Investment Snapshot

|

The funding landscape for Climate-tech witnessed

a steady trend in the first two months of H2 FY2026 (Oct-Nov 2025), recording ~ $200 million across 35 deals.

READ MORE >

|

-

200

Total Funding

$ Mn

-

35

No. of Deals

|

|

|

Capital for Climate

|

|

Scaling Deep Tech for a Greener Industrial Future

"As a thesis-driven organisation, our focus is on identifying the highest emissions-intensity, highest growth areas, where there is ability to make meaningful impact at scale through the adoption of innovative technologies.

We look for IP-led technologies and materials that can transform entire industries or sectors, preventing the adoption of high pollution, long-life assets. Our focus areas include industrial energy, materials, resource efficiency, green chemistry and process optimisation for hard-to-abate and rapidly growing sectors."

Starlene Sharma, Co-founder & Partner, Green Artha

Maya Chandrasekaran, Co-founder & Partner, Green Artha

READ MORE >

|

|

|

|

The Kuali Fund: Financing Climate Resilience for Vulnerable Communities

"Although India has made major strides in expanding basic financial access, gaps remain in the depth, relevance, and quality of services, especially for communities most exposed to climate and weather shocks. In response, through its newest fund called the Kuali Fund, GAWA planning to invest capital to transform financial institutions into effective financers of climate solutions while also investing in climate-solution providers that can deliver accessible, high-impact climate mitigation and adaptation tools."

Agustín Vitórica, Co-Founder and Co-CEO, GAWA Capital

Luca Torre, Co-Founder and Co-CEO, GAWA Capital

READ MORE >

|

|

|

Innovation Spotlight

|

|

Real-Time Decarbonization: Validating the Shift from Fossil Fuels

"Every Promethean system is equipped with energy meters, ultrasonic flowmeters, and matched-pair temperature sensors that stream data to the cloud. Customers can log into a dashboard and see real-time heat delivered, energy consumed, COP values, hourly savings, and emissions avoided. This transparent measurement and verification is essential for building trust, especially under ESCO models."

Ashwin Krishna KP, Head-Energy Efficiency, Promethean Energy

READ MORE >

|

|

|

|

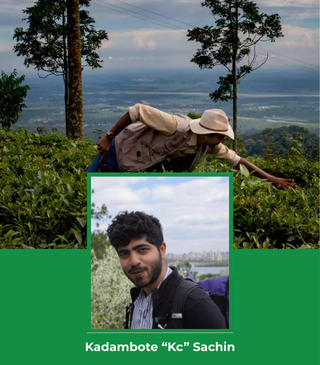

From Soil to Sinks: Merging Ecological Restoration with Carbon Removal

"Across Alt Carbon’s early projects, ERW (Enhanced Rock Weathering) applications have delivered meaningful agronomic benefits alongside carbon removal. In Darjeeling tea and neighbouring bamboo plantings, initial harvest data indicates yield increases in the range of roughly 20–30%, alongside improvements in soil structure and nutrient availability in monitored plots."

Kadambote “Kc” Sachin, Head of Chanakya (Strategy Team), Alt Carbon

READ MORE >

|

|

|

Spotlight

|

|

Catalyzing Capital for India’s EV Transition: The EM-PACT Journey

"Launched in March 2025 by the Impact Investors Council and KPMG, EM-PACT is an impact investment

facilitation platform designed to connect investors with high-potential opportunities in the e-mobility space.

The aim was to provide structured discovery, clearer articulation of value propositions, and a more

transparent interface between innovative enterprises and impact-focused capital."

READ MORE >

|

|

|

|

|

What’s New

|

|

India Announces Unified Climate Finance Mechanism to Implement National Adaptation Plan

Read more➔

|

AVPN Launches SDG 5 Climate-Focused Investor Toolkit to Accelerate Gender-Smart Climate Finance

Read more➔

|

Arvind Limited and Peak Sustainability Ventures Launch India’s First Industrial-Scale Cotton Stalk Torrefaction Plant

Read more➔

|

ABC Impact Partners with DBS and UOB for US$110 Million Sustainability-Linked Subscription Loan Facility

Read more➔

|

Uttarakhand Designates Environment Department as Nodal Agency to Harness Carbon Credits

Read more➔

|

Upaya Social Ventures invites applications for the ClimaFii Alliance Cohort 2026

Read more➔

|

|

|