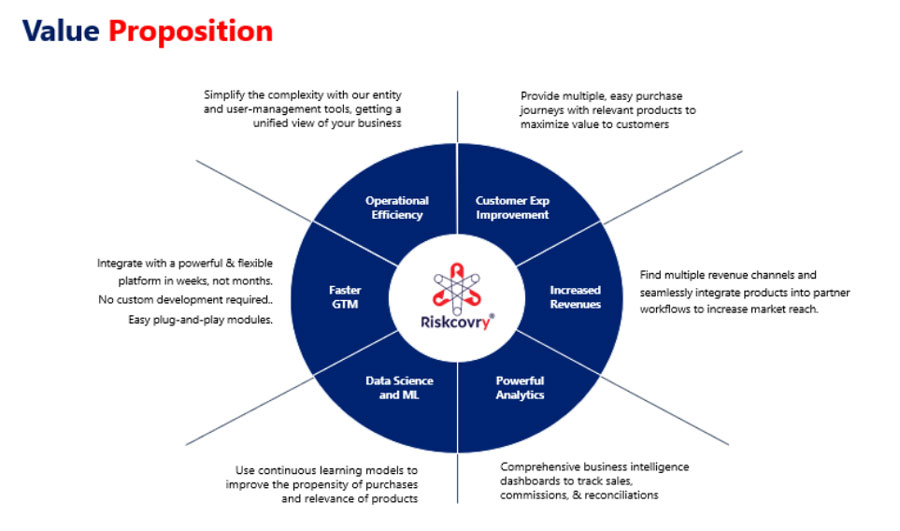

Riskcovry’s Value Proposition

India's insurance penetration is currently at a paltry 4.2% as of 2019 compared to a global average of 7.1%. Riskcovry's solution has multiple use cases to improve insurance penetration as well as to widen the insurance reach.

How it Works

We have engineered a unique protocol interface that lets any insurer drop ship their code on to our gateway to ensure seamless integration between the insurer and the distributor. This standardization allows any product from any insurer to be added at a rapid pace without the need of development. The use cases on the distribution side lies in the ability to underwrite different types of risks from different insurers and even offer them as combo products. This enables a distributor to go live in weeks rather than in months.

Benefits of Riskcovry’s Platform

There are primarily two benefits in using our solution: cost and time to market. From a cost point of view, a distributor would have to invest $100,000+ to start an insurance distribution business by building a technology team, which excludes the cost of acquiring a distribution license. Our solution enables a distributor to integrate with us for a tiny fraction of that investment without the need to make an additional hire. In terms of time, we save our customers 70% in time to market.

Riskcovry’s journey so far

Our thesis is validated by way of our 70+ enterprise customers (from banks and brokers to retailers and digital companies) representing 12+ industries, for whom we currently enable 75+ products from 30+ insurance companies. We are the fastest growing start-up in India in our space of 'insurtech infrastructure'. We are in an advanced stage to launch in another market this quarter.

We have gone through 3 rounds of funding thus far, the latest being a Series A of $5M which we announced earlier in March this year, bringing onboard great investors like Omidyar Network India and Pentathlon Ventures, among others.