GIIN launch "Guidance for Pursuing Impact in Listed Equities"

The GIIN released new guidance to help investors achieve impact in public equity investments. Developed with input from over 100 investors, Guidance for Pursuing Impact in Listed Equities uses the GIIN's Core Characteristics of Impact Investing to provide baseline practices and expectations for asset managers seeking to achieve positive impacts in listed equities.

The guidance is structured around four main aspects of listed equities impact investing: setting fund/portfolio strategy, portfolio design and selection, engagement and performance data usage. Additionally, it introduces two key concepts, investor contribution and theory of change, that investors should consider when designing and managing listed equities impact funds. Click here to download it.

Va Tech Wabag water tech company bags ₹4,400 Cr order from Chennai Metro Water to build 400 MLD desalination plant

The project has been funded by Japan International Cooperation Agency (JICA) and seeks to improve Chennai’s water security through a stable source of drinking water in the form of desalination.

The project will be executed by WABAG in a joint venture with Metito Overseas Ltd. Once completed, the project will be the largest desalination plant in the South East Asian Region

Source : Business Line

Report Launch! Tracxn launches "HealthTech India - Feed Geo" Report

The report contains an In-depth analysis of sector in a particular Geography through Investment Trends, Interesting Companies, Market Details, etc. Click here to download the report.

Sequoia Capital India and Global Founders Capital have invested in Nimbbl

Sequoia Capital India and Global Founders Capital (GFC) have backed BNPL and UPI-powered Indian fintech Nimbbl’s $3.5 million seed and pre-Series A rounds, reported TechCrunch. Online investment platform Groww and angel investors also participated in the funding. The firm will use the proceeds to accelerate sales.

Source : Deal Street Asia

pi Ventures raises $2.6m

The fund will invest in startups focused on disruptive AI and other forms of biotech, and material science. BII, Nippon India Digital Innovation AIF, Accel, and entrepreneurs & family offices and senior leaders from IBM, Facebook and Google have backed the fund. pi Ventures announced the first close of its second fund at $40 million in January last year. With Colruyt’s investment, the fund is on track to hit its final close in the second quarter of 2023 at Rs 675 crore to Rs 750 crore.

Source : Deal Street Asia

Call for Applications! I-Win 2.0 Accelerator

I-Venture @ ISB is inviting applications from women-founded/co-founded startups for its I-WIN (Women of Innovation) 2.0 accelerator program. Get the right support you need to supercharge your startup's growth and secure funding. Applications closing on 31st March 2023. Click here to apply.

Ikea Foundation has partnered with TechnoServe to support 400 green Indian businesses.

GreenR, a TechnoServe initiative, is a one-of-a-kind accelerator, solely nurturing high growth businesses disrupting the Environment Action space. We help identify and execute strategies needed to build resilient revenue models and world-class enterprises alongside the most promising Environment Action Entrepreneurs. Our aim is to restore the environment and uplift communities around the world through your scale-bound startups. Our programs are 12 and 21 months long, ensuring our tailored growth advice is nurtured and tested, exponentially increasing green consumption. Clcik here to apply.

Global start-up accelerator Turbostart is inviting applications for its fourth cohort for India and plans to invest up to $1 million each in 10 startups.

TurboStart is a sector-agnostic, early-stage accelerator and provides a platform for entrepreneurs and startup founders to scale their businesses. The accelerator has now opened applications for the 4th Cohort to enlist startups seeking to raise seed and pre-Series A funding.

Source : YourStory

Bezos Earth Fund Invests $34 Million to Help Deliver Healthy, Climate-Friendly Food and Improve Corporate Climate Accountability

The Bezos Earth Fund today announced $34.5 million in grants as part of its $10 billion commitment to fight climate change and protect nature, supporting transformative work to improve greenhouse gas (GHG) accounting and disclosure and advance food systems transformation.

Source : Theia Ventures Climate News Review

International Finance Corporation announced to invest Rs 3,750 million in a sustainability-linked bond issued by Tata Cleantech Capital.

With this, the company will work towards scaling up on-lending towards renewable energy projects and diversifying into energy efficiency and e-mobility sectors over the next three years. "Aligning with our sustainability goals, IFC’s innovative financing structure will enable us to strengthen our green financing portfolio. Also, the financing will help diversify our borrowings’ profile in the fight against climate change," said Manish Chourasia, Managing Director, Tata Cleantech Capital. The SLB is a joint venture between Tata Capital Limited and IFC. It will help Tata Cleantech Capital Limited (TCCL) strengthen its position as a leading green financier by taking on ambitious climate and sustainability targets.

Source : YourStory

Webinar Alert! Addressing Power Dynamics in Investment Processes

Criterion is hosting a webinar on the subject. LPs, GPs, and social entrepreneurs will discuss the unique processes and practices they follow, the power dynamics involved, and their experiences and opinions on the way it impacts their work.

Topic: Addressing Power Dynamics in Investment Processes

Date: 30th March 2023

Time: 6:30 PM IST

To register for the event, kindly reach out to us at info@c4dpartners.com.

Call for nominations 2X Forum

2X Forum is looking for women entrepreneurs, representatives of women’s and civil society organisations and a wider range of thought leaders in gender lens investing for strategic advice and engagement. Deadline: 14th April, 2023. Click here to apply.

Milkbasket cofounder Anant Goel’s new startup Sorted bags $5 Mn

Former Milkbasket CEO and cofounder Anant Goel has ventured into the fruits and vegetables (F&V) segment with a new omnichannel startup, Sorted. A franchisee network of digital mom-and-pop stores, the F&V startup has so far raised $5 Mn in its ongoing seed round. Sorted provides its customers quality fruits and vegetables that come straight from the farms.

Source : Inc42

Cross Boundary launches "Sovereign Advisory Viewpoints – Debt For Climate Swaps" Report

CrossBoundary’s latest Sovereign Advisory Viewpoints report is a brief explainer on the topic of Debt for Climate Swaps and should be useful to both experienced market participants and the casually curious.

The Debt for Climate Swaps structure is still considered in its infancy but provides partial relief to a fiscally constrained debtor in exchange for a commitment towards climate and nature-based initiatives. Click here to download the report.

Trilegal has been recognised as the Energy and Resource Law Firm of the Year at the Asian Legal Business (ALB) India Law Awards 2023

Webinar alert | Technology working towards Paradigm Shift in Indian Agri and Dairy Industry-Rapid Adoption or gradual progress?

Agri/Dairy practitioners still largely continue to follow the traditional methods. Some amount of mechanisation and automation has seeded the process in parts and resulted in incremental gains for the farmer, but the country is yet to see game-changing interventions adopted at scale. IT, IoT, AI/ML, and cloud are slowly entering the agritech lingo. However, on a large scale, a clear winner is yet to emerge. Click here to register.

Dasra launches India Philanthropy Report 2023

The India Philanthropy Report 2023, written as a collaboration between Bain & Company and Dasra, provides an in-depth view of the private philanthropy ecosystem in India. Private philanthropy is expected to expand 11% annually over the next five years, with developments in family philanthropy, CSR, and retail giving as key drivers. The report spotlights the role domestic funders will play in bolstering community resilience. Click here to read the complete report.

The IPCC has released the final part of its sixth assessment report, described as "a clarion call" to massively fast-track climate action

Here is a short snippet from the report:

A many-fold increase in climate finance is essential to rapidly reducing greenhouse gas emissions, along with the removal of barriers such as information sharing, making finance available to those who need it and general international cooperation. Click here to read the report summary.

Read the report summary here: https://lnkd.in/eCuTNZPm

Unitus Capital launches monthly newsletter!

The newsletter focuses on interesting updates, news, regulations, and trends surrounding the market and our focus sectors. Click here to read it.

Gray Matters Capital hosts a webinar on Student Sourcing Strategy for Income Share Agreements (ISA)

This webinar series is designed to provide participants with a hands-on understanding of Income Share Agreements to build a sustainable training model and support students with skilling and job placement. In this second session, participants will gain deeper insights on student sourcing strategies for ISA. Click here to register.

Uravu Labs raises $2.3 million in seed round

Deep-tech startup Uravu Labs has raised $2.3 million in seed funding from JITO Angel Network, Anicut Capital, Speciale Invest, and Rocketship.vc. Other investors who participated in this round include Vesta, Spectrum Impact, ZNL Growth Fund, VERSO, Echo River Capital and wealthy individual investors.

Source : YourStory

Aavishkaar Capital Taps Another LP For $200-Mn Fund

Aavishkaar Capital, the impact investing arm of Aavishkaar Group, is set to receive another cheque from a limited partner for its sixth India-focused fund that aims to raise up to $200 million.

Source : VCCircle

Impact Investors Council Launches "2022 in Retrospect: India Impact Investment Trends" Report

Our annual India Impact Investment Trends report aims to showcase critical impact investing trends and share insights into the state of education, health, agriculture, financial inclusion, climate solutions, gender lens investing and other key sectors. Download now: https://lnkd.in/dk6SVU7E

DPIIT official Manmeet Nanda appointed new MD & CEO of Invest India

The board of Invest India has appointed Manmeet K Nanda as the Managing Director and Chief Executive Officer of the investment promotion and facilitation body under the Department for Promotion of Industry and Internal Trade (DPIIT). Nanda, is joint secretary in the DPIIT and succeeds Deepak Bagla, who resigned from the post last week.

Source : Economic Times

Elevation Capital To Expand Focus On Fintech Space, Financialisation Of Savings

Early-stage to growth-equity investment firm Elevation Capital, backer of the likes of Paytm, Swiggy, Acko, ShareChat and Meesho, among others, is increasing its focus on the business-to-business (B2B) fintech and fintech infrastructure segments,

Source : VCCircle

Cedar-IBSi Capital Floats Fintech VC Fund For India, GCC And Other Markets

Management consulting firm Cedar Consulting and fintech market intelligence platform IBS Intelligence have teamed up to form a new venture capital fund that will invest in fintech companies across India, Europe, and member countries of the Gulf Cooperation Council (GCC).

Source : VCCircle

Omnivore exits fruit spraying tech startup MITRA following Mahindra acquisition

Mahindra & Mahindra was already a shareholder with 47.33% stake in MITRA efore purchasing all remaining shares, including Omnivore’s stake today. The transaction marks an exit for Omnivore, India’s leading agrifoodtech venture capital firm. The move also comes after Mahindra set up a new farm machinery plant in India, which will roll out new products designed at Mahindra’s global technology ‘Centers of Excellence’ in Finland, Japan, and Turkey.

Source : AgFunder News

Tamil Nadu launches exclusive women's startup mission

Ramanathan says that most women in the state own micro-enterprises, and through the mission, it is “looking at encouraging women entrepreneurs and providing them with the necessary assistance to scale their businesses and redefine their business models, with a special focus on women entrepreneurs in tech.” In the same vein, he added, “For Tamil Nadu to achieve its target of a $1 trillion economy by 2030, women’s participation is important, which will push more women to get into the startup ecosystem.”

Source : YourStory

Event Alert! CIIE.CO hosts Innocity Booster

Join CIIE.CO for the Innocity Booster on 13th April for early-stage startups. Get your product or investor pitch reviewed by experts and feedback. on Go-to-Market, Product Roadmap, Investments, and much more. Click here to register.

BlueOrchard leads $54m funding in EV charging startup CHARGE+ZONE

Of the total funds raised, $8 million was in the form of debt investment from an infrastructure strategy managed by BlueOrchard, the statement added. With the latest infusion, the total capital raised by the company stands at $67.5 million. The startup will use the funds to finance an immediate roll-out of 286 charging stations, 1,130 e-buses and e-trucks and over 1,250 e-car fleets, as well as new expansion targets.

Source : Deal Street Asia

Report launch! USAID and Invest India launch "Investment Landscape of Indian E-Mobility Market" Report

The Indian automobile industry has always been a great investment story, it being the third largest in the world. The electric mobility sector too has gained significant traction and is expected to grow at an annual growth rate of 49% till 2030. In 2022, India reached a major milestone of selling 1 million EVs. EVs recorded robust growth in 2022, supported by the implementation of favourable policies and program by the government. There are innovative business models and technologies coming up in the space every day and the Indian start-up ecosystem is poised to spearhead the revolution that is required for the mobility market. Click here to read the complete report.

Incofin has launched the Water Access Acceleration Blended Finance Fund with €36 million

The blended fund aims to provide 20 billion liters of water to 30 million people, mainly in Africa and Asia. The committed capital comes from a diverse pool of private and public investors, including Danone along with BNP Paribas, the U.S. International Development Finance Corporation (DFC), Norfund, the Danish development finance institution IFU, and international foundation Aqua for All. The U.S. Agency for International Development (USAID) provided catalytic funding to enable a first-loss tranche.

Source : Impact Alpha

EV startup Kabira Mobility raises $50 million from Qatar's Al-Abdulla Group

Indian electric two-wheeler manufacturer Kabira Mobility has raised $50 million funding from Qatar-based conglomerate Al-Abdulla Group. Kabira Mobility, a Panjim-based EV startup, will be using the fresh funding for its future growth in India. It plans to ramp up production capacity of its electric bikes KM3000, KM4000, introduce new products and enhance sales infrastructure across the country.

Source : Zee Business

PhonePe raises $200M from Walmart

Payment and financial services unicorn PhonePe has raised an additional $200 million in primary funding from Walmart at a pre-money valuation of $12 billion. With this, the company has raised $650 million from several global investors.

Source : YourStory

Aerem bags $5m to tackle solar energy adoption in India

Aerem, a solartech and financing platform based in India, has secured US$5 million in its pre-series A round led by Avaana Capital, with Blume Ventures participating. The amount includes US$1.5 million in debt financing.

Source : Tech in Asia

Report Launch! IVCA launch their India Venture Capital Report 2023

Commenting on the launch of the ‘India Venture Capital Report 2023’, a co-branded report with Bain and Company, Rajat Tandon, President, IVCA said, “Over the years, the alternative investment asset class has demonstrated remarkable resilience.We remain optimistic about the long-term growth prospects of the industry and its ability to navigate uncertainty, identify opportunities, and support India's dynamic entrepreneurial ecosystem." Click here to read the report.

Report Launch! FMO launches their annual report: Ambitious Choices in Critical Times.

It includes their Management Board's Letter, Supervisory Board Report, 2023 outlook, information on their updated 2030 Strategy, and more. Click here to read the report.

Pitch to CIIE.CO For Startup India Seed Fund

CIIE.CO is accepting pitches from startups looking to apply for the Startup India Seed Fund Scheme. We are seeking to invest up to INR 50 Lakhs through CCD instrument.

To be eligible, the startup needs to be incorporated not more than two years from the date of application. Furthermore, the startup shouldn't have received any other government funding more than INR 10 Lakhs. Click here to apply.

Gold loan startup Yellow Metal gets $3 million in funding led by MSA Novo

The round also saw participation from Japan-based Spiral Ventures and existing investors WaterBridge Ventures and Java Capital.

Source : Economic Times

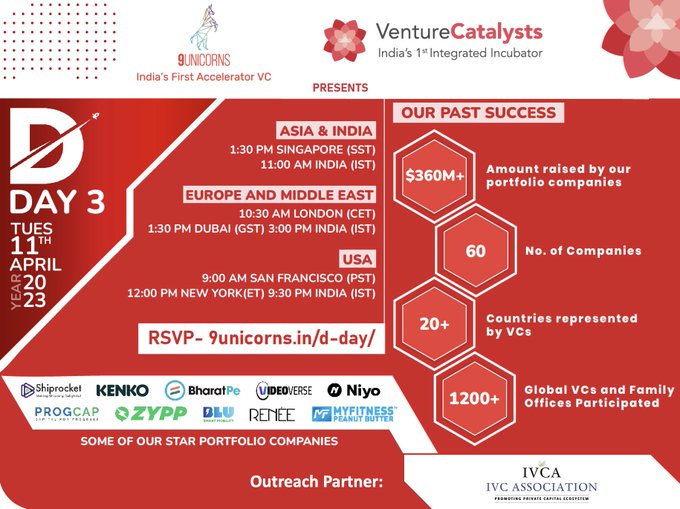

9 Unicorns and Venture Catalysts host D-Day

Built on the lines of the US-based accelerator Y-Combinator, Mumbai-based 9Unicorns is India’s first First Accelerator VC operating uniquely as VC and an Accelerator, and Venture Catalysts’ (VCats) maiden fund. 9Unicorns has raised a total of INR 880 CR for investing in early and growth stage startups, across the next upcoming sectors in India and globally. 9Unicorns plans to invest in 150+ companies in ~3years. Some of the notable investments have been ShipRocket, Vedantu, VideoVerse, Niyo, Progcap, Zypp Electric, BluSmart, Renee Cosmetics, BrightChamps, Tagz Foods, MyFitness and GOAT Brand Labs. Click here to register.

Mirova makes first close of Asia, Africa sustainability debt fund at $171m

Sustainability-focused investment manager Mirova announced that it raised $171 million in the first close of its blended finance debt fund, the Mirova Gigaton Fund. The fund aims to provide medium to long-term debt financing for clean energy projects primarily in emerging countries in Asia and Africa, as well as in Latin America and the Middle East, according to the announcement. Mirova, the sustainable investment-focused affiliate of asset manager Natixis Investment Managers, said it targets to raise $500 million for the fund and expects to deploy $1.2 billion of private debt to SMEs. Particularly, the fund focuses mostly on areas including solar home systems, agri-solar, commercial and industrial solar, telecom tower solarisation, mini-grids, as well as e-mobility, battery storage, and carbon credit pre-financing. The vehicle has so far received commitments from the US International Development Finance Corporation (DFC); Swedfund, Sweden’s development finance institution for sustainable investments in developing countries; and the Swedish International Development Cooperation Agency.

Source : Deal Street Asia

Villgro's idea for an 'Impact Financing Facility for Climate-Focused Social Enterprises' is selected as one of the 6 winners for the The Global Innovation Lab for Climate Finance.

Climate Resilient Landscape Finance (CRLF) is a first-of-its-kind model where financiers, conservancy management, and landowners collectively share the risks and rewards of sustainable land management activities. Click here to know more.

HealthPlix Technologies raises $22M in Series C funding round

Bengaluru-headquartered HealthPlix Technologies has raised $22 million in a Series C funding round led by Avataar Venture Partners and SIG Venture Capital. The round also saw participation from its existing investors, including Lightspeed Venture Partners, JSW Ventures, Kalaari Capital, and Chiratae Ventures. HealthPlix has cumulatively raised about $20 million in venture funding.

Source : YourStory

Heritas Capital has marked the first close of its impact-focussed fund at $20 million.

Singapore-based private investment firm Heritas Capital, which has around 20 companies in its portfolio including digital health startup Mfine, has marked the first close of its impact-focussed fund at $20 million.

Financial services firm DBS has committed $10 million to the Asia Impact First Fund (AIFF) to become its anchor investor.

The other limited partners (LPs) who chipped in for the fund’s first close include Tsao Family Office, IMC Group, Ishk Tolaram Foundation, ANF Family Office, Pang Sze Khai (chairman of Octava Foundation and Octava Pte Ltd).

Source : VCCircle

Impact Assets launches the 12th Edition of IA 50 Impact Fund Managers

Now in its twelfth year, the ImpactAssets 50™ is the most recognized free database of impact investment fund managers. This annually updated list is a gateway into the world of impact investing for investors, financial advisors and philanthropists. The IA 50 offers an easy way to identify experienced and emerging impact fund managers and is intended to illustrate the breadth of impact fund managers operating today, though it is not a comprehensive list. Fund managers selected to the IA 50 demonstrate a wide range of impact investing activities across geographies, sectors and asset classes. View the complete list here: https://impactassets.org/IA-50/

NEWS DPIIT launches National Incubator Capacity Building Programme to accelerate startup growth

The three-month mentorship and advisory support programme aims to support the growth of incubators across the country and build a strong ecosystem for nurturing innovation and startups. It is designed to help incubators become sustainable by providing knowledge resources and tools for entrepreneurs to grow. The initiative is aimed at developing customised business models for incubators and organising masterclasses and workshops on managing the Startup India Seed Fund Scheme (SISFS). The programme will also offer access to VITALS (Villgro Information Tracking and Learning System), a technology-based information system for tracking the incubation of enterprises.

Source : YourStory

Brookfield mulls $1b investment in Avaada

Brookfield Asset Management is in talks to invest $1 billion in multiple tranches in Avaada Ventures Pvt Ltd (AVPL), the parent entity of Avaada Group

Source : Deal Street Asia

Raaho Bags Funding From IP Ventures, Vijay Shekhar Sharma To Connect Truckers With Shippers

Trucking marketplace Raaho has raised INR 20 Cr ($2.4 Mn) from Inflection Point Ventures (IPV), Roots Ventures, and Blume Founders Fund as part of its extended pre-Series A round. The funding round also saw participation from prominent angel investors like Paytm founder Vijay Shekhar Sharma and CRED founder Kunal Shah.

Source : Inc42

Healthtech startup Breathe Well-being raises Rs 50 crore in funding

Healthtech startup Breathe Well-being announced on Thursday it has raised Rs 50 crore in a funding round co-led by 3One4 Capital, Accel and General Catalyst. FounderBank Capital and Supermorpheus also participated in the round. Breathe Well-being offers an alternative to medicines to prevent, manage and reverse type 2 diabetes.

Source : Economic Times

Jumbotail secures Rs 75 Cr in debt round led by Alteria, Innoven Capital

Jumbotail is a foodtech platform that provides full-stack services for kirana stores, including storefront delivery and payment collection. It also has a fintech platform that provides payment solutions and access to working capital credit from third-party credit providers to its customers, using transactional data and proprietary algorithms.

Source : YourStory

Rockstud Capital Sets Up $36.4 Mn Angel Fund To Back 25 Indian Startups

Asset management firm Rockstud Capital on Monday (March 14) launched an INR 300 Cr ($36.4 Mn) second fund (Rockstud Capital Investment Fund II) to back pre-Series A and Series A-stage startups. The angel fund will invest between INR 1 Cr and INR 10 Cr in 25 startups in the digitalisation, sustainability, financial inclusion, consumption, and health sectors. It will also offer a flexible ticket size in current and follow-on funding rounds.

Source : Inc42

Indian banks set up crack teams to help startups move funds from SVB to GIFT City

Major Indian banks, including Axis Bank, Kotak Mahindra Bank, ICICI Bank, and HSBC, have reportedly set up specialised teams to help startups move their funds from collapsed Silicon Valley Bank (SVB) accounts to their branches in GIFT City, Gujarat. The banks, which have set up their International Financial Services Center Banking Unit (IBU) in Gandhinagar-based Gujarat International Financial Tech (GIFT) City, cater to non-residents and foreign entities and allow them to open dollar accounts and deposits.

Source : YourStory

Omnivore aims to raise 130 Mn USD for it's AgriTech & Climate Sustainability Fund III

Source : VCCircle

Norway India Partnership Initiative (NIPI) latest quarterly newsletter focuses on “A Strategic Bilateral in Health Creating Impact”.

A health initiative between Government of India and Government of Norway, the

Norway India Partnership Initiative (NIPI) aims to innovate and scale up quality

continuum of care for Maternal, Newborn and Child Health in India. Click here to read the complete newsletter.

J&K to come up with new policy to 'facilitate 3,000 startups in five years'

The Jammu and Kashmir administration will soon announce a new amended startup policy that will facilitate at least 3,000 startups in five years.

The new startup policy will take inputs from the policies of states like Karnataka, Gujarat, Uttar Pradesh and Tamil Nadu to ensure that it will help to tackle the challenges and address the concerns of the market.

Source : Economic Times

Report Launch! AgTech Funder launches Global AgriFoodTech Investment Report 2023

Global investment in agrifoodtech startups declined 44% on record-breaking 2021 levels, but several climate-related categories bucked the global trend, posting year-over-year increases. Read more in 2023 Global AgriFoodTech Investment Report. Click here to download the report.

Supply chain financing startup Mintifi raises $110 million in funding led by Premji Invest

According to Mintifi, it will use a large part of the current raise to expand its loan book, and focus on growth of disbursals on its platform. It is also expected to use the capital to bolster its technology platform and offer a software product to corporate partners helping them to monitor supply-chain distribution.

Source : Economic Times

Report Launch! 2X Global launches "Inclusive gender and climate finance" guide

2X Global launches a new guide to address the twin crises of Climate Change and inequity. This guide aims to help investors embed an inclusive lens in their climate and gender portfolios. Click here to read the guide.

Webinar Alert! Masterclass on Income Share Agreements (ISA) hosted by Gray Matters Capital

A pioneer in creating innovative financing tools, Gray Matters Capital is excited to host a series of webinars on how skilling and training institutions can incorporate ISA to build a sustainable revenue model and support students with skill development and job placement.

Join their webinar series that kicks off Thursday, March 16 from 4:00 pm- 5:00 pm IST. Click here to register.

Event Alert! Mint India Investment Summit and Awards

Live Mint is hosting their Mint India Investment Summit and Awards in collaboration with Trilegal. The two-day event, from 16th-17th March, will bring together the most influential minds in the country to discuss the opportunities and challenges that comprise India’s investment landscape. Click here to register for the event.

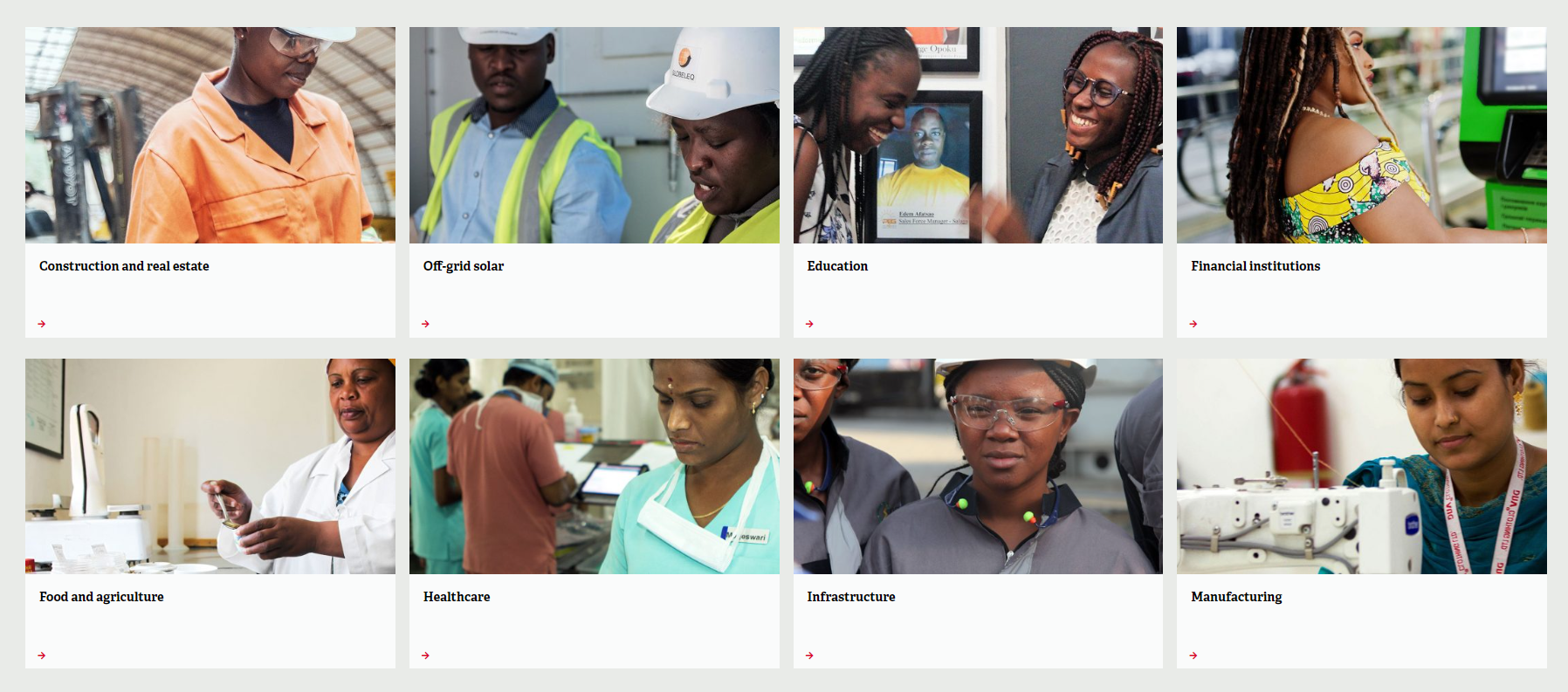

British International Investment launches Gender Lens Investing Toolkit for different sectors

Source : British International Investment

CPPIB Takes Control Of Indian Energy Firm With $268-Mn Deal

The Canada Pension Fund Investment Board (CPPIB) has bet $268 million more on an Indian energy company to gain a majority stake, as the North American nation’s biggest pension fund continues to pour money into the South Asian country.

Source : VCCircle

Report Launch! Recur Club launches "Recur Startup Pulse 2023: Fundraising in uncertain macro conditions" Report

The Startup Pulse 2023 report by Recur Club, a platform for alternative financing to startups and SMEs, summarised all their insights from a survey of more than 200 founders pertaining to the funding paradigm in this report. Click here to read the report.

Report Launch! Blume Ventures launches their annual Indus Valley Report

Indus Valley is Blume's moniker for India’s startup ecosystem. This issue takes stock of the rise and evolution of this ecosystem, reviews 2022, and finally looks at what to expect in the future. In this report, they have tried to present a brief outline of the report.

The report has 3 sections: 1) Understanding India 2) Understanding Indus Valley 3) State of the Valley 2021. Click here to read the report.

Greenko Energy looks to raise $700m from ADIA, GIC, others

Greenko Energy Holdings, a renewable power producer based in the southern Indian city of Hyderabad, is raising $700 million in equity funding from existing investors. The company has signed a definitive agreement with affiliates of Singapore’s GIC, the Abu Dhabi Investment Authority (ADIA), and Japan’s ORIX Corp to rake in the amount. Greenko founders Mahesh Kolli and Anil Kumar Chalamalasetty have also reportedly pumped in capital.

Source : Deal Street Asia

Healthtech startup SigTuple raises fresh round of funding from Endiya Partners, Accel

Healthtech startup SigTuple has raised Rs 34.5 crore ($4.3 million) in a fresh round of funding led by existing investors Endiya Partners and Accel, with participation from a few strategic leaders from the Healthcare sector. This fresh fund is part of its Series C round of funding.

Source : YourStory

Voiceoc raises Rs 3 Cr from BioAngels

Voiceoc offers a platform to improve engagement between hospitals and patients, increase appointment bookings, reduce calls made to customer care, and offer quick and personalised support to the latter. Operational in India and the Middle East, the company is currently handling over one million patient conversations every month.

Source : YourStory

B Capital closes its first healthcare-focused fund worth $500M corpus

Venture capital firm B Capital has raised its first healthcare fund, committing to invest $500 million in healthcare-focused startups in the United States, Asia, and Europe. Named Healthcare Fund I, the new fund will focus on specific sub-sectors such as biotech and medtech and take B Capital's total assets under management (AUM) to $6.3 billion, the VC firm said in a statement. B Capital has backed over 20 startups in the healthcare sector across these regions.

Source : YourStory

EV cab service provider Evera has closed its pre Series A funding round at 57 crore INR

The funding’s first tranche saw participation from IEG Investment Banking Group, while Direct Capital and Westova Global invested in the second round.

Founded in 2019 by Nimish Trivedi, Rajeev Tiwari and Vikas Bansal, Evera provides EV cab service to customers across business-to-customer (B2C) and business-to-business (B2B) segments

Source : VCCircle

Jarsh Safety raises around Rs 3 crore in a pre-seed funding round led by Mumbai Angels.

Founded by Kausthub Kaundinya, Sreekanth Kommula and Anand Kumar in 2016, Jarsh Safety is an internet of things (IoT) based startup focused on developing safety wearables in the industrial safety segment.

Source : VCCircle

Event Alert! Second of the EdTech Growth Summit

The 2nd Edtech Growth Summit is a unique initiative by NIIT that aims to help Edtech founders navigate through the uncertainties of the economy and the challenges presented by the post-pandemic era. The summit offers deep insights into scaling a sustainable Edtech start-up by providing an opportunity to learn from top investors who have supported multiple successful Edtech start-ups. Click here to register.

Publication Launch! Village Capital launches "Smarter Systems: How Tweaking Your Diligence Process Can Unlock Overlooked opportunities" Implementation Guide

Village Capital found that there are discrepancies in how investors evaluate men-led and women-led startups, potentially leading them to overlook promising startups and overestimate less promising startups. This implementation guide outlines three steps we found that accelerators can incorporate into their selection processes to consistently evaluate all startups more accurately. Click here to read the guide.

Back SEBI seeks beneficial ownership details of foreign investors

"The regulator has sought details of the ultimate beneficial owners specifically in cases where the senior management official or fund manager has been listed as the beneficial owner," said one of the sources.

In cases where the custodial banks do not provide details of beneficial ownership, the regulator would deem those foreign funds ineligible and ask them to liquidate their holdings in the Indian market by March 2024, the source added.

Source : Live Mint

Report Launch! British International Investment in partnership with Grantham launched the "Mobilising investment for a just transition to net zero in India" Report

The report raises awareness of the opportunities of a just transition and highlights priority areas that the finance community should consider towards financing a just transition in India.. Click here to read the report.

IIT Madras and AIIMS Delhi undertake initiatives to nurture student entrepreneurship

The Indian Institute of Technology Madras (IIT-M) will create an INR 100 Cr Innovation and Entrepreneurship fund to support students and faculty’s efforts to set up startups.

“In the next five years, we would like to realise an IIT Madras with a diversified group of faculty, students and staff actively pursuing nationally relevant and internationally-recognised fundamental and translational research. As part of this vision, we would like to have students from all parts of India, especially rural India to be associated with them,” said V Kamakoti, director of IIT-M.

AIIMS-Delhi administration announced plans of rolling out a startup policy for its medical students.

To promote entrepreneurship among medical students, AIIMS-Delhi will be joining hands with other Indian academic institutes such as the Indian Institutes of Technology, Indian Institutes of Management, and Indian School of Business (ISB). Besides this, it will also associate with large corporates including McKinsey, Boston Consulting Group and Bain & Company to provide business management exposure to medical graduates.

Source : Inc42

Rajasthan Investor Conclave brings startups and investors on the same page

As part of its ongoing efforts to scale the growth of its booming startup ecosystem, iStart Rajasthan — the state government’s flagship startup program — hosted the Rajasthan Investor Conclave. Organised in partnership with Jaipur-based virtual incubator and fundraising platform Startup Chaupal, the conclave was a common platform for startups and investors to network and find opportunities for partnerships.

The Rajasthan Investor Conclave also helped familiarise startups and investors with the Rajasthan Startup Policy 2022, that aims to promote Rajasthan as a hub for innovation and boost startup growth across industry verticals and encourage diversity and sustainability within the startup ecosystem.

Source : YourStory

Report Release! Circular target-setting guidance for businesses

This initiative exists to harness metrics for businesses to support corporate circular target-setting, as a new focus of the Circular Economy Indicators Coalition, in collaboration with Accenture.

We want to enable companies to create quantitative, targeted goals which drive measurable progress toward circularity and help companies navigate existing resources to measure and manage their progress. Click here to view the document.

Event Alert! Sovereign Wealth Funds and Pension Funds Investments in India: Unique Considerations and Critical Issues

The confluence of India’s focus on scaling up its infrastructure, the search for bankable yield instruments by Sovereign Wealth Fund (“SWF”) and Pension Funds (“PF”), and the coming of age of InvITs and REITs, has led to a pronounced increase in investments by SWFs and PFs into India. Click here to register for the event.

EV startup Ultraviolette looking to raise $120M

Electric motorcycle startup Ultraviolette Automotive Pvt Ltd is planning to raise $120 million in its next round of investment, which it will use to expand globally and grow its vehicle platform.

The company has raised $55 million in funding since inception from a clutch of investors, including TVS Motor Company, EXOR Capital, Qualcomm Ventures, Zoho, Gofrugal Tech, and Speciale Invest.

Source : YourStory

Germany’s KfW To Pump $18 Mn In Vertex Ventures’ $500 Mn India, SEA Fund

DEG, the investment arm of German state-owned development bank KfW, will reportedly invest $18 Mn in venture capital (VC) firm Vertex Ventures’ latest SEA and India Fund V.

Regulatory filings seen by Nikkei Asia said that the investment will be deployed towards promoting growing businesses in the SEA region with a high developmental impact.

As per the German investment firm, the Vertex Ventures’ fund will largely be used to fuel ‘innovative technology companies within traditional industries’ to support sector development and improve resource utilisation.

Source : Inc42

Grayscale Ventures Marks First Close Of $20 Mn Fund.

Singapore-based Grayscale Ventures has made the first closure at $10 Mn of its $20 Mn micro-fund. The fund targets AI, vertical SaaS and DevInfra-based (development infrastructure) startups.

The micro-fund will invest between $200K and $1 Mn in 15-20 pre-seed startups in a period of four years. It will have a final closure by quarter three (Q3), 2023.

The fund will target about 10% ownership in the invested startups, preferring to lead the fundraising rounds or co-lead them with other specialised funds.

Source : Inc42