|

🍀Launch Event - Unlocking Investor Action for Just Transition in India’s Fashion Sector 🍀

On Tuesday, 22nd July 2025, the Impact Investors Council and the Impact Investing Institute launched their program, 'Unlocking Investor Action for Just Transition in India’s Fashion Sector'. The event convened 78 delegates from a diverse range of stakeholder groups, including investors, financial institutions, consulting firms, entrepreneurs, and policymakers, all with a shared focus on the fashion industry and Just Transition.

The discussions and case studies presented during the event offered insights from both financing and practitioner perspectives, shedding light on current ground-level efforts and the actions needed to advance Just Transition in India’s fashion ecosystem.

The recording of the session can be accessed here: https://www.youtube .com/watch?v=iOjJGvUVHzY

To know more about this program, click here: https://iiic.in/just-transition-in-fashion/

⭐Member Exclusive Session with Kartik Desai - Key Insights from UN's FfD4 Conference⭐

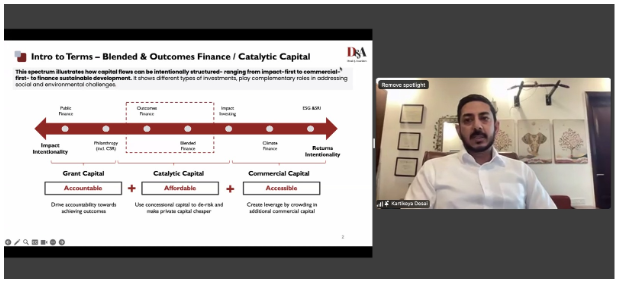

On Thursday, July 31st, we hosted an insightful online session with Mr. Kartik Desai, Founder & CEO of Desai & Associates. Fresh from his participation in the UN's 4th International Conference on Financing for Development (FfD4) in Spain, Kartik shared valuable insights with our impact investing community.

The session covered several critical topics, including the origins of Financing for Development (FFD) through the Monterrey Consensus, the evolution of development finance from Addis Ababa to Seville, and key trends in global development finance. Kartik also discussed the global agenda for blended finance, impact through outcomes-based finance, and charting India's development finance roadmap. The discussion concluded with implications for Indian funders and impact organizations.

The interactive format allowed members to engage directly with Kartik during the Q&A session, making it a highly valuable experience for all participants in the Indian impact investing ecosystem.

|