The funding landscape for Climate-tech witnessed a steady trend in the first two months of H2 FY2026 (October-November 2025), recording ~ $200 million across 35 deals. While the total capital deployed has moderated compared to the ~ $1,253 million raised across 73 deals in the preceding six-month period (averaging ~ $209 million per month), the deal velocity remains robust, averaging nearly 17 deals per month compared to 12 per month in the prior period.

This period indicates a continued growth of early-stage bets. While the previous half-year was defined by a mix of growth capital and late-stage rounds, the current data highlights a focus on the Seed stage, which accounted for 69% of deal volume (22 out of 35 deals). Series A activity also remained healthy, contributing nearly 47% of the total funding value ($93.8 million). This surge in early-stage activity signals a widening funnel of new climate innovations entering the market, even as ticket sizes normalize.

Sustainable Mobility retained its position as the most active subsector, attracting $86 million across 12 deals. However, the dominance of mobility is being closely challenged by the Energy sector, which secured $71 million across 11 deals, narrowing the gap significantly compared to previous quarters.

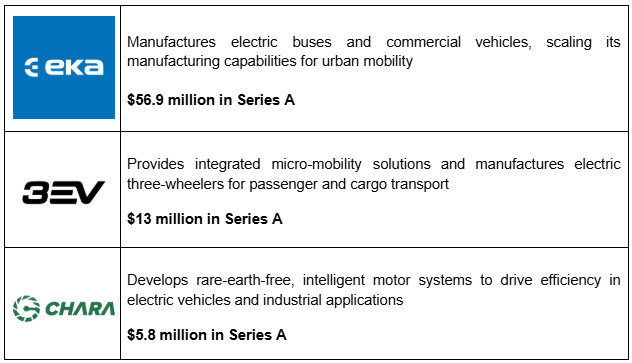

In the Mobility sector, EKA Mobility spearheaded the capital inflow with a $56.9 million round, demonstrating a persistent belief in OEM expansion. Beyond OEMs, the ecosystem continues to diversify into infrastructure and components, evidenced by 3ev and Chara Technologies, the latter focusing on deep-tech motor solutions.

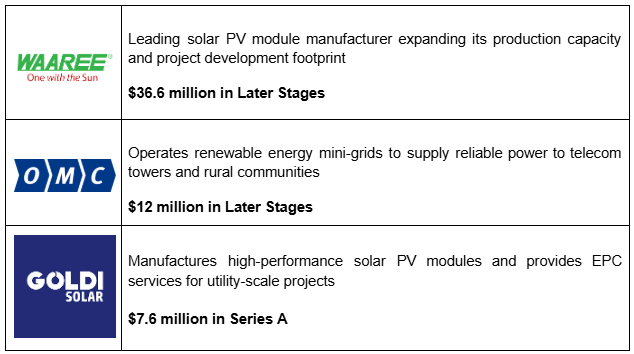

The Energy segment exhibited strong resilience, largely due to continued confidence in late-stage deals. A notable transaction involved Waaree, which secured the second-largest investment of the period at $36.6 million. Significant later-stage funding was secured, reflecting strong confidence in solar manufacturing. This trend was further supported by investments in both renewable infrastructure, with OMC Power raising $12 million (Later Stages), and distributed energy models, as showcased by Goldi Solar's $7.6 million Series A funding.

Notably, the "Others" category (including carbon markets and climate data and other subsectors) outperformed historical trends, raising $35 million, largely driven by a standout $30 million Series B round by Varaha. This marks a significant maturity signal for nature-based solutions and carbon markets in India, a segment that had previously seen smaller, seed-sized transactions

Stage Wise Snapshot

Sector Wise Analysis

Disclaimer: Disclaimer: The logos of enterprises used in this newsletter are for illustrative purposes only and do not imply their endorsement or affiliation to IIC. All trademarks and logos belong to their respective owners, and their inclusion in this newsletter is not intended to infringe upon any intellectual property rights.