The funding for Climate-tech showcased resilience in the first half of FY2026, totalling $1,253 million across 73 deals, following an exceptional $1,435 million in the preceding period (October 2024 - March 2025)

However, this moderation conceals a significant and healthy shift in the market. While exceptionally large, late-stage mega-deals characterized the preceding period, the current period demonstrates a substantial acceleration in early and growth-stage funding, indicating a broadening and maturing ecosystem. The prior period was heavily influenced by a single outlier (a $1.0 billion investment in Erisha E-Mobility).

The data indicates that between October 2024–March 2025 and April–September 2025, funding patterns shifted from late-stage deals toward early and growth-stage enterprises. Funding for Series A rounds experienced substantial growth, increasing by 359% from $111.2 million to $510.1 million. This trend suggests a robust pipeline of companies successfully advancing from the Seed stage and securing capital for expansion. Concurrently, seed stage funding also saw a significant increase, rising from $55 million to $111 million, although the number of deals remained constant.

This trend reflects a robust positive signal, indicating a strengthening of the sector's foundations, supported by a strong pipeline of new companies and the availability of capital for scaling proven technologies.

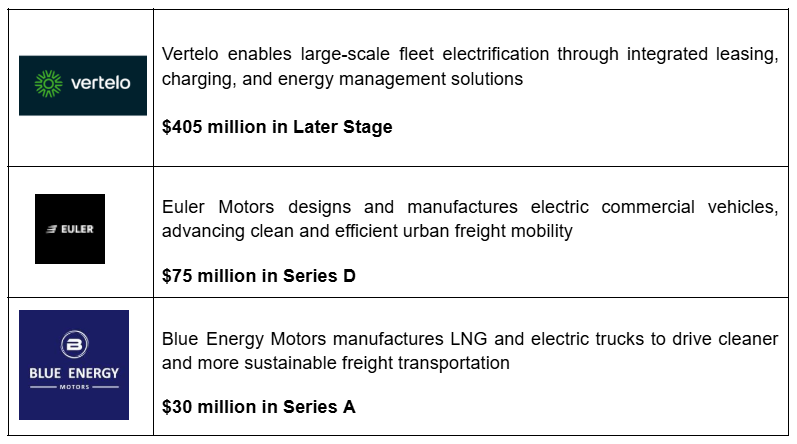

Sustainable Mobility continues to dominate the Climate-tech landscape, retaining its position as the leading subsector in H1 FY2026. The segment attracted over $955 million across 28 deals, reinforcing its role as the cornerstone of investor activity within Climate-tech.

EV manufacturers and component innovators led the charge, with notable rounds raised by Euler Motors ($75 million, later stages), Blue Energy Motors ($30 million, Series A), and Ultraviolette Automotive ($21 million, later stages). These deals demonstrate continued investor conviction in India’s electric mobility market, particularly in the commercial vehicle and high-performance EV segments.

Beyond OEMs, innovations across battery-swapping, charging infrastructure, and software systems for EV optimization gained traction. Battery Smart ($29 million, Series B) expanded its battery-swapping network for electric two- and three-wheelers, while Vecmocon Technologies ($18 million, Series A) advanced in-vehicle intelligence and control systems. EKA Mobility ($23.7 million, Seed) reflected growing confidence in new EV manufacturing models combining design, component sourcing, and digital integration.

Collectively, these developments highlight India’s evolving e-mobility ecosystem – expanding from production-focused OEMs to deep-tech component specialists and charging infrastructure enablers.

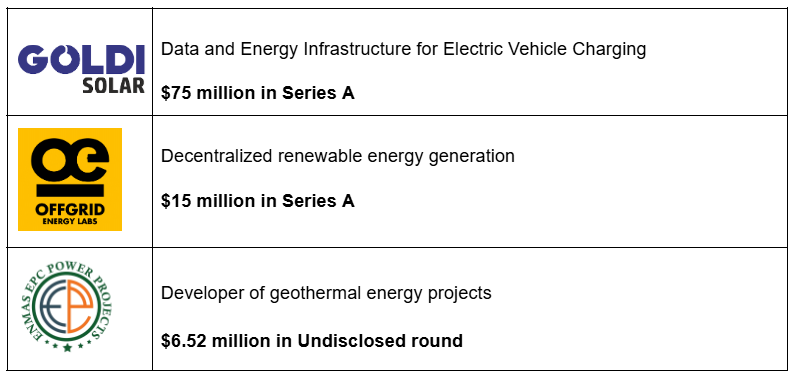

The Energy segment ranked second in total funding, raising $184 million across 22 deals in the first half of FY2026. While the quantum moderated compared with $182 million in the preceding period, the sector showed broader diversification across clean generation, power electronics, and energy management technologies. Key deals included GoldiSolar, Offgrid Energy & EEPC.

The sector additionally experienced heightened innovation in grid digitization and smart energy management, with emerging companies introducing integrated hardware-software platforms for monitoring, optimization, and storage integration. The confluence of clean energy generation with IoT-driven grid intelligence and battery technology continues to attract investor interest in this domain.

Waste Management and Circular Economy emerged as a major growth segment, with funding rising by over 480% from $11.2 million in October 2024–March 2025 to $65.16 million in April–September 2025, marking a rebound toward the $90 million invested during July–September 2024.

Stage Wise Snapshot

Sector Wise Analysis

Disclaimer: Disclaimer: The logos of enterprises used in this newsletter are for illustrative purposes only and do not imply their endorsement or affiliation to IIC. All trademarks and logos belong to their respective owners, and their inclusion in this newsletter is not intended to infringe upon any intellectual property rights.