Q1: Could you walk us through how Oikocredit has evolved over the past decade from its founding mission to today’s global impact portfolio and describe the major strategic pivots you have made in response to shifts in social and environmental impact investing?

Oikocredit is celebrating its 50th anniversary this year. For the majority of these five decades, our strategy revolved around equity and debt investments in financial inclusion—be it microfinance, MSME finance, or insurance—within our focus geographies in emerging economies.

2014 marked a major shift with the formal introduction of Agriculture and Renewable Energy as additional focus sectors. While we had done some agriculture investments before, this formalized it as a core part of our strategy. The initial renewable energy focus was on areas like manufacturers and rooftop solar, laying the groundwork for our current, broader climate lens. Climate, as we see it today, is a much broader sector, and our 2014 renewable energy work was just one portion of that.

In 2021, Oikocredit also introduced a community-focused approach. This extended beyond traditional financial inclusion to address holistic community resilience, expanding our investments into housing, healthcare, education, water and sanitation (WASH), and community infrastructure for low-income communities.

Q2: What external drivers and internal priorities have influenced these strategic pivots, and how has Oikocredit’s climate-focused approach taken shape in recent years?

Global headwinds such as climate change disproportionately affect low-income communities. This reality, in line with both market opportunities and our investors’ increasing awareness, drove the 2025 expansion from a renewable energy focus to a much larger, climate-related focus. A key enabler of this transition is our unique cooperative structure. Our retail investors, especially in Europe, are very aware of the climate issue and are demanding more climate-positive investments.

Under this climate strategy, Oikocredit plans to deploy and build an AUM of €200 million over the next five years from our balance sheet, focusing on four key themes:

Furthermore, we are in the early stages of exploring a separate, dedicated climate fund. This vehicle would invest beyond the €200 million balance sheet exposure, utilizing a blended finance approach with a mix of debt and equity. For this new vehicle, the themes in India would be more focused on the EV ecosystem, battery technology and recycling, and alternative biomaterials. In Africa, the focus would be more on infrastructure for sustainable food and agriculture, as well as biochar.

Q3: Within your portfolio, how do you assess and prioritize climate-linked investments – for instance, adaptation in smallholder agriculture versus mitigation in renewable energy? Has Oikocredit developed any internal taxonomy or impact lens to guide climate allocation?

While high-income countries can afford to make significant investments in climate mitigation, emerging and low-income countries must prioritize adaptation strategies. However, a judicious approach and a fair balance are required to invest in both.

Even among the geographies Oikocredit focuses on, the approaches differ depending on local needs. India is much further ahead in its climate ecosystem, so our investments there may see a higher proportion towards mitigation via the EV ecosystem. In contrast, countries in Africa may see a higher proportion of investments in sustainable food systems or biochar, which focus on adaptation in smallholder agriculture.

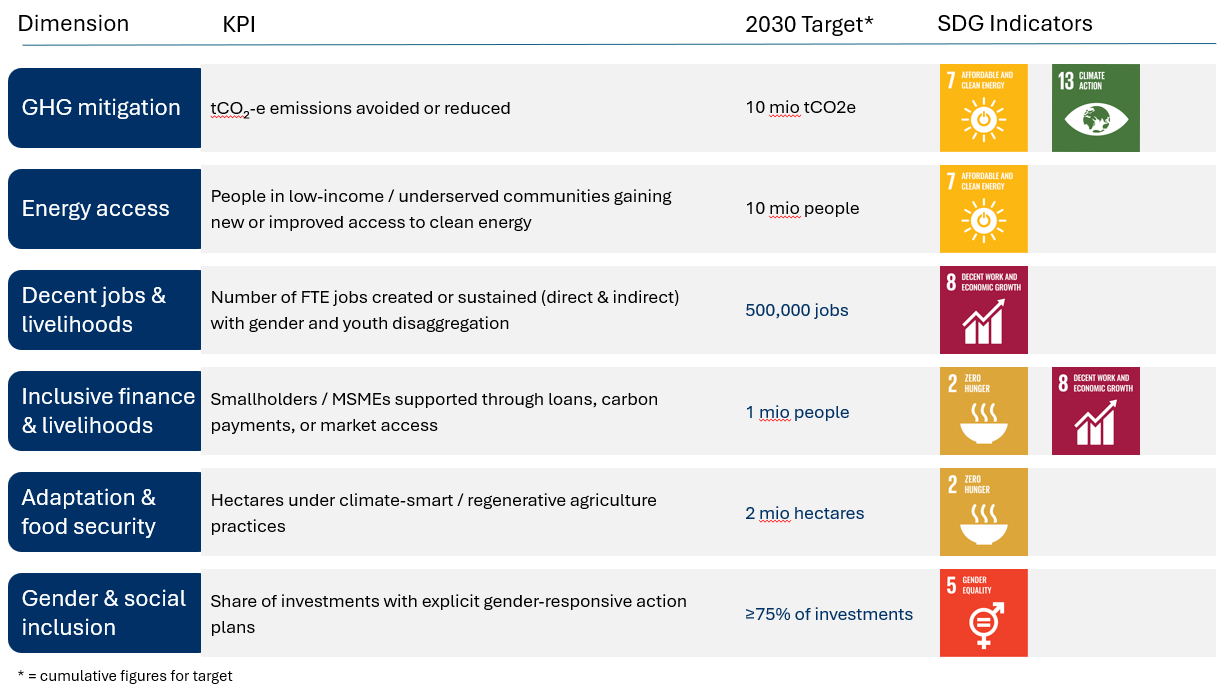

Overall, with our aim of building the €200 million portfolio over the next 4-5 years, we want to achieve the following social and environmental impact linked to 5 SDG goals:

Q4: How has Oikocredit’s investment strategy changed over the years, and what new structures are you continuing to explore in the future?

Oikocredit has historically invested in Series B to Series C rounds, with an average investment ranging from $4-5 million, and up to $10 million. However, recognizing the nascent nature of the climate sector and its solutions, Oikocredit may consider earlier, pre-Series A opportunities for climate-specific investments. This flexibility would enable smaller investment sizes of $2-3 million, supporting businesses in proving their models and scaling their impact.

Furthermore, Blended Finance remains a cornerstone of our investment strategy. We currently utilize guarantee structures from several Development Finance Institutions (DFIs), some of which are country or region-specific. As the climate investment portfolio expands, we will continue to engage additional partners to establish portfolio-level guarantee structures, political risk insurance, and secure grant/concessionary long-term debt providers. This blended finance approach is crucial for managing the inherent risks often associated with a climate portfolio.

We are also in the preliminary stages of exploring an alternative investment vehicle, beyond the existing €200 million on-balance sheet exposure, which will be developed based on these blended finance principles.

Q5: As Oikocredit strengthens its climate focus, how are climate risk assessment and adaptation outcomes being integrated into your investment strategy, and how are linkages between sectors identified?

The linkages constitute a fundamental aspect of our strategy, particularly considering our origins in financial inclusion. While we are de-prioritizing new microfinance initiatives, we will continue to explore opportunities with larger, multi-product financial institutions (NBFCs).

We perceive a significant opportunity in investing in NBFCs that are developing climate-specific or green finance portfolios. For instance, we can provide financing to an institution that subsequently on-lends for rooftop solar, greenhouse financing, or other green assets. Whether our investment is direct in a rooftop solar company or in a finance company that supports this infrastructure, the impact lens remains consistent. The metrics—such as CO₂ reductions or renewable energy generated—are aligned across the portfolio.

Q6: Looking ahead, which emerging themes does Oikocredit see as high-impact opportunities for climate-aligned finance over the next decade?

We will continue to explore all climate-related sub-sectors across our focus countries. As discussed, the immediate, high-impact opportunities we see in India include the EV ecosystem, battery technology, and alternative biomaterials, alongside indirect climate finance through financial institutions.

Looking further ahead, we see significant high-impact opportunities in nature-based solutions, the circular economy, digital climate innovation, and carbon markets. Geopolitically, with the US scaling back on climate commitments, Europe will have to do much of the heavy lifting. Oikocredit aims to remain a key, trusted channel for directing that responsible capital toward the communities that need it most.

.jpg)

Harsh Shah – Head of Equity (Asia), Oikocredit

Harsh leads Oikocredit’s Equity investments across Asia, overseeing portfolios in financial inclusion, agriculture, and climate-focused enterprises. He brings over 12 years of experience in impact investing and in operating roles at startups, and has worked across multiple asset classes and investment stages during his time at Oikocredit and Caspian.

Background of Oikocredit

Oikocredit is a pioneering global social impact investor and cooperative, rooted in its ecumenical founding in the Netherlands in 1975. With nearly five decades of experience, its mission is to challenge all to invest responsibly, working towards a more just society.

Managing over €1 Billion in total assets, Oikocredit channels capital, sourced from over 40,000+ investors, into financial inclusion, sustainable agriculture, and climate enterprises. Focusing on Africa, Asia, and Latin America, the cooperative provides both financing (loans/equity) and capacity building to local partners. This approach builds community resilience and sustainably improves the quality of life for people with low incomes, reaching over 53 million low-income globally.