About

Chiratae Ventures and the Author

Launched in 2006, Chiratae Ventures India Advisors (formerly IDG Ventures India Advisors) is India’s leading technology Venture Capital funds advisor, advising approximately USD 870+ million of assets across 4 funds since inception across various offshore and domestic funds. The funds advised by Chiratae Ventures India Advisors have invested in ~100 companies across Consumer Media & Tech, Cloud/Software, Deep-tech, Health-tech, Fin-tech, Agri-tech, B2B Commerce, Logistics & Mobility. The author of this article leads the impact practice at Chiratae. Vidya has previously worked in the areas of entrepreneurship development, grassroots rural development, and mobile payment fintech products for the un(der)banked as a technologist and product management leader.

2x Challenge: Walking the talk on Gender Lens Investing in India

At Chiratae, gender equity is one of the 5 development impact thematic areas at the centre of our impact practice. Data and arguments, both economic and moral, build a strong case for gender lens investing, and show that not only is this the right thing to do, it is also good for business. This article will go beyond presenting evidence, to give a glimpse of our journey in weaving gender considerations into our work, and our recent qualification for the 2X Challenge (2xChallenge.org) for advancing gender equity, by our investor, CDC Group plc. We are privileged to be CDC Group’s first VC fund investment in South Asia to be qualified for the challenge which has so far almost doubled its commitments from DFIs, private sector and government/non-private capital globally, from the original target of $3 billion.

As a background, Chiratae Ventures is a mainstream technology-focused VC in India with over $870 million AUM, and 95+ investments across sectors such as consumer & media, healthcare, inclusive finance, food and agriculture, logistics and mobility, small business growth, education, sustainable consumption, and software. Chiratae operates at the intersection of technology, private markets, financial returns and ESG/impact. All new funds since 2016 are ESG integrated for risk and we measure (and report) the impact and SDG contribution by our active portfolio companies invested into by these funds.

When the impact practice was initiated, we identified gender equity as one of the 5 development impact thematic areas that were important to us. Setting up an impact practice for existing fund strategies and a significantly sized active portfolio required a measured approach (pun intended) and the first step was to undertake a retrospective impact mapping across a subset of our investments that were impacting people or the planet tangibly and measurably. The findings were encouraging and showed tailwinds to support the work and strategy going forward.

We institutionalised impact measurement across our portfolio companies, designing metrics aligned to the Impact Management Project framework and GIIN’s IRIS+ catalogue. Specific to the gender thematic area, these metrics were designed to gather data around women as employees and leaders, founders, consumers and business-owners. We are now approaching our 4th quarter of impact measurement and over time, have worked alongside our companies to report on gender data across these stakeholder groups. This has given us the unique ability to know and track the impact on women and girls through our portfolio. Equally importantly, measurement has led to awareness and sensitization within our portfolio companies, many of whom were earlier not tracking some of the data we sought. Now that the data is being reported quarterly, this forms a baseline and reference for any gender-related intervention which can be introduced and its outcomes tracked. We believe that awareness is the first step towards change, and measurement has indeed aided awareness and baselining. While our approach to gender was designed independent of the 2X Challenge, it also found high resonance with its criteria.

The 2X Challenge was conceived and set up by a group of DFI’s to garner support and commitment from institutional investors and asset owners towards making their capital work for gender equity through women’s economic empowerment. In their words, it “calls for the G7 and other DFIs to join together to collectively mobilize $3 billion in commitments that provide women in developing country markets with improved access to leadership opportunities, quality employment, finance, enterprise support and products and services that enhance economic participation and access.” Originally set up with a target of attracting $3 billion in commitments, it has far exceeded that with commitment letters pouring in from all over the world, and a major announcement will soon be made at the upcoming G7 meeting on extending the reach of the program. In fact, more 2X Challenges are being conceived and designed around other development impact areas that are in urgent need of collective attention and capital.

It is to be noted that the funding commitment does not imply a distinct and separate pool of capital, but applies to the asset owner’s existing pools of capital and ongoing investments. If an investment is found to be 2X qualified based on the qualification criteria, then the investor’s commitment towards the challenge is satisfied to the extent of this investment. Given that some institutional investors may have committed a significant chunk of their assets towards the 2X challenge, investments that are able to qualify could be more attractive to them.

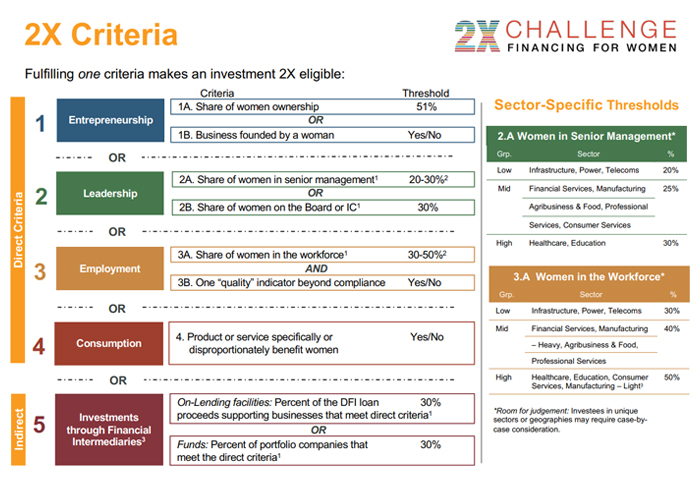

Qualification involves being evaluated against the 2x criteria by an asset owner that has committed to the 2X Challenge. The criteria use data points and thresholds to ascertain how an investee company or fund stacks up in terms of advancing gender equity by value or volume. They look at benefits to women as founders, leaders, employees and consumers for direct investments, while fund managers can either themselves meet one of the categories directly, or target women’s economic empowerment through their investments.

The thresholds are sensitised to sector and region, and while they provide useful guidance for evaluation, the investor may use their judgement to adjust these for regional or other nuances.

Source: 2X Challenge criteria documentation

Once an investee is found to be 2X qualified, they are asked to sign a commitment letter, committing to maintain or better its qualifying thresholds and continuing to report data during the period of investment. This is not a contractual obligation, but rather an honorable commitment, and not intended to attract adverse consequences with respect to committed capital should the thresholds not be maintained for any reason. It is meant for asset owners to nudge and encourage capital allocation to work for gender equity through a more structured process of dialogue, qualification, intent, action and measurement. Investees in turn benefit from qualification as a validation of social impact, attractiveness to greater pools of capital, enhanced performance through unlocking the gender business case and access to resources and technical assistance.

Chiratae primarily qualified through its portfolio of investments made by Fund IV (where CDC Group is an investor) that are advancing women’s socio-economic empowerment. This is a validation of and testament to the stellar work by our founders towards gender equity across all stakeholder groups: excellent policies that retain women in the workforce and advance women as leaders; introduction of new insurance product categories sensitised to women’s health; safe commute that also translates to addressing time poverty; the largest community of (expectant) mothers in India; access to income-generation and markets for home-based gig workers and individual entrepreneurs in social commerce, lead generation and nutrition; vernacular social commerce for female consumers in Bharat; reproductive health advancements lowering costs and increasing success rates; at-home access to fitness, nutrition and mental health services; access to a peer community & free online medical consultation for parents(to-be); and many more.

An extract from our quarterly impact report below shows aggregated figures for active portfolio companies across Fund III and Fund IV (cumulative, since our investment and as of September 2020):

As mentioned earlier, measurement served to aid in awareness which is the first step towards change. While qualification is a validation, it also encourages us to look beyond measurement and take the next steps in our gender program, the objective of which is to expand opportunities through advancing gender equality and empowerment of women & girls, while keeping financial objectives at the fore. We recognise that this is a gradual process that will succeed through dialogue, buy-in and sponsorship from our stakeholders. It will also require the industry at large to participate for systemic change to begin.

In the Indian context, platforms such as WinPE are generating tremendous support and action to increase representation of women in the PE/VC industry, and industry associations such as IIC and IVCA are looking at gender initiatives and recognitions this year, marking much-needed regional attention towards women as entrepreneurs and consumers. While the 2X Challenge serves to align massive amounts of capital towards solutions for gender equity, such regional attention is a welcome move to seeding this at the local industry level – together, this has the potential of achieving a network effect to align asset owners, asset managers (both impact funds and mainstream VCs) and entrepreneurs to work cohesively and collaboratively to unlocking opportunity, while at the same time creating impact at scale. We are excited about being a part of this movement.