Startup India launch the National Incubator Capacity Development Program

With the intent to support, train and further guide Incubator managers of the country, Startup India has launched the National Incubator Capacity Development program. Click here to know more and apply

SIDBI and NIIF's Fund of Funds comment on how they choose GPs for capital allocation at the IVCA Conclave 2023

“SIDBI seeded the fund managers in the country, we take pride in that. Approximately 43 per cent of our fund of funds has supported first time fund managers where we have given the first check. It is the fund manager who matters for us. If a fund manager is having those critical skills, even if he pivots through the life of the cycle, he will bring success to us,” Satya Prakash Singh, Chief General Manager, of SIDBI’s venture finance and investment vertical

“We look for experience in the team. That experience many have been gained by doing 2-3 funds under the franchise or by working elsewhere and or by experienced professionals coming together. Roughly we split our portfolio half and half. From a quantum point of view, half of it is about established manager and the other half is about emerging managers,” Anand Unnikrishnan, Managing Partner - Fund of Funds, NIIF, said. (Source: Business Today)

Publication Launch! India Venture Debt Report 2023

Stride Ventures have launched of their latest and 2nd edition of the India Venture Deb Report 2023, which offers unique insights, key trends and emerging opportunities from the thriving VentureDebt ecosystem in India! Click here to read the report.

CarTrade launches Rs 750 Cr venture fund to invest and acquire companies

Auto platform Cartrade Tech said it launched a venture arm, CarTrade Ventures, to invest up to Rs 750 crore over five to seven years in areas including auto finance, leasing, insurance, servicing, car ownership, electric vehicles, clean energy, and new-age technologies. (Source: YourStory)

Marico has been awarded with "Corporate Citizen of the Year 2022" award by Economic Times

For Marico, one of India's leading fast-moving consumer goods (FMCG) companies, sustainability became a core business strategy much before India Inc recognised it to be an important aspect of doing business. Its social welfare initiatives impact a variety of stakeholders such as farmers, local communities, women and youth, teachers, students, and government agencies. That's why the jury chose Marico as Corporate Citizen of the Year. (Source: ET)

Multiples Alternate Asset Management and its co-investors are investing up to Rs 1,200 crore ($144.7 million) in Murugappa group company TI Clean Mobility

The investment is part of TI Clean Mobility’s planned fundraise of Rs 3,000 crore from its parent, Mumbai-listed Tube Investments of India Ltd, and external investors including Multiples and State Bank of India. (Source: VCCircle)

Event Alert! Winpe Leadership Summit takes place on the 28th of April, 2023

Join us on 28th April, 2023 as we embark on a knowledge and networking summit for women investors and entrepreneurs, followed by the prestigious Winpe Awards to acknowledge the sustained efforts of individuals and firms in creating an equitable ecosystem. Click here to register.

Tata 1mg-backed 5C Network strikes first acquisition with healthtech firm

With this acquisition, 5C aims to combine its expertise in digital diagnostics with Krayen. The merged entity aims to provide accurate diagnostic solutions to healthcare providers and patients. (Source: VCCircle)

SEBI plans to allow perpetual funds

“Such vehicles are emerging in the West and are supposed to survive perpetually as they do not have a tenure. The fund may or may not be listed and the fund may adopt a strategy which allows it to give a redemption option at periodic intervals to investors. This benefits the fund manager because he is not working through a finite cycle where he has to raise money and exit every few years even if the asset looks good and promising from a longer term perspective,” said a person familiar with the matter. (Source: Financial Express)

SIDBI enters venture debt market makes 4 small investments

“Along with equity investments, we are talking about the ability to provide debt. A lot of banks, even today, are not in a position within their straitjacket to provide debt to companies. So, SIDBI has gone into what is known as venture debt… We’ve partnered with a few of the funds that we’ve supported and we’ve been able to get leads from those funds,” SIDBI Chairman & MD Sivasubramanian Ramann said at the IVCA Conclave 2023 in Mumbai.

He revealed that the company had already made four “small” early-stage debt investments. However, did not reveal the companies SIDBI had invested in. (Source: Inc42)

International Finance Corporation (IFC) is considering an equity investment worth $25 million in Ather Energy

IFC said its proposed investment will help increase access to high-quality and affordable electric scooters in India, particularly in Tier II and Tier III cities, through scaling the company’s production and distribution network. (Source: Dealstreet Asia)

Quadria Capital was awarded the 'Outstanding Action towards Gender Diversity' Award at IVCA Conclave 2023

Northern Arc was awarded the Social Impact Award at IVCA Conclave 2023

.jpg)

Digital twin startup Intangles raises $10M in Series A round

Scrut Automation, a risk compliance automation platform, has raised $7.5 million from MassMutual Ventures. Existing investors, including Lightspeed Venture Partnersand Endiya Partners, also participated in the round and increased their stakes. (Source: YourStory)

FreshToHome raises $104M led by Amazon Smbhav Venture Fund

Bengaluru-based fish and meat retailer FreshToHome has raised $104 million in its Series D round of funding led by Amazon Smbhav Venture Fund . New investors in the round include Dubai-based E20 Investment Ltd, Bengaluru-based Mount Judi Ventures, and Jeddah-based Dallah Albaraka. (Source: YourStory)

Mintoak Raises $20 Mn In Series A Round

Fintech startup Mintoak Innovations Pvt. Ltd has raised $20 million (Rs 165 crore) in a Series A funding round, led by PayPal Ventures. The round also saw participation from British International Investment, White Whale Venture Fund and existing investors HDFC Bank and Pravega Ventures. (Source: VCCircle)

Belgian impact investor Incofin closes India Progress Fund at $77m

Belgian impact investor Incofin announced the final close of its India Progress Fund at $77 million as it looks to ramp up investments in financial inclusion and the agri-food value chain in the hinterlands. These two sectors make the deepest social impact and are the top drivers for climate change adaptation potential in the Indian context, Incofin said in a statement.

The investor base comprises a diverse set of private and institutional investors including Korys, British International Investment, Proparco, the Belgian Investment Company for Developing Countries (BIO Invest), the SDG Frontier Fund, the King Baudoin Foundation, several Belgian family offices and the Indian development financial institution and fund of funds SIDBI. (Source: Deal Street Asia)

Event Alert! YourStory hosts TechSparks Mumbai Edition

TechSparks has been the definitive platform for entrepreneurs to flex their ‘hustle muscle’ for publicity, connections, recognition and funding. We understand that networking and forming connections are important for emerging entrepreneurs and have made provisions to facilitate VC, enterprise and other ecosystem connections for founders. Click here to register.

Biotech startup UBreathe raises $181K on Shark Tank India

UBreathe, a biotech startup that develops plant-based air purifiers, secured a deal of $181,000 from Emcure Pharmaceuticals head Namita Thapar on Shark Tank India.

Unlike mechanical purifiers that filter only dust pollution and are highly toxic to the environment, their solution captures all the contaminants in the air. The product is tested and certified by NABL Labs and has been reviewed and recommended by the faculty of AIIMS Delhi. (Source: YourStory)

Farmer-focused ecommerce firm Cattle Guru raises funds from Antler

Gurugram-based ecommerce startup Cattle Guru has raised $240,000 from early-stage venture capital firm Antler.

The ecommerce platform provides doorstep delivery of cattle feed to farmers. Farmers can place an order, track their delivery, and make payments on receiving their feed without having to travel long hours and distances. (Source: YourStory)

IFC proposes $100m senior loan to IIFL Home Finance

The proposed investment will be in the form of a senior secured loan for a tenor of up to six years. Once approved, the funding proceeds will be used to provide retail buyers with financing for affordable housing with a focus on the low-income group, said the IFC disclosure.

KKR double down on the low-carbon transition and impact investing

KKR is staffing up for a dedicated climate fund, bringing on Emmanuel Lagarrigue, a former Schneider Electric executive who helped establish General Atlantic’s Beyond Net Zero, and GoldmanSachs partner Charlie Gailliot to co-lead the new fund. (Source: Impact Alpha)

NITI Aayog has launched a Women Entrepreneurship Platform (WEP)

NITI Aayog has launched a Women Entrepreneurship Platform (WEP) for providing an ecosystem for budding & existing women entrepreneurs across the country. SIDBI has partnered with NITI Aayog to assist in this initiative.

As an enabling platform, WEP is built on three pillars- Iccha Shakti, Gyaan Shakti & Karma Shakti

- Iccha Shakti represents motivating aspiring entrepreneurs to start their business

- Gyaan Shakti represents providing knowledge and ecosystem support to women entrepreneurs to help them foster entrepreneurship

- Karma Shakti represents providing hands-on support to entrepreneurs in setting-up and scaling up businesses

Temasek Holdings is in advanced talks to buy a minority stake in Cloudnine Hospitals, valuing the Indian hospital chain at 30 billion rupees.

Temasek is likely to invest around 5 billion rupees for a 15-20% stake in the maternity, gynaecology, and paediatric hospital chain through its Sheares Healthcare unit, ET said, citing two people aware of the development.

Apart from Temasek, existing investor NewQuest Capital will increase its stake in the Bengaluru-based company with an investment of about 2 billion rupees, the report said. (Source: Deal Street Asia)

FreshBus raises Rs 26Cr seed funding from ixigo

FreshBus, a Bengaluru-based EV bus startup, has secured Rs 26 crore in seed funding from ixigo (Le Travenues Technology Limited).

With this, the company is looking to launch premium inter-city electric bus services across India. The service would commence simultaneously from Hyderabad and Bengaluru with the launch of 24 electric buses. The operational routes would be announced by March.

Mumbai Angels invests in agritech startup RuKart

Mumbai Angels, an early-stage investment platform part of alternate investment firm 360 ONE, has invested an undisclosed amount in agritech startup RuKart. The startup is trying to minimise post-harvest losses and unsustainable practices in the vegetable, fruit, and flower segments, said Nandini Mansinghka, CEO of Mumbai Angels, in a press note. The founders of RuKart want to create an environmentally-sustainable farm ecosystem for small plot holders or those who operate on less than 0.5 acres of land to grow fruits, vegetables and flowers. (Source: YourStory)

PhonePe lands $100M in additional funding at $12B valuation

Digital payments app PhonePe has raised $100 million in additional funding from Ribbit Capital, Tiger Global, and TVS Capital Funds, at a pre-money valuation of $12 billion. This comes almost a month after it raised $350 million from private equity firm General Atlantic, making it the country's most valuable payments firm. (Source: YourStory)

Kae Capital, Whiteboard, Others Back B2B Firm Onwo

Bengaluru-based business-to-business (B2B) platform Onwo on Monday said it has secured $1.6 million (around Rs 13.2 crore) in a seed funding round led by Kae Capital. The round also saw participation from Whiteboard Capital, 2 am VC, Kettleborough VC, Climber Capital and Point One Capital, among others. (Source: VCCircle)

HireSure.Ai Raises Seed Funding

HRtech platform HireSure.ai, announced on Wednesday that it has raised $2.5 million (Rs 20.7 crore) in a seed funding round co-led by YCombinator and Binny Bansal’s Three State Capital. The round also saw participation from San Francisco-based Tribe Capital and Pioneer fund. (Source: VCCircle)

Caspian Equity launches LEAF Fund to invest in Food and Agriculture startups Read more

"Caspian LEAF will focus on high impact, close to farmer solutions that benefit small and marginal farmers. Some of the spaces we are looking at are, efficiency in input use, reduction in drudgery, labour saving farm machinery, close to farm processing and traceability solutions. We hope to be more than just investors, and help build robust and sustainable businesses that become market leaders in the spaces they operate in," Emmanuel Murray, Investment Director at Caspian Equity and Fund Manager of Caspian LEAF Fund.

The fund, which has a size of Rs 52 crore, will invest in pre-series A startups with ticket sizes ranging from Rs 1-5 crore. The fund expects to invest in 12 startups and has already secured commitments from leading investors such as IndusInd Bank, Sivakumar Surampudi, Kishore Moorjani, Swaminathan Aiyar and Shyamprasad Bhat. (Source: Ani News)

Simple Energy Eyes Fresh Funding To Boost E-Scooter Output

The company recently raised over $20 million in a bridge funding round that saw participation from high-net-worth individuals such as Thyrocare Technologies’ founder Arokiaswamy Velumani, Gokaldas Group’s Ashwin Hinduja, Nash Industries’ owners Sanjay and Sandeep Wadhawa, and Purple Moon Ventures, among others. It also counts Sattva Group and Athiyas Group as investors. To date, it has raised $42 million. (Source: VCCircle)

Sixth Sense Ventures Leads $5.4 Mn Round In Prozo

Noida-based supply chain platform Prozo on Tuesday said it has raised pre-Series B funding of $5.4 million (around Rs 45 crore) led by Sixth Sense Ventures, with participation from Jafco Asia and other investors. (Source: VCCircle)

Accel-Backed Venwiz Raises $8.3 Mn In Series A Round

Business-to-business (B2B) software-as-a-service (SaaS) platform Venwiz has raised $8.3 million (Rs 68.8 crore) in a Series A funding round, led by Sanjay Nayar's early-stage tech-focused venture capital company, Sorin Investments.

The round also saw participation from existing investors Accel and Nexus Venture Partners along with new investors Jafco Asia, Riverwalk Holdings, Force Ventures and angel investors like Sanjeev Rangrass (ITC agri business), Anshuman Sinha (AT Kearney), Prabhav Kashyap (Bain), amongst others. (Source: VCCircle)

C4D Partners aims for $40 Mn for India focused fund's first close

At C4D Partners, we are much excited and enthused as we move ahead on our journey of impact with our latest India-dedicated fund – C4D Bharat Shubharambh Fund. As we’re working toward our first close, seeking to connect with conscious investors, and encouraged by all the support from the impact industry, we feel positive about our journey ahead, says Arvind Agarwal, Co-founder & CEO, C4D Partners. (Source: VCCircle)

EV-Focused Mufin Green Finance Raises Debt Round

Listed non-banking financial company (NBFC) Mufin Green Finance Ltd, announced on Wednesday that it has raised $7 million (Rs 58 crore) in debt funding by way of green bonds from impact investment firm, Symbiotics Investments.

The bond forms part of the $75 million green basket bond program structured in partnership with British International Investment (BII), the United Kingdom development finance institution. (Source: VCCircle)

PadCare Taps Social Alpha, Lavni, Others

Sanitary pad recycler PadCare Labs has raised seed funding of $605,891 (around Rs 5 crore) led by Social Alpha, with participation from Lavni Ventures, 3i partners, Rainmatter and Spectrum Impact. (Source: VCCircle)

Turno Raises $13.8 Mn From B Capital, Quona, Others

Commercial electric vehicle startup Turno on Thursday said it has secured Series A funding of $13.8 million (around Rs 112 crore) co-led by global venture capital firms B Capital and Quona Capital.

The round was also participated by existing investors Stellaris Venture Partners and Avaana Capital, with new investors Alteria Capital and InnoVen Capital. (Source: VCCircle)

General Catalyst, Accion, Others Back Magma

Taozen Technology Pvt Ltd, which runs cross-border business-to-business (B2B) supply chain enablement startup Magma, has raised $3.3 million (around Rs 26.4 crore) in a seed funding round led by General Catalyst.

The round also saw participation from Accion Venture Lab, Titan Capital, WEH Ventures and All in Capital, with angel investors Aayush Phumbhra (Chegg), Varun Alagh (Mamaearth) and Srini (BigBasket, Bluestone). (Source: VCCircle)

Zypp Elec Taps Gogoro, Goodyear, Others For $25 Mn Round

Electric vehicle delivery app Zypp Electric on Wednsday said it has raised Series B funding of $25 million (around Rs 206 crore) led by Gogoro.

The round also saw participation from a clutch of new and existing investors including Goodyear Ventures, 9Unicorns, WFC, Venture Catalysts, LetsVenture, IAN, Ivygrowth, Grip with angel backers.

Digital Lender LoanTap secured debt funding of $2.9 million (around Rs 24 crore) from global investment firm Lighthouse Canton.

Founded by Satyam Kumar and Vikas Kumar in 2016, LoanTap offers loans and overdraft products to salaried professionals with earnings of Rs 30,000 and above. Besides, the company also provides credit solutions to micro small, and medium enterprises (MSMEs) in personal finance, supply chain invoice financing and electric two-wheeler segments. (Source: VCCircle)

MSwipe In Talks To Raise $75 Mn In New Funding Round

Founded in March 2011 by Manish Patel, Mswipe is an independent merchant acquirer and payment services provider that makes mobile PoS (mPOS) devices for merchants

PeerCapital, an early-stage technology-focused venture capital firm, plans to raise ₹900 crore ($108.7 million) for its maiden fund

PeerCapital has completed the first close of its maiden fund at about Rs 300 crore ($37.5 million), managing partner Ankur Pahwa told ET on Thursday. The fund plans its final close of the remaining Rs 300 crore by September 2023, after which the target of Rs 600 crore ($75 million) will be triggered, Pahwa said, adding that there was also a green shoe option of Rs 300 crore; (Source: LiveMint)

Skilling Firm Cusmat Gets Infusion From Arkam, Unitus, Others

Virtual reality-based skilling platform Cusmat on Tuesday said it has secured Series A funding of $3.5 million (around Rs 28.9 crore) led by Arkam Ventures.

The round also saw participation from Unitus, Better Capital, Venture Catalysts, MapMyIndia, 9 Unicorns, We Founder Circle, Mumbai Angels Network, Dholakia Ventures, Ice VC and Legacy asset LLP. (Source: VCCircle)

EV Maker Simple Energy Raises $20 Mn In Bridge Round

Electric vehicle maker Simple Energy, on Tuesday said it has secured over $20 million in an ongoing bridge funding round.

The fundraise saw the participation from Thyrocare Technologies Ltd’s founder Arokiaswamy Velumani, Gokaldas Group’s Ashwin Hinduja, Nash Industries owners Sanjay and Sandeep Wadhawa and Purple Moon Ventures, among others. Existing investors Manish Bharti and Vasavi Green Tech also took part in the round. (Source: VCCircle)

Capria, Omnivore, Others Back BharatAgri

LeanCrop Technology Solutions Pvt Ltd, which runs agritech startup BharatAgri (formerly LeanAgri), has raised $1.6 million (around Rs 14 crore) in an extended Series A funding round led by Capria Ventures.

The round also saw participation from investors including Omnivore, India Quotient, 021 Capital, Ratnagiri Impex and Sanjiv Rangrass (Unitus Ventures), among others. (Source: VCCircle)

Third Point, Iron Pillar, Others Invest $50 Mn In Ushur

The fresh funds will be deployed for expanding the company’s experience automation portfolio, developing AI-led innovations, expanding to new regions and industry verticals.

With this round, Ushur has raised nearly $92 million in total funding till date. Iron Pillar participated in the startup’s extended Series B fundraise, making its one of the first bets from the second fund. The $30 million Series B round was led by Third Point Ventures. (Source: VCCircle)

Classplus Backs Test Prep App Abhinay Maths

Test preparation app Abhinay Maths has raised an undisclosed capital from edtech platform Classplus.

"This strategic investment from Classplus will also allow us to use the leverage of technology and provide cost-effective test prep coaching to millions of government job seekers from tier 2, 3, and 4 cities" said Abhinay Sharma, founder and chief executive officer, Abhinay Maths. (Source: VCCircle)

Bike Bazaar Hits Final Close Of Series D At $30 Mn

The round comprised of two tranches. In the first leg, Bike Bazaar had raised $20.6 million from Women’s World Banking Asset Management and Lending Partners, while in the second leg, the company secured $10 million from Deutsche Investitions- und Entwicklungsgesellschaft (DEG).

The Pune-based startup has raised a total of $58.4 million (around Rs 482 crore) in equity funding so far. (Source: Impact Alpha)

Event Alert! YourStory hosts SheSparks 2023 on the 3rd of March in New Delhi

SheSparks 2023 aims to bring together women changemakers, bring new women role models for India to the forefront, draft policy recommendations to be sent to the government, bring fresh and actionable learnings from women changemakers and invest in women-led businesses driving change. Click here to know more.

Abler (formerly Nordic Microfinance Initiative) Seeks To Raise $140 Mn For New Fund

“India is where we started and continues to be a key market for us, with roughly 40% of our $345 million committed capital invested as equity in Indian financial inclusion companies. Since our establishment in 2008, our public-private partnership has contributed to enabling millions of low-income people with a wide span of responsible financial services,” said Smriti Chandra, investment director and head of Smriti Chandra’s India office. (Source: Ani News)

FM Proposes Accelerator Fund To Boost Agritech

Finance Minister Nirmala Sitharaman on Wednesday proposed to set up an accelerator fund to support agritech startups as well as to encourage entrepreneurship, primarily in rural areas.

“The accelerator will aim for working on innovative ideas and may also help with packaged food, which will not only help in increasing productivity but also farmer income,” said Anil Joshi, managing partner at Unicorn India Ventures. (Source: VCCircle)

Mumbai Angels Leads Seed Round In A Toddler Thing

Baby focused brand A Toddler Thing on Thursday said it has raised seed funding of $268,689 (around Rs 2.2 crore) led by early-stage investment firm Mumbai Angels, with Lead Angels and Chennai Angels. (Source: VCCircle)

Launch of Yash Entrepreneurs Program

If you are a startup working in the Sexual and Reproductive Health space, working towards achieving India’s Family Planning goals. Click here to apply

Event Alert! Ankur Capital hosts the 4th Edition of India Pitch Fest

After 3 editions and numerous success stories, Ankur Capital is hosting the fourth edition of India Pitch Fest!

If you are a pre-seed, seed, or early stage start-up register now to have an opportunity to pitch to multiple investors under the same roof, Click here to register.

British International Investment releases new Insight report – Investing for Impact in India

We’ve been a long-standing and committed partner supporting economic development in India. We’ve invested more in India than any other country, and our current portfolio is valued at $2.2 billion. Past investments include supporting the emergence of the IT sector in the late 1990s and early 2000s. The sector now represents over half of the global outsourcing market as well as 7.4 per cent of India’s GDP and more than five million jobs. Read the complete report.

Northern Arc Investment is awarded the Best House for Alternatives by Asia Asset Management

Tamil Nadu Govt. unveils Electric Vehicles Policy 2023

Through this policy, the Govt. of Tamil Nadu aims to:

1. Increase the share of electric buses in the state to 30% of the fleet by 2030

2. Chennai, Coimbatore, Tiruchirappalli, Madurai, Salem & Tirunelveli are declared as EV cities. In each of these cities, electrification of auto rickshaws and buses will be done within 10 years in a phased manner.

3. Government of Tamil Nadu will also undertake the development of public charging infrastructure in these cities through public private partnership.

4. The scheme includes supporting taxi fleets and app-based transport aggregators in transitioning to an electric fleet.

Source: Hindu Business

Event Alert! Bharat Inclusion Summit

CIIE.CO are coming up with the Bharat Inclusion Summit on March 3, with workshops, panels, and fireside chats to bring together industry leaders while also creating intentional spaces for networking and collaborations. Click here to register. Limited seats only.

SAVE THE DATE: The GIIN Impact Forum is taking place in Copenhagen, Denmark on October 4-5, 2023.

Lok Capital 's new fund meets the 2XChallenge criteria

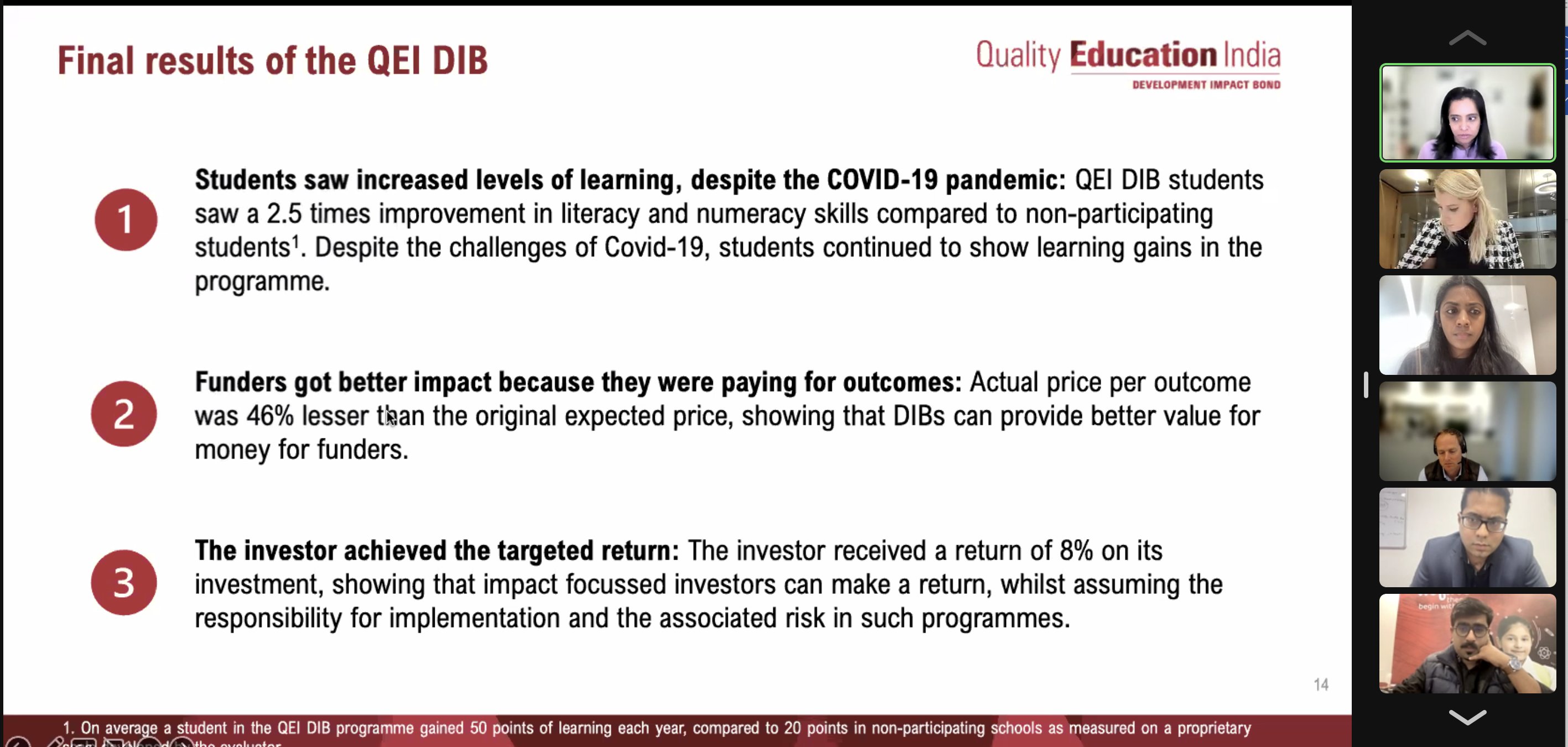

Lessons from the Quality Education India Development Impact Bond (QEI DIB)

Social Enterprise Feature: Phool.co

The Indian-based start-up has created a new type of vegan leather known as "fleather." Fleather is made from the waste generated from India's flower industry and is sustainable and biodegradable. The process involves collecting discarded flowers, boiling them and turning the residue into a paste that is then molded into sheets and transformed into a range of products such as wallets, phone cases, and backpacks. Fleather is not only environmentally friendly, but it is also more affordable than traditional vegan leather made from PVC and PU. Enterprise founder hopes to scale up production and make fleather a viable alternative to traditional leather. (Source: BBC)

Launch of Innovation in Plastics: The Potential & Possibilities Playbook

Marico Foundation launches “Innovation in Plastics: The Potential & Possibilities”. A playbook that features 15 promising startups that are addressing key themes like recycling, waste collection, sorting, plastic alternatives, & marketplace platforms. Download the publication here: https://lnkd.in/g8BYbVEe

Social Enterprise Feature: e-TRNL Energy

Read this article to know more about why CIIE.CO invested in e-TRNL Energy with a focus on the need for innovation, its unique battery proposition, and the favorable market conditions that will contribute to the scalable growth of the company. Read more at: https://go.ciie.co/eTrnl

Welcome to India Impact Investing Live Newsfeed