India's Orios Venture Partners targets $120m corpus for latest fund

India’s Orios Venture Partners is targeting a total corpus of $120 million for its latest fund, as it looks to ramp up investments in early-stage startups, a top executive told DealStreetAsia. The venture capitalist has already amassed a significant part of the capital and has clocked as many as 17 investments from it so far. “The fund has seen over 50% institutional participation,” Anup Jain, Managing Partner at Orios Venture Partners, told DealStreetAsia. It is expected to close over the next few months and is betting big on sectors such as domestic SaaS, climate and sustainability, financial services, education, and healthcare, among others, he said.

Source : Deal Street Asia

Chanakya Fund Trust Launches INR 100 Cr Fund To Invest In Tech, Manufacturing Startups

Chanakya Fund Trust on Tuesday (April 25) announced the launch of its maiden INR 100 Cr ($12.5 Mn) sector-agnostic fund to invest in startups and small and medium enterprises (SMEs). The SEBI-registered Category-II alternative investment fund, Chanakya Opportunities Fund I, will also have a greenshoe option of INR 100 Cr. The trust said that the fund would invest in profitable SME companies with high-potential opportunities in unorganised sectors.

Source : Inc42

Niro has closed its Series A round of Rs 90 crore

Niro has closed its Series A round of Rs 90 crore ($11 million) through a mix of equity ($8.5 million) and debt ($2.5 million).

The startup secured the equity funding from a consortium of investors including Elevar Equity, GMO Venture Partners, Rebright Partners, Mitsui Sumitomo Insurance VC, and others. Venture debt was funded by InnoVen Capital

Source : YourStory

Climake launch "The State of Climate Finance in India 2023" in partnership with Unitus Capital

The report reviews progress in India’s climate action goals, and reviews how climate finance is keeping pace.

It includes:

· India's key climate action developments in 2022;

· Trends in India’s climate investments from 2022;

· A deep dive into major segments of climate action and stock-take of their current progress and future opportunity.

· Our thoughts on how climate investments (and investors) will evolve as climate action picks up over the next few years.

Biotech startup Nkure raises pre–Series A round

Nkure Therapeutics, an NK cell therapy company, has announced the closure of its pre–Series A round with participation from Endiya Partners, Kotak Investment Advisors, Featherlite and a few angel investors.

Source : BioSpectrum India

Haqdarshak raises funds

Haqdarshak Empowerment Solutions Pvt Ltd (HESPL) has closed its pre-Series A1 funding round with investments from Innovating Justice Fund and Village Capital-managed Financial Health Innovation Fund.

The company did not disclose the details of the financial transaction, but two people close to the matter told VCCircle that the deal size was pegged between $1.8 and $1.9 million.

Other investors who took part in the round include Abhishek Rungta (INT), Deep Bajaj, (Sirona Hygiene), Bhavin Pandya (Games 24X7), M/S Morpheus Ananta and Bindu Subramaniam (SaPa), among others.

Source : VCCircle

Content startup Lokal raises $14.6 million funding from Global Brain, SIF, others

Lokal, a news and classifieds platform focused on regional languages, on Tuesday said it has raised Rs 120 crore ($14.6 million) from new investors Global Brain, Sony Innovation Fund — both Tokyo-based venture capital firms — and others.

The funding round, dubbed Series B, also saw participation from India Quotient and other existing investors, the statement said.Source : Economic Times

HerKey, has raised a $4 million in a #funding round from @Kalaari and 360 ONE Asset

Career engagement platform for women, HerKey, on Wednesday, said it has raised a $4 million in a funding round from Kalaari and 360 ONE Asset (earlier known as IIFL Asset Management). Angel investors participating in the round included Zia Mody, Managing Partner, AZB & Partners; Puneet Dalmia, Managing Director, Dalmia Bharat Group; Pramit Jhaveri, Former CEO, Citi India; Aditi and Shuchi Kothari, DSP Investment Managers Private Limited; KP Balaraj, Founder, KPB Family Trust, Ranjan Pai, Chairman, Manipal Group; Neeraj Bajaj, Chairman, Mukand Limited, and Akash Bhansali.

Source : YourStory

Capria opens $100-million Global South Fund II

The new fund will focus on investing in 20-25 tech startups in the entrepreneurial hotspots of India, Southeast Asia, Latin America, the Middle East and Africa, the Seattle, Washington-headquartered fund said in the statement.

Source : Economic Times

ADB, GEAPP Announce $35 Million for Energy Access and Transition for South and Southeast Asia

The $35 million will be managed by ADB through the forthcoming GEAPP Energy Access and Transition Trust Fund (GEATTF). The funds will improve energy access and support energy transition activities in Bangladesh, India, Indonesia, Pakistan, and Viet Nam.

Source : ADB

FMO proposes $50m investment in India’s SK Finance

Dutch development bank FMO has proposed to invest $50 million in the Indian non-banking financial company (NBFC) SK Finance, formerly Esskay Fincorp, according to a disclosure. SK Finance is an NBFC that operates in north-western India under regulatory oversight. It provides financing backed by assets in the vehicle and lending segments for micro, small, and medium-sized enterprises (MSMEs) to entrepreneurs in rural and semi-urban areas who are underserved.

Source : Deal Street Asia

Real Time Angel Fund (RTAF) revealed its second closing at Rs 125 crore

Real Time Angel Fund (RTAF), a SEBI-registered angel fund based in India and focused on early-stage startups, revealed its second closing at Rs 125 crore, increasing its fund size to Rs 510 crore. RTAF claims to have already invested in 10 startups since its inception seven months ago. These include MyMandi, TransportSimple, Punt Partners, FreshoKartz, MeraTractor, MentorKart, O2Nails, LarkAI, CapitalSetu, and We360.

Source : YourStory

Indian transport tech firm Chalo Mobility raises over $26m in fresh funding

Indian transport technology startup Chalo Mobility has secured about $26.25 million in fresh funding, according to its regulatory filings accessed by DealStreetAsia. The company has raised about $23.75 million in Series D funding from Avaatar Ventures and the SmartStart Fund, showed its Singapore-registered holding company’s filings with the Accounting and Corporate Regulatory Authority (ACRA).

Source : Deal Street Asia

Japanese VC fund JAFCO Asia earmarks $20m for South Asian startups

Japanese early-stage venture capital fund JAFCO Asia aims to deploy $15-20 million in South Asia this year, with a firm focus on India, an executive at the firm told DealStreetAsia. Within South Asia, the firm has only invested in India so far. Between September 2021 and March 2023, the firm closed six investments in India — Prozo, Akudo, Pazcare, TwidPay, Driffle, and Venwiz — from its JAFCO Asia S-8 Family Funds.

Source : Deal Street Asia

New Report!

The report launched by Global Steering Group showcases the role of impact in scaling capital mobilisation to fund slum-upgrading programmes globally. Click here to read the report.

Bidra Innovation Ventures (Bidra) received $200 million in funding

Bidra Innovation Ventures (Bidra) received $200 million in funding from Morocco-based Mohammed VI Polytechnic University (UM6P) and the OCP Group to back sustainable technology in India and emerging markets. The initiative will expand Bidra's investment scope to include innovations in sustainable agriculture, energy, water, and other climate technologies to focus on emerging markets like India, Africa, and others. The funding comes a year after Bidra launched a $50 million fund backed by the same investors focused on agriculture

Source : YourStory

Ecosoul home bags $10M in Series A Round

EcoSoul Home Inc. has raised $10 million in Series A round led by Accel Partners and Singh Capital Partners. The capital will be used to launch new products, as well as fund international expansion in the UK, Europe and Asian markets, besides improving its tech and data capabilities.

Source : YourStory

Knocksense Raising $1 Mn In Pre-Series A Funding, Gets Nazara Founder’s Backing

Hyperlocal content production platform Knocksense said Wednesday it has secured funding from Nitish Mittersain, founder of gaming company Nazara Technologies, as part of its pre-Series A funding round.

The company said it is in the process of closing the $1 million (Rs 8.2 crore) round which has also seen participation from We Founders Circle, LetsVenture, Mumbai Angels Network, and Imperial Holdings.

The Lucknow-based startup aims to utilize the funding towards geographical expansion within India to newer Tier II/III cities.

Source : VCCircle

Seven women-led Indian start-ups selected for TVARAN Acceleration Program

The selected seven women-led enterprises who will participate in the TVARAN program are Climate Sense, Green Grahi, Green Delight, MOWO Fleet, Swachha Eco Solutions, KNP Arises Green Energy and Bharat Krushi Seva. These women-led enterprises will undergo a six-month acceleration program aimed at financing and implementing go-to-market strategies for women entrepreneurs.

Source : CNBCTV18

Healthtech startup Tricog Health raises $8.5 million

Heart focused healthtech startup Tricog Health on Wednesday said it has raised $8.5 million in a funding round, dubbed Series B2, from Omron Health Care and Sony Innovation Fund, among other investors.

The round also saw participation by returning investors The University of Tokyo Edge Capital, Inventus Partners and SG Innovate. The Series B2 round marks a total raise of $30 million for the Bengaluru-based startupSource : Economic Times

Unitus Capital launches Exit Report

The report presents a summary of this effort where Unitus Capital have worked with investors to earn them strong and healthy returns. Till date, Unitus Capital has facilitated 53 exits for 30 companies with a median IRR of 43% and 4.4x MOIC to date. Read the complete report here.

Launch of Blended Finance for the Energy Transition (BFET) program

USAID and the Department of State, in collaboration with the Office of the U.S. Special Presidential Envoy for Climate (SPEC), is launching the Blended Finance for the Energy Transition (BFET) program. With catalytic co-funding from the U.S. government and other partners, the goal of BFET is to mobilize $1 billion or more of capital to accelerate emerging markets’ energy transition efforts and limit global average temperature rise to 1.5°C. While private capital is increasingly directed at the energy transition in emerging markets, it is not yet at the speed and scale needed to address the global climate crisis. In response, BFET is seeking to unlock new and deep pockets of institutional capital that have typically been too risk averse to deploy capital into the energy transition in target investment countries (India, Indonesia, South Africa, and Vietnam) and other emerging markets, with the intention of accelerating the deployment of equitable, affordable, and reliable clean energy. Click here to know more.

IVCA launches VC101, learning programme for first-time fund managers

https://twitter.com/IndianVCA/status/1647896383091867651The Indian Venture and Alternate Capital Association (IVCA) on Monday launched a one-of-a-kind learning and knowledge-sharing programme on fund management - #VC101, for emerging venture fund managers. It is one among several initiatives by IVCA to strengthen the environment for venture capital in India and push India as the leading fund management hub in the world.

Source : Economic Times

Call for Climate Change Entrepreneurs! UnLtd Incubation Program

We are looking for Social Enterprises that are solving important climate change issues to protect and preserve our natural environment with innovative and impactful solutions. Click here to know more.

UnLtd India serves as a canvas for early-stage social entrepreneurs in India to nurture their ideas and grow as true artists of change. For the last 14 years, we have been finding and supporting entrepreneurial individuals with a passion to bring about long-lasting solutions to pressing problems in India.

Event Alert! Climate Asia host Building a sustainable legacy for a greener tomorrow

The conference will address four pertinent themes that intersect with climate change, and which are essential to address in order to effectively tackle the challenges posed by this global issue. The conference will entail discussions on Climate Careers, Gender, Philanthropy and Public and Mental Health. Click here to register.

Event Alert! Google Cloud and YourStory present The Future of Finnovation 2023

To know more about how the next few years will play out for fintech in India, sign up for The Future of Finnovation 2023 that will outline innovations for digital financial businesses in India. Click here to know more.

Indian VC Pavestone Capital raises $52.5m so far for first fund

Indian venture capital (VC) firm Pavestone Capital has so far raked in about Rs 430 crore ($52.54 million) for its first fund as it looks to actively invest in the fast-growing enterprise technology sector in the country.

Source : Deal Street Asia

Nysha Mobility Raises $3.5 Mn For Manufacturing EV Components

EV components startup Nysha Mobility Tech (NMT) has raised $3.5 Mn in a combination of equity and debt funding. The seed funding round saw participation from investors such as Touchstone Ventures, Panthera Peak Capital. Nikhil Bhandarkar, Kelachandra Family office, Ghanshyam Dass (ex-CEO - Nasdaq Asia), Kanoria Family Office, Kiran Bulla, JCL Family Office, Pahwa family Office, Suraj Sreenath (DreamGains Financial), also participated in the funding round.

Source : Inc42

Event Alert! Join UNDP at the 2023 Financing for Development Forum

A global financial system fit for purpose. Join UNDP's Administrator Achim Steiner as he moderates this critical discussion on remaking the international financial architecture to achieve the SDGs at FFD2023.

SIDBI has announced the launch of a pilot scheme for better financing terms in the electric vehicle space

The pilot phase of 'Mission 50K-EV4ECO' aims at strengthening the EV ecosystem, including uptake for two, three and four-wheelers through direct and indirect lending, Small Industries Development Bank of India (SIDBI)

Source : YourStory

SimpliContract Secures Funding To Offer Better Business Contract Management To Retail, Tech Cos

SaaS startup SimpliContract has secured $3.5 Mn in a Pre-Series A funding round led by Emergent Ventures. Kalaari Capital, Picus Capital, Foster Ventures, Leslie Ventures, and Sentinel Ventures also participated in the round.

Source : Inc42

Event Alert! 4th Annual India Power Conference 2023

India Power Conference 2023 is India’s Largest power gathering providing a platform to enable business opportunities for solution providers of all forms of power generation from conventional to renewable energy and associated energy storage. This leading forum is where the energy industry can meet, share and discuss solutions for India’s energy future. Click here to register.

INI Farms gets Rs 16 crore investment from ESG First Fund

Leading exporter of fruits and vegetables INI Farms has received Rs 16 crore ($1.95 million) investment from ESG First Fund, managed by Aavishkaar Capital, an Aavishkaar Group company and set up in partnership with KfW, a German state-owned development bank.

Source : Economic Times

Caspian Debt joins the Partnership for Carbon Accounting Financials

Taking a step forward in contributing towards the global effort of cutting carbon footprint, Caspian Debt now joins the Partnership for Carbon Accounting Financials (PCAF), the first Indian Non bank finance institution to do so.

Source : Times of India

Awign launch "The Power of Gig: Shaping the Future of Work"

The concept of gig work has existed for a long time in India, across urban and rural areas, in the form of daily-wage construction labourers, farm workers and household help. Over the last decade, temporary and casual gigs have expanded across industries with the emergence of tech-enabled platforms offering on-demand services like ride-sharing, online food ordering, home services and hyperlocal deliveries. Click here to read the complete report.

PhonePe raises $100 mn in ongoing $1 bn funding round

This comes less than a month after the company raised $200 million in funding from its majority shareholder Walmart. In February, PhonePe had raised $100 million from Ribbit Capital, Tiger Global, and TVS Capital Funds. It had raised $350 million in a fresh funding round led by private equity firm General Atlantic in January. The company expects further investments to be announced in due course.

Source : Deal Street Asia

New Report! “Breaking Barriers: A Practical Guide to Unlocking Foundation Endowments for Mission and Returns.”

Private foundations and family offices have an incredible opportunity to orient over $3 trillion to support building a sustainable future for us all - both economically and environmentally.

To clear a path to this goal, Builders Initiative and Social Finance have teamed up to release a new report, “Breaking Barriers: A Practical Guide to Unlocking Foundation Endowments for Mission and Returns.” Click here to read the report.

Webinar Alert! TiE Bangalore and Matrix Forum host "Harnessing the power of AI for Sustainability; Carbon Emissions, EV & more."

Rapido Backer AdvantEdge Founders To Float Third VC Fund For Mobility Bets

Gurugram-based venture capital fund AdvantEdge Founders, which counts Samvardhana Motherson Group and Hero MotoCorp as its backers, is floating its third fund to back early-stage startups primarily in the mobility and electric vehicle segment.

Source : VCCircle

KIAL To Halt Startup Fund Of Funds Citing Correcting Valuations

Citing correcting valuations, KIA announced pausing its startup fund. “In PE/VC investment, vintage of the fund i.e. the time to start deploying capital is very important. Presently, valuations are correcting, hence it is prudent for the FOF to defer investing and catch a better vintage of funds. With this view, we have taken the call to postpone the PE/VC FOF," said a spokesperson at Kotak Investment Advisors Limited.

Source : VCCircle

Pi Ventures secures Rs. 100 Crore from SIDBI'S Fund of Fund Scheme

With the commitment out of the Small Industries Development Bank of India (SIDBI)-managed fund, pi Ventures is on track to make the final close of its second fund in the June-ended quarter of 2023. The company estimated the fund to be in the range of Rs 675 crore to Rs 750 crore.

Source : YourStory

Verlinvest-Backed V3 Ventures Launches India Ops, To Invest Up To INR 900 Cr In Tech Startups

Early-stage venture capital fund V3 Ventures on Tuesday (April 4) said it has launched its operations in India and is looking to invest up to 100 Mn euros (approximately INR 896.5 Cr) in the country, Europe, and the US. V3 Ventures has already invested in audio content platform Kuku FM and digital healthcare app Eka Care in India

Source : Inc42

Call for Applications! FinBlue's Pitchfest 2023

Selected startups will get opportunity to develop innovative products in fintech domain by availing plug-&-play incubation space, SandBox among others. Click here to apply. Last Date: 15/04/2023

Event Alert! Founder's First Capital Partners host 'The State of Social Justice Impact Investing' event

Join Founders First Capital Partners, and co-hosts Impact Alpha, Mission Investors Exchange, and Rockefeller Philanthropy Advisors to:

- Hear from leading courageous impact investors from foundations, corporations, and fund of funds on their social justice impact investment commitments and lessons learned.

- Learn about creative fund models and results from fund managers at Apis & Heritage, Founders First, and New Majority Capital.

- Discuss how investors and philanthropists can stay the course amidst uncertainty and support their double bottom line priorities.

Fintech Startup U GRO Secures $41.3 Mn To Offer Credit To MSMEs

Fintech startup U GRO Capital has secured INR 340 Cr ($41.3 Mn) from IFU and long-term shareholders. The startup’s board has approved a preferential allotment of INR 240 Cr to IFU (Investeringsfonden for Udviklingslande) via its Danish Sustainable Development Goals Investment Fund.

Source : Inc42

Indian mid-market PE firm Paragon Partners closes second fund at $85m

Indian private equity (PE) firm Paragon Partners has closed its second fund at Rs 700 crore ($85.37 million) as it looks to ramp up investments in high-growth mid-market companies, multiple sources privy to the development told DealStreetAsia. It has already clocked three investments from the fund in companies namely omnichannel meat and seafood brand TenderCuts, logistics startup GoBOLT and personal care brand mCaffeine.

Source : Deal Street Asia

Report Launch! RMI launch #Decarbonising the Indian Steel Industry: Roadmap towards a Green Steel Economy’ Report

The importance of #steel in supporting India’s growth will increase with #economic #development, #infrastructure build-out, and #urbanisation in India. This report identifies five key levers to decarbonise steel:

1. Use of green hydrogen for steel production.

2. Introduction of a more significant share of #renewableelectricity in captive electricity consumption.

3. Carbon capture, utilisation, and storage (CCUS) to decarbonise existing carbon-intensive steel production processes.

4. Greater use of scrap to make steel.

5. Increasing energy efficiency across steel production processes.

Cold chain marketplace Celcius Logistics has secured Rs 100 crore in its Series A #funding round led by IvyCap Ventures.

The company aims to utilise the fresh capital for tech innovations to solve the fragmented cold supply chain, reduce wastage in perishables, and focus on sustainability. Tej Kapoor, Managing Partner at IvyCap Ventures, will be joining the board of Celcius on behalf of the investor. Celcius earlier raised Rs 35 crore from existing investors Mumbai Angels, Supply Chain Labs, Endurance Capital, VCats, Huddle, Eaglewings Ventures (EVAN), and others.

Source : YourStory

Cedar-IBSi hosts Digital Banking Summit

The Cedar-IBSi Digital Banking Summit explores global perspectives from industry leaders on various topics, including NextGen Digital Banking, the Role of Neo and Digital-only Banks, Customer Journeys and Experience, Leveraging Big Data, Cloud, and more. Click here to register.

Event Alert! TiEMumbai hosts Unboxing India 3.0

We are happy to announce the 16th edition of our flagship conference - TiEcon Mumbai that will be taking place on the 2nd of June 2023 at the Jio World Convention Center, BKC - Mumbai.

What's happening at TiEcon Mumbai 2023:

Attendance - We are expecting 1800+ delegates comprising of leading CXOs, successful entrepreneurs, investors, academics, policymakers, and thoughtful practitioners from India and around the world.

Access to Funding - Shortlisted Startups will pitch to Investors at the TiEcon Mumbai

Startup Zone - Startups will showcase their innovative products / service to delegates, Investors, Charter Members & Corporates.

Indian mid-market PE firm Amicus Capital hits first close of second fund

Indian mid-market private equity (PE) firm Amicus Capital Partners, the backer of startups like online insurance platform RenewBuy, Capital Small Finance Bank and Berar Finance, has hit the first close of its second investment vehicle at $75-100 million (Rs600-800 crore), DealStreetAsia has learnt. The PE major is targeting to raise a total of about $200 million for the vehicle to ramp up its investments across fast-growing sectors such as financial services, consumer, healthcare, technology and business services.

Source : Deal Street Asia

EV motorcycle startup Raptee receives Rs 3.27 crore in grants from ARAI

Automotive Research Association of India (ARAI) has given a grant of Rs 3.27 crore to Chennai-based EV motorcycle startup Raptee. The grant was given under AMTIF's (Advance Mobility Transformation & Innovation Foundation) Industry Accelerator program as a part of the Capital Goods Scheme by the Ministry of Heavy Industries, Government of India. Raptee is among the 10 startups & MSMEs to receive this grant from ARAI.

The funds received by Raptee will be utilised for the development of the design and the motorcycles core high voltage motor controller over the next eighteen months, as the company gears up to launch their first motorcycle later this year.

Source : Zee Business

Godrej Consumer Products (GCPL) will invest ₹100 crore to anchor Early Spring, an early-stage fund being set up by Spring Marketing Capital

The new fund, with a corpus of ₹300 crore, will invest between ₹5 crore and ₹20 crore in companies from seed to pre-series A stages. In addition, GCPL will offer its expertise and experience to help founders of early-stage Indian consumer startups.

"The mandate of the fund is to have specific focus on categories such as home and personal care and health and wellness, which is also the broad area and purpose for Godrej as well," Omar Momin, head of M&A, GCPL

Source : Economic Times

IKF Finance raises Rs 2.5 bn led by Accion’s Digital Transformation Fund

South India based NBFC, IKF Finance, raised Rs 2.5 billion in a funding round led by Accion’s Digital Transformation Fund. Incorporated in the early 1990s by MR VGK Prasad, the used vehicle, housing and MSME financier is backed by Motilal Oswal Alternate Investment Advisors, which invested in the company in 2015.

Source : India Times

Ossus Renewables Bags Funding From Nikhil Kamath’s Gruhas To Produce Green Hydrogen

Cleantech startup Ossus Biorenewables has raised $2.4 Mn in its pre-Series A round from Gruhas, cofounded by Zerodha’s Nikhil Kamath with Puzzolana’s Abhijeet Pai, and Rainmatter Climate.

Ossus will use the fresh funds to accelerate the deployment of its bioreactor, OB HydraCel, across sectors like refining, foods, brewing, chemicals and pharmaceuticals. It aims to produce 3-5 tonnes of green hydrogen every day before the end of 2023.

Source : Inc42

Zero Cow Factory raises $4 million in a seed funding round from Green Frontier Capital, GVFL, and Pi Ventures

The bioengineered milk startup will use the funds to obtain regulatory approvals to launch in the market, accelerate research and development, and increase production, among other things.

Source : YourStory

Webinar Alert! GIIN host “New Guidance on Adopting an Equity Lens Across Investment Sectors" Webinar

Hosted by Tynesia Boyea-Robinson, the launch webinar will introduce the updated IRIS+ Thematic Taxonomy to serve as a guiding resource for applying an equity lens across investment sectors. Click here to register.

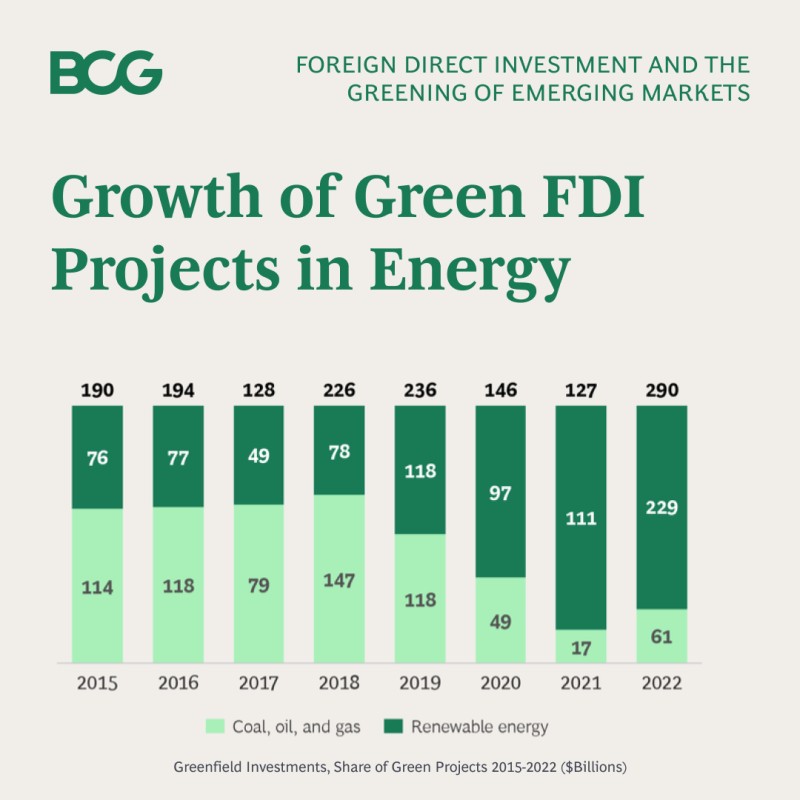

Report Launch! BCG launch "Foreign Direct Investment and the Greening of Emerging Markets" Report

The report explores the crucial role that FDI can play in accelerating the growth of green markets in emerging economies.

Green foreign direct investment is a powerful tool for catalyzing and amplifying environmental benefits, particularly those related to climate action. This is especially true in the realm of renewable energy, where strategic investments can have a significant impact. Click here to read the complete report.

Apis Partners seeks $500m for latest Asia, Africa fund; IFC may come in as LP

In a disclosure, IFC, a member of the World Bank Group, said it is considering an investment of up to $60 million into Apis Growth Markets Fund III (AGF III), a PE fund that will make growth-stage investments in companies operating in the financial services and technology sectors in Asia and Africa. The fund will seek to take significant minority stakes, or in some cases majority stakes, in companies with strong performance, marketing positioning, expansion potential, and high-quality management. It will issue cheques of $60-70 million, including co-investments, per transaction.

Source : Deal Street Asia

Shell Foundation and British International Investment sign MoU to work in partnership to increase access to finance for clean energy businesses

Through the MoU, the institutions will provide investment to help address the finance barriers that exist for early to mid-stage businesses in sectors aligned with BII’s strategic priorities and SF’s charitable objectives including, but not limited to, distributed renewable energy, e-mobility and agri-tech, as well as supporting cross-cutting solutions in the areas of climate and gender inclusion. Click here to read more.

InsuranceDekho Acquires Sequoia-Backed SME Insurance Firm Verak

The acqui-hire is expected to help InsuranceDekho, part of CarDekho group, to grow its SME insurance vertical as it expands its offerings in the micro-business insurance space. Verak’s founder Rahul Mathur, who previously founded BimaPe, will join InsuranceDekho along with his team. The company did not disclose the financial details of the transaction.

Source : VCCircle

AVIOM Housing Finance raises $30 Mn to support low-income households

Delhi-based AVIOM Housing Finance Corporation (AVIOM HFC) has raised $30 Mn in a Series D funding round led by Nuveen through a mix of primary and secondary investments in tranches.

Source : Inc42

Magenta Mobility has bagged an equity investment of $22 million from bp and an investment fund managed by Morgan Stanley India Infrastructure

Magenta Mobility plans to use this funding to expand its fleet to 4,000 three- and four-wheel EVs (electric vehicles) across the country over the next year. The capital will also support Magenta Mobility’s market expansion into eight more cities across India in the next two years, apart from strengthening its presence in Bengaluru, Mysuru, Delhi, Gurugram, Noida, Hyderabad, and Mumbai, said the company in a statement. Jio-bp, part of the joint venture between UK-based bp and Reliance, will be the exclusive EV charging partner for Magenta Mobility’s fleet.

Source : YourStory

Funding Climate Action: Pathways for Philanthropy

Funding Climate Action: A Pathway to Climate Philanthropy, a report developed by Aspen Institute in partnership with Morgan Stanley Private Wealth Management, is designed to provide insight and tools to inspire philanthropists to address climate change. The report lays out various approaches to climate philanthropy, supported by case studies of five funders and profiles of key resource organizations. It concludes by offering a set of six guiding principles for climate philanthropy. Click here to read the report.

Vigyos Centre raised seed funding from Japanese investors

Vigyos Centre, a fintech and adtech startup, secured seed funds to the tune of Rs 1 crore from Japanese investors, including employees from Softbank.

Incubated by Indian Institute of Management (IIM), Bangalore, Vigyos Centre was founded by Kanishq Gupta and Faiz Khan. The startup provides over 200 financial services in offline and online modes, in Tier II and III cities by the means of franchise setup, to small and middle enterprises.

Source : YourStory

Moneyboxx Finance raises over Rs 24 Cr equity to fund AUM growth

Moneyboxx Finance Limited, a BSE-listed Non-Banking Finance Company (NBFC) that provides unsecured and secured business loans to micro-entrepreneurs, said it has raised equity capital of over Rs 24 crore by way of private placement from non-promoter investors.

Source : YourStory

Battery recycling startup Metastable Materials raises seed funds from Sequoia Surge

Bengaluru-based battery recycling startup, Metastable Materials, has raised a seed funding round led by Sequoia Capital India’s scale-up programme, Surge, along with the participation of Speciale Invest and Theia Ventures. Angel investors Akshay Singhal and Kartik Hajela (Co-founders at Log9), Archana Priyadershini (Co-founder at fwdSlash Capital), and Sanjeev Rangrass (Venture Partner of Unitus Ventures) also participated.

Source : YourStory

Event Alert! Launch of Greening of Finance by Women

Attend the event to learn more about GroW, hear from women leaders on their journeys, and network with professionals from the sector!

The event is open to professionals of all genders working in financial inclusion, clean energy, carbon markets, climate adaptation, ESG, gender lens investing, just transition, green finance and climate tech.

Register your Interest: https://lnkd.in/d6DMryGu

APAC Sustainability Seed provides $3M funding to 13 sustainability innovators

The APAC Sustainability Seed Fund is a pioneering initiative that has been launched by AVPN, with the support of Google.org and the Asian Development Bank (ADB). This fund is focused on accelerating sustainability in the Asia-Pacific region and will provide funding opportunities to non-profit organizations that lead innovative solutions in combating climate change and driving sustainable development.

Equality Fund launches Gender Lens Investing Toolkit

The toolkit includes Equality Fund's Gender-Lens Investing criteria, which are a set of investment screens to guide what we invest in and how. They create a streamlined way to analyze how investments work for—or against—women, girls, and trans people. It also includes an introduction to Equality Fund's Intersectional Investment Guidelines, which act as an anchor to ground gender-lens investing in systemic change

Click here to download Equality Fund’s Toolkit for Gender-Lens Investing

Avanti Finance has raised $24 million in Series B funding

Avanti Finance—a Bengaluru-based technology-led NBFC focused on financial inclusion—has raised $24 million in Series B funding from Rabo Partnerships and IDH Farmfit Fund. Existing investors Oikocredit and NRJN Trust also participated in the round. The investment will support Avanti's mission to provide frictionless, affordable, and hyperlocal credit products to smallholder farmers in India, enabling them to build sustainable livelihoods, Avanti Finance said in a statement

Source : YourStory